For the GDX weekly, it would be nice to see those stochastics get fully oversold, they are getting close but still not there, matters though what it looks like on Friday's close

Newsletter Signup

Search

Thursday, March 22, 2012

yes divergence is building on the 60 min, here's my ...

yes divergence is building on the 60 min, here's my chart. both stochastics are oversold again so that's good. you need to see MACD cross back up to confirm the divergence. For now GDX is still wedging down. Also watch the GDX/GLD ratio trendline

Wednesday, March 21, 2012

cycle chart

here's a chart that was sent to me, but I dont' know who the author is, otherwise I'd give credit. Interesting chart, but who knows.

Personally though I do think we'll see a sell in may again this year, though I would not surprise me to see it earlier such as in April sometime, we'll see I guess.

Sunday, March 18, 2012

Weekend Commodity Newsletter Sunday Mar 18th

I went a little overboard on the commodity newsletter this week, covers tons of stuff, here you go!

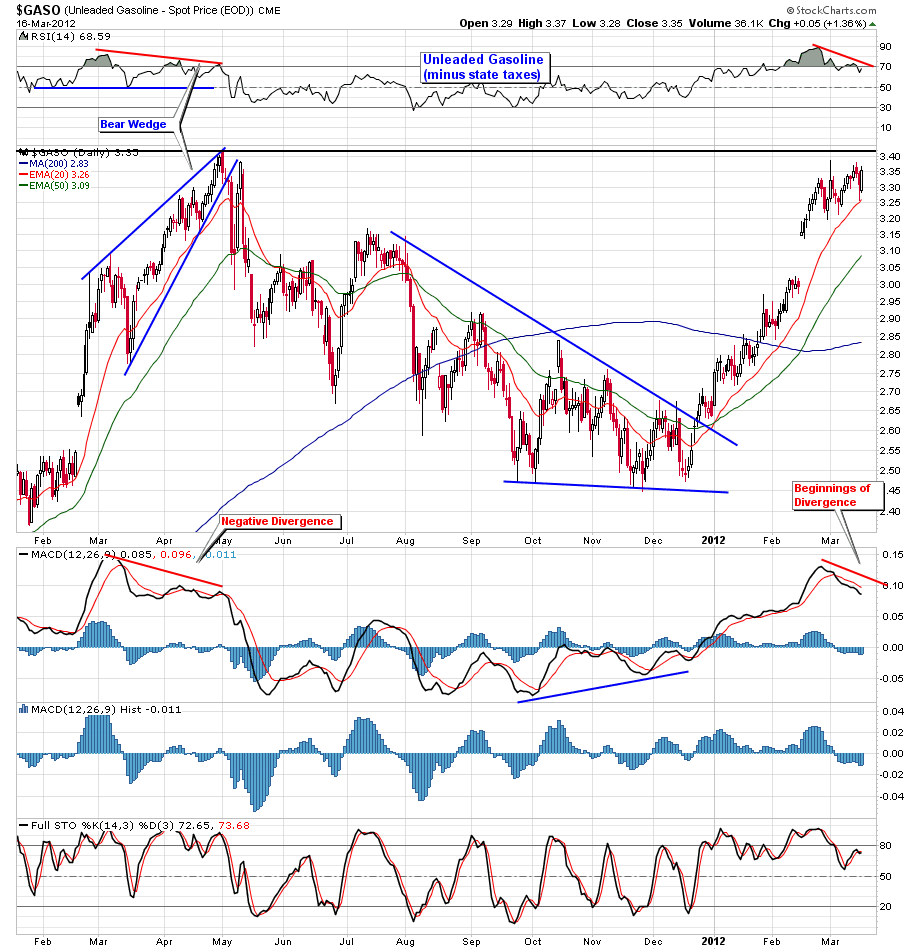

Unleaded Gasoline

$GASO - Unleaded gasoline (does not include taxes you pay at the pump), some preliminary Neg Divergence forming, however note what happened last Mar, price rallied for another 1 1/2 months to form a longer divergence.

$GASO - weekly view, see the long term trendlines/resistance, breakout out over those would be painful at the pump

A Few Misc commodities

USO - 60 min view of USO Crude ETF, the correction ...

USO - 60 min view of USO Crude ETF, the correction has been overlappy and choppy, suggests an eventual upside break

$WTIC - crude daily, the pattern still continues to look bullish, it has consolidated over resistance and now the Ratio is turning up and MACD is above zero.

US Dollar is down 40 cents, so that will help

OIH - Oil Services - interesting pattern to watch, volume has been light

Thursday, March 15, 2012

Hello everyone, here's our comprehensive Thursday newsletter covering the general market, Treasuries/Bonds, Copper,Coal,Nat Gas, Gold, and some trade ideas.

Enjoy your Friday and have a great weekend!

Thursday March 15th, 2012 Newsletter!

GLD 5 min and 60 min comments

Tuesday, March 13, 2012

Monday, March 12, 2012

Choose Your Own Adventure: SPX 2013

Interesting article for fun from

The violent selloff and subsequent grinding higher feels very unique. Some have even said this market feels “unnatural” or “rigged” due to quantitative easing, high frequency trading, LTRO, ZIRP and other boogie men. I assure you these market conditions are not unique at all. Here are 5 examples of statistically similar markets and what transpired afterwards.

These instances were identified by our pattern recognition algorithm as self-similar in form to the market conditions we are currently experiencing. The requirements for this search was a substantial selloff followed with a choppy bottoming process and a grind higher taking out the previous highs. Spoiler alert: These instances (since 1970) overwhelmingly occur in bull markets and tend to lead to meaningfully higher prices.

For reference sake, here’s where we’re at:

Instance 1:

The result is quite bearish:

Instance 2:

Actually embedded in instance 1 (freaky): July 1990 – March 1991

The result: Higher prices

Instance 3:

January 1994 – March 1995

The result: Super bull

Instance 4:

February 2005 – July 2005

The result: A pullback and new highs

Instance 5:

April 2010 – November 2010

The result: This instance is fresh in our minds and most will remember a shallow pullback and higher prices.

Instance 6:

The present

To aid your visualization I’ve included the appropriate negative space for both a bullish and bearish outcome. There is room for both interpretations, but the choice, as always, is up to you.

Bullish:

Bearish: