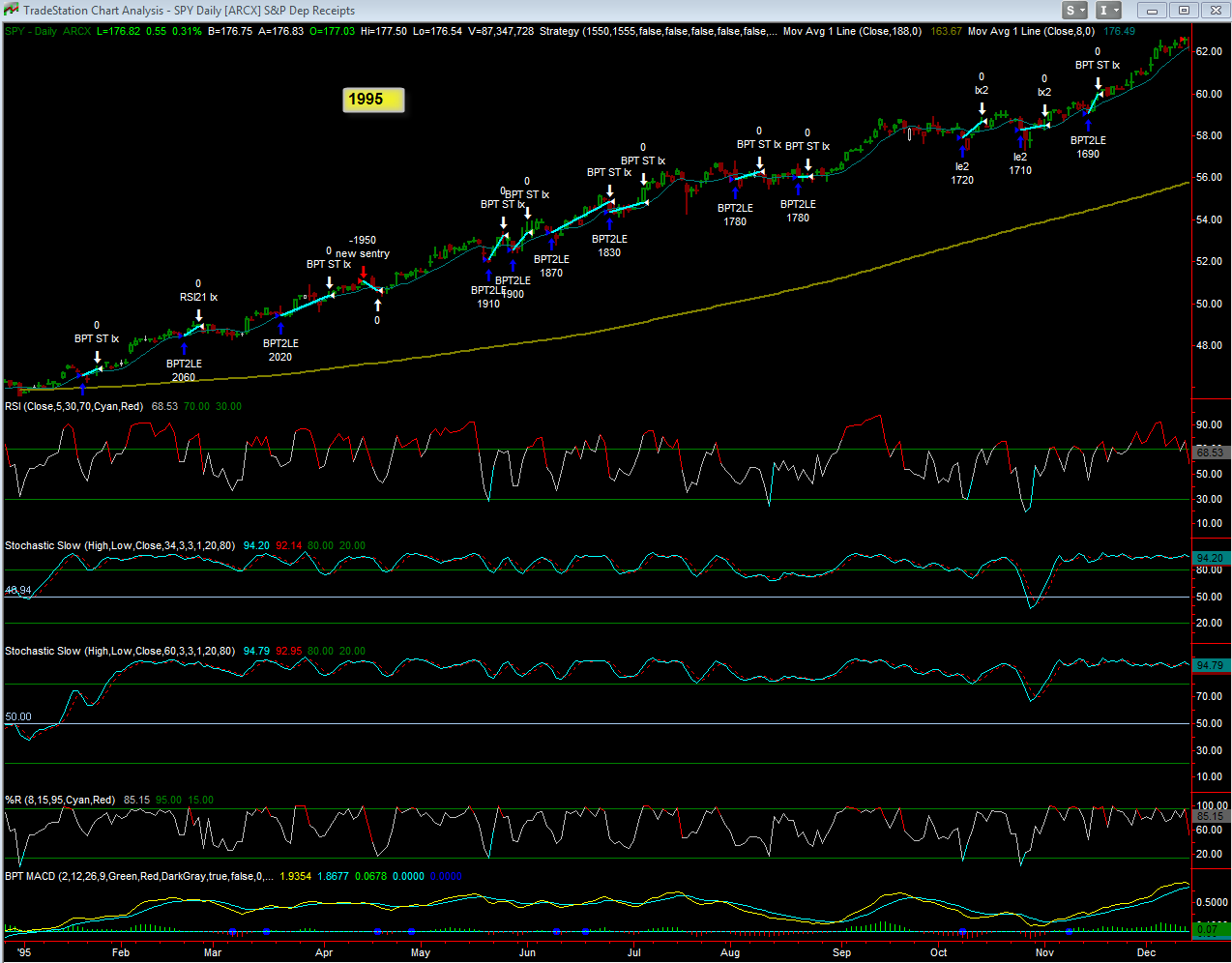

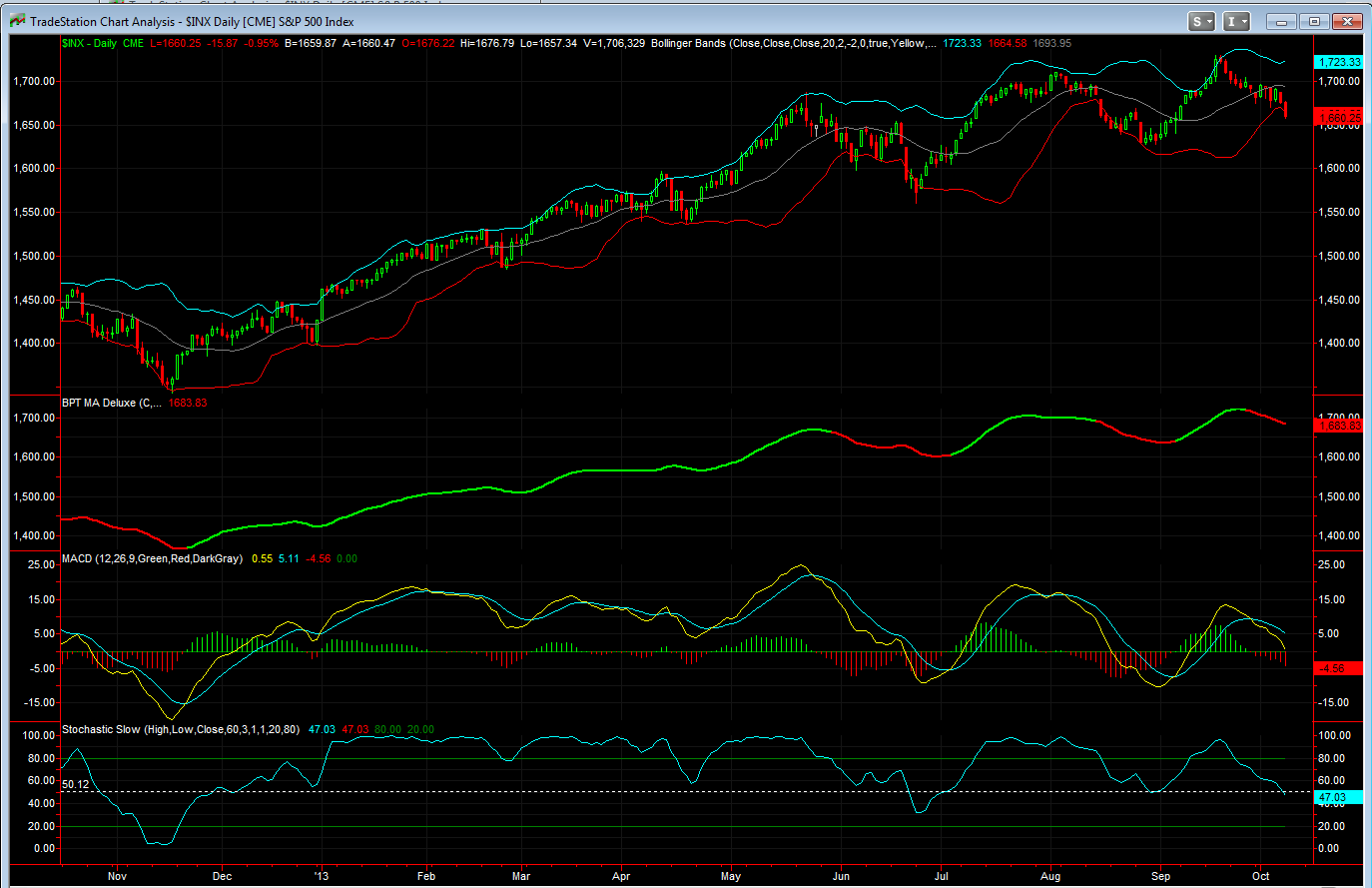

As I stated previously, the SPY Pro Scaleout version would scale out of 20% of its shares at a 1% gain at a price of SPY $164.96, that just occurred as you can see from the chart. Again if you are following the scale out version please don't wait for me to post the confirmations, as I stated, the best thing to do is to simply place a GTC sell limit order in at your broker when you first enter the trade, that way it will just execute automatically for you.

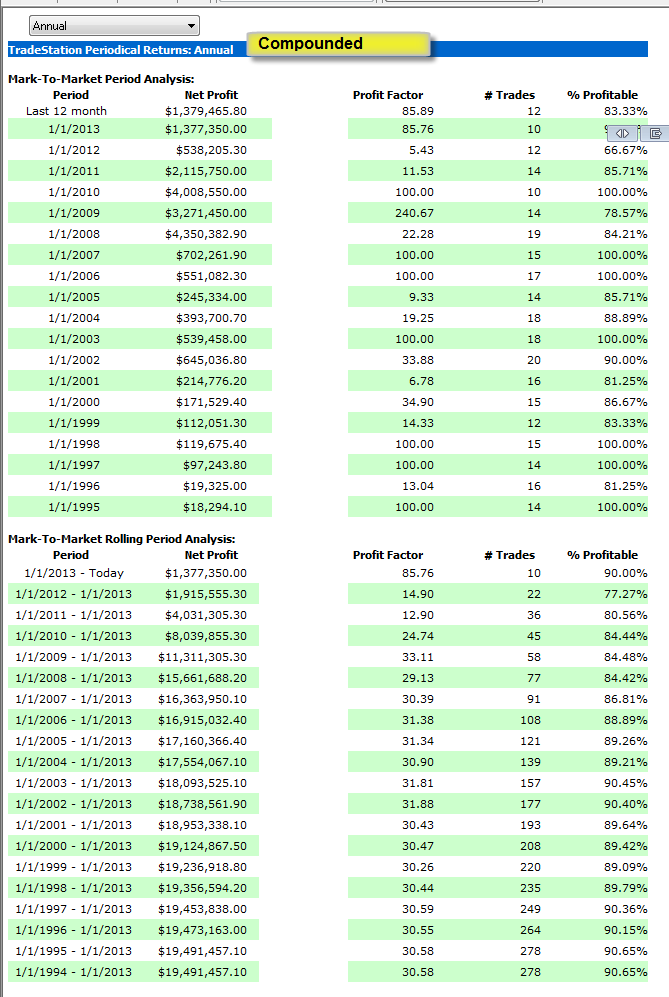

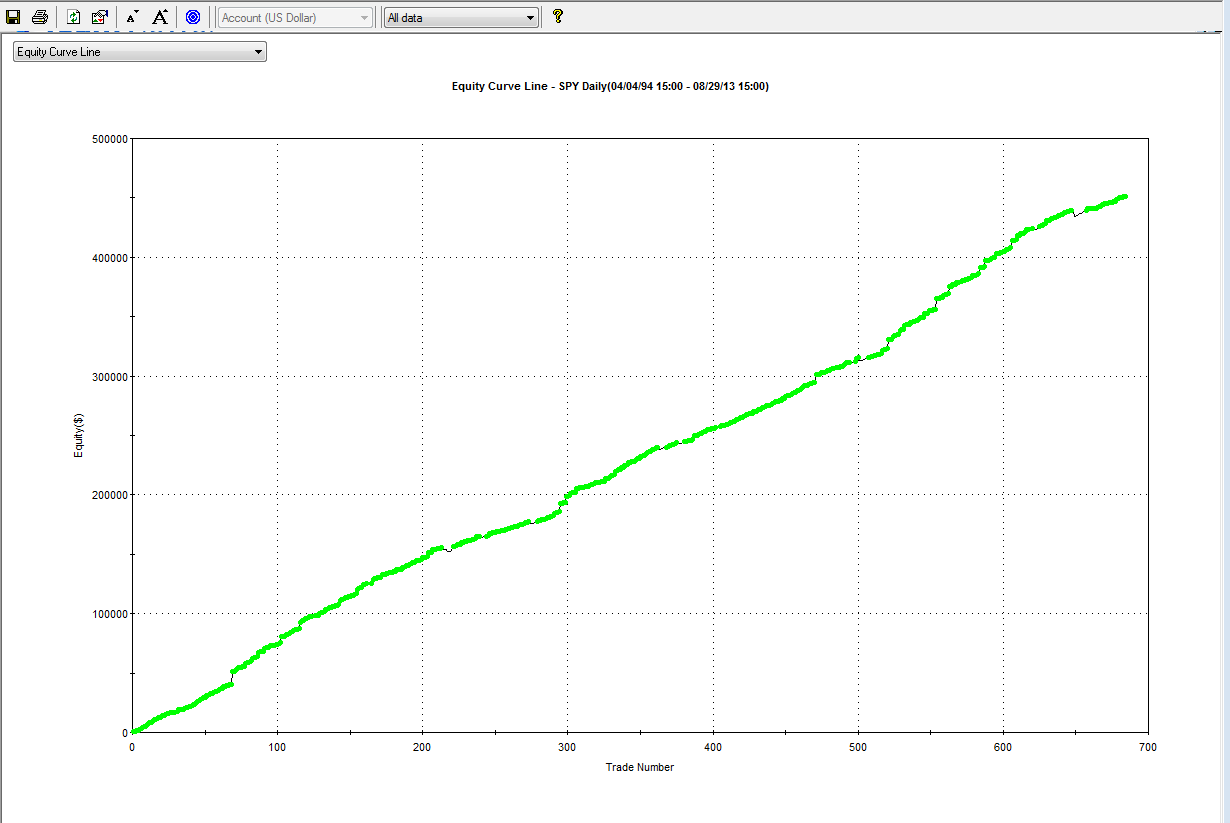

I'm also including the stats: 96.05% winning trades, 684 total trades, 93 consecutive winning trades, 2 consecutive losing trades and a beautiful profit curve.

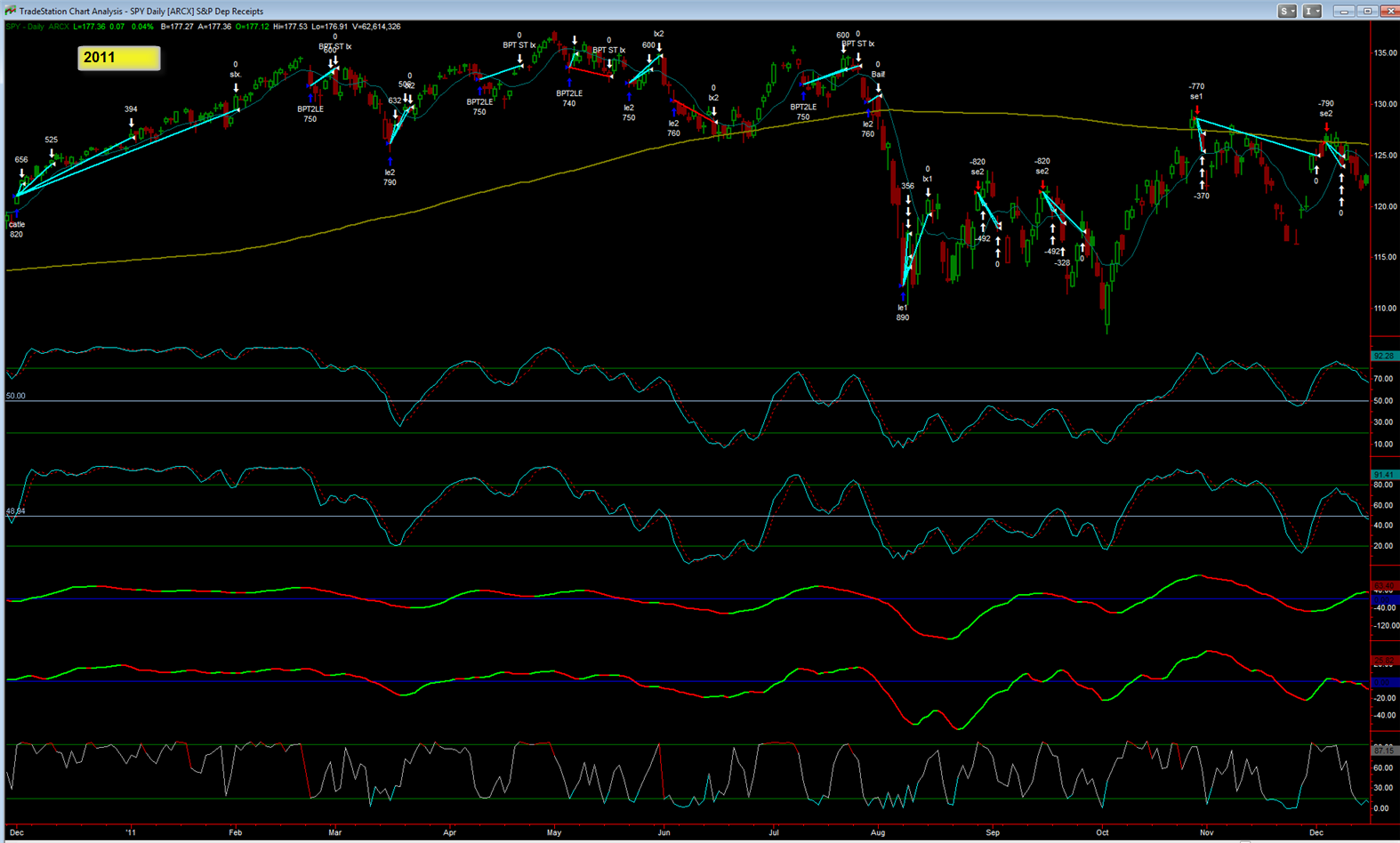

In regards to the rest of the system trade, if SPY closes over the 8 day moving average, the system will exit it's total position and go to cash, that's actually not to far away and something you can monitor on your own, just add an 8 day MA to a daily chart of SPY.