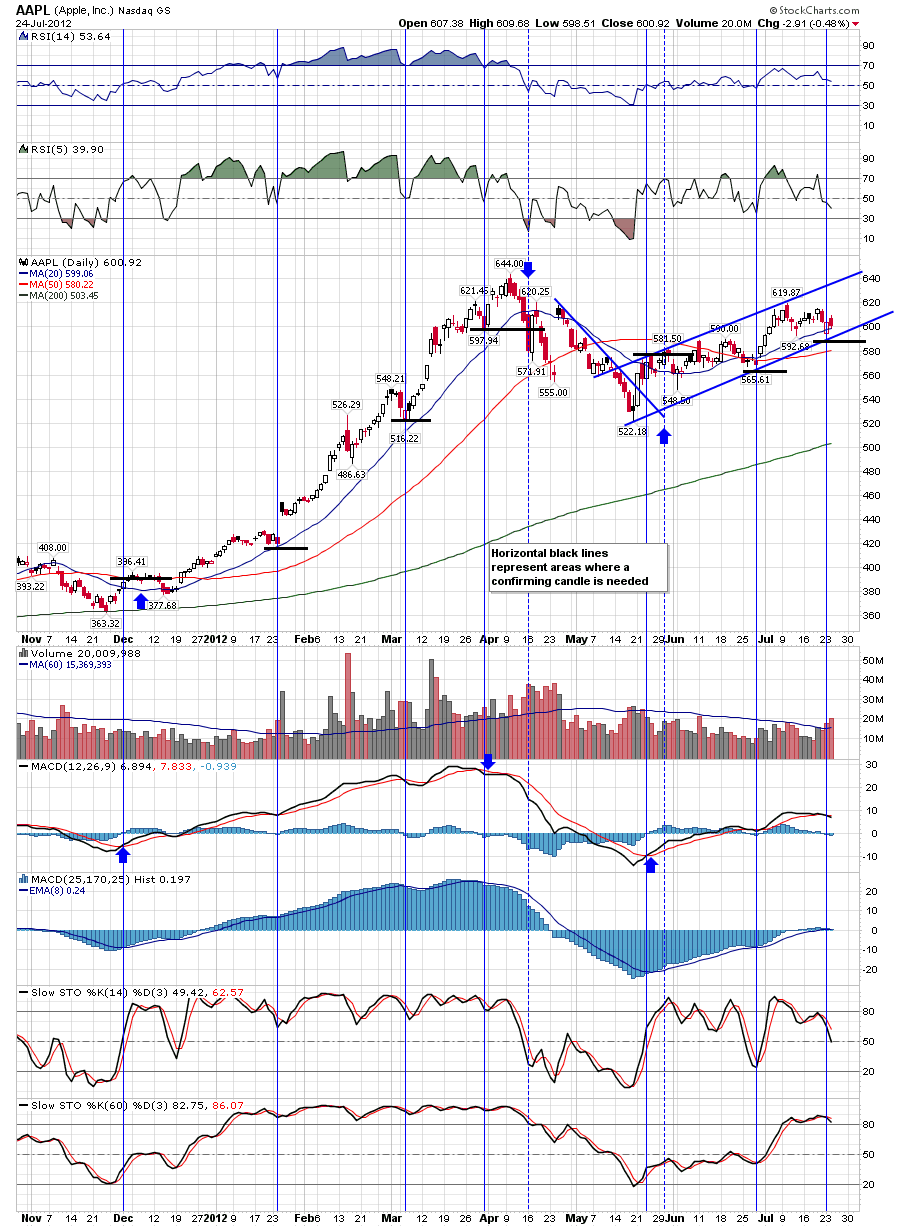

The BPGDM is now at levels not seen since 2008, it's current at 7%, which is an extremely oversold level for a bullish percent chart. Bullish Percent charts have a range of 0% - 100%, but almost never hit 0% or 100% except in the most extreme cases - very rare events.

Gold Stocks have been very weak this year, save for the bounce off the May lows. Seasonality wise, precious metals tend to be weak during thee summer months and bottom during late July or Aug. Gold stocks are also very cheap from a fundametal standpoint and are trading at levels not seen in years. GDX and some individual gold stocks appear to be lower risk buys.

However if you would rather wait for a 'trigger', one trigger would be the BPGDM closing back over the 8 day moving average as shown in this chart, which is a mechanical system. For more analysis on precious metals gold, silver and gold stocks, as well as other general market analysis, please sign up for our newletter. Also we currenly have a 50% sale on our 6 month membership, click here to sign up now