Newsletter Signup

Search

Followers

Blog Archive

-

▼

2015

(1142)

-

▼

March

(168)

- $SPX 60 min, notice how price stopped exactly at t...

- SPY Pro system 1st scaleout achieved

- $TRAN, weekly chart, shows clear support and resis...

- $TRAN daily chart, monitor trendlines - http://bit...

- $SPX daily, nice rally so far price has rallied of...

- $SPX, here's a clear weekly view of the SPX, it's ...

- $SPX monthly long term view, after 6+ years into a...

- $GDX daily, possibly forming a bull wedge with som...

- $USD, big picture monthly long term view of the do...

- $USD, US Dollar Daily chart - http://bit.ly/1F8oT0j

- $Natgas, natural gas daily chart, broke the triang...

- $WTIC, big picture monthly view of Crude Oil - htt...

- $coffee, downtrend channel - http://bit.ly/1F8onj2

- $CRB, monthly big picture view of the commodities ...

- $TNX, long term view of 10 year Treasury Yield, in...

- - http://bit.ly/1OOksgJ $SPX Weekly

- - http://bit.ly/1H56iCt $POST Short Setup

- - http://bit.ly/1H561iQ $RXN Short Setup

- - http://bit.ly/1M8rbTV $PAA Long Setup

- - http://bit.ly/1M8pVQv $SRS another great trade t...

- - http://bit.ly/1M8pFRz $SOXS great trade this wee...

- $UNG, Natural Gas ETF, breaking the lower support ...

- Here's my FREE comprehensive Market Newsletter - T...

- $WTIC, crude oil, nice bounce again today, however...

- $UNG, natural gas ETF, monitor the triangle patter...

- $USD, US Dollar - testing the uptrend line - http:...

- $SOX, weekly SOX semiconductors - http://bit.ly/1C...

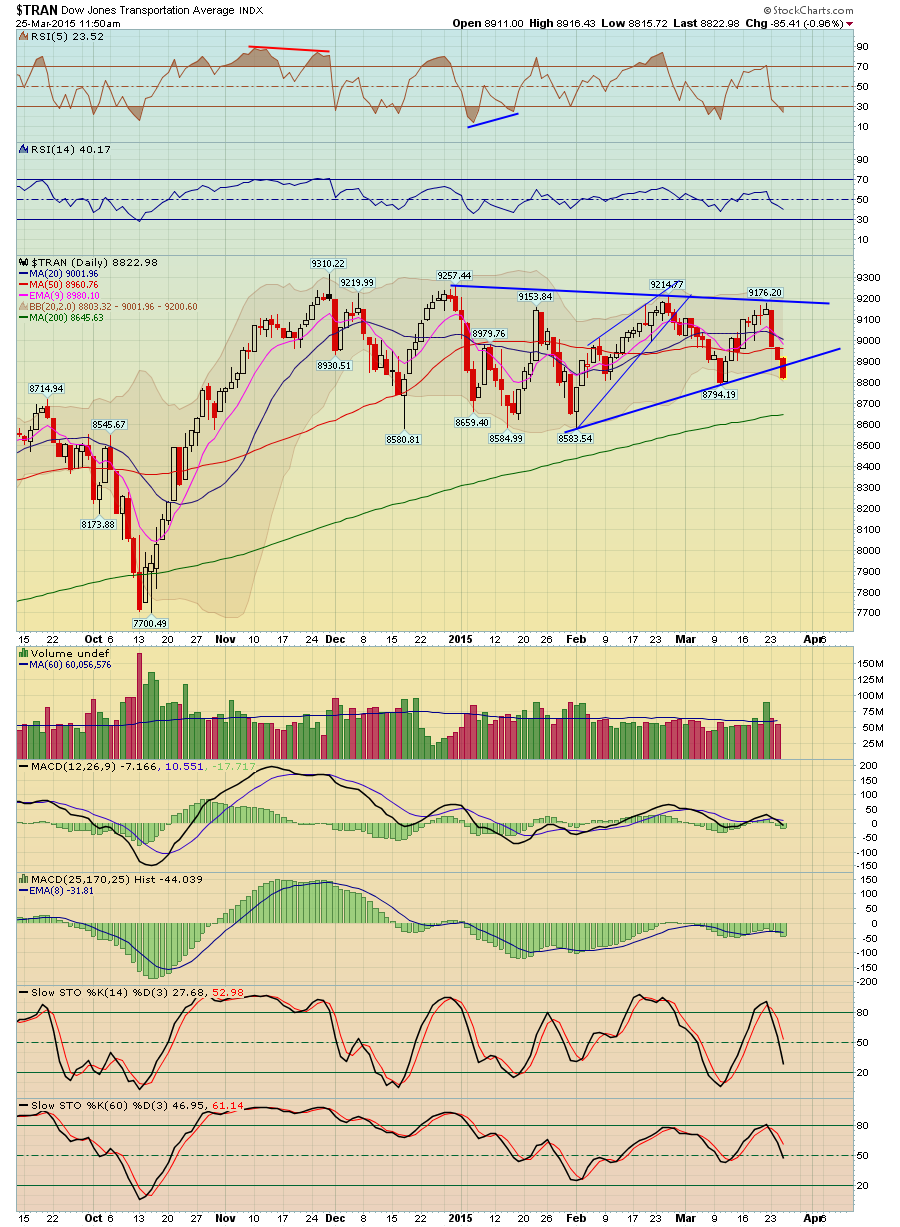

- $TRAN and $INDU, this chart shows Dow Theory, noti...

- $TRAN, Transports - http://bit.ly/1CQqhWh

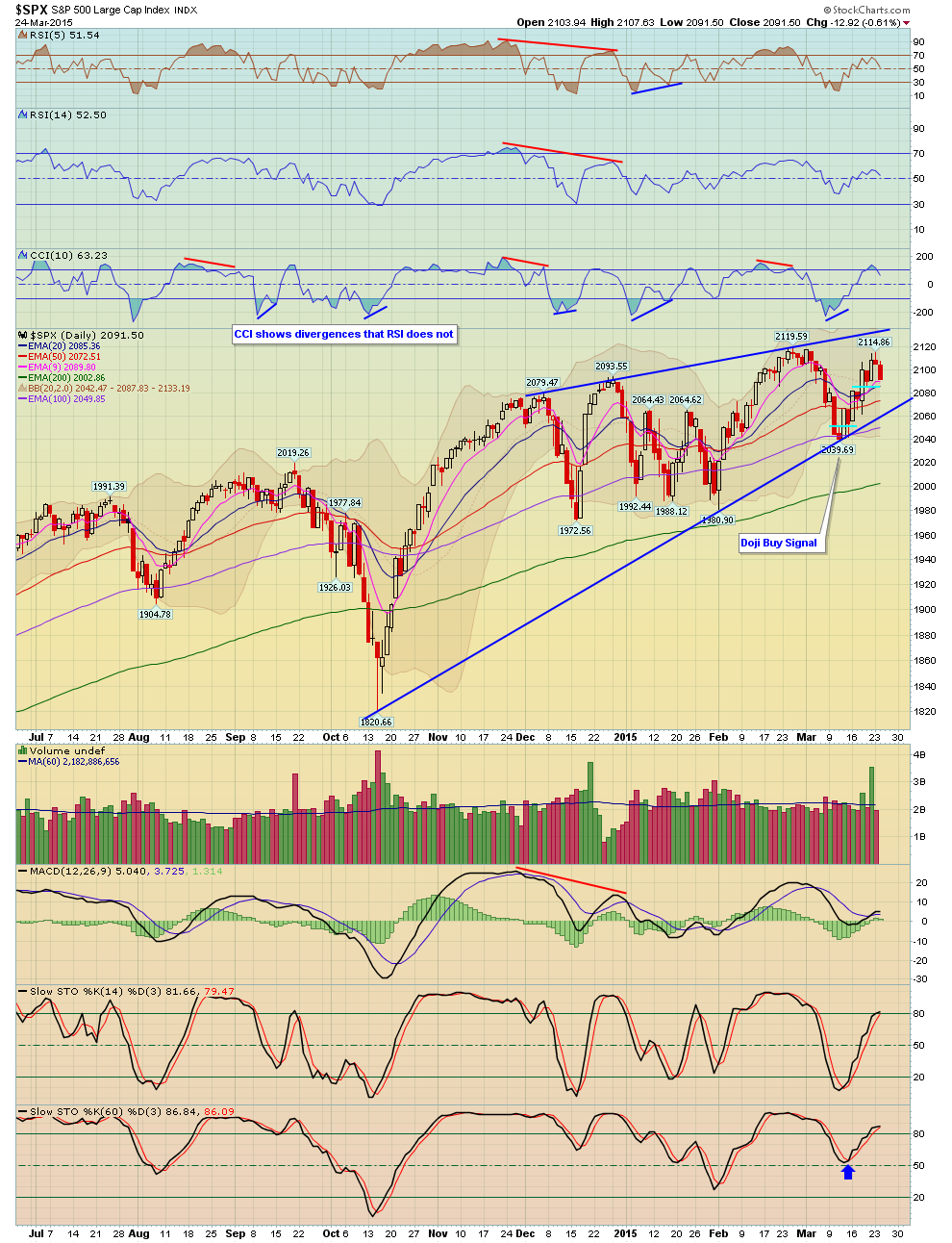

- $SPX daily, shows a potential sloping H&S patern -...

- $SPX daily chart, shows the same wedge pattern, no...

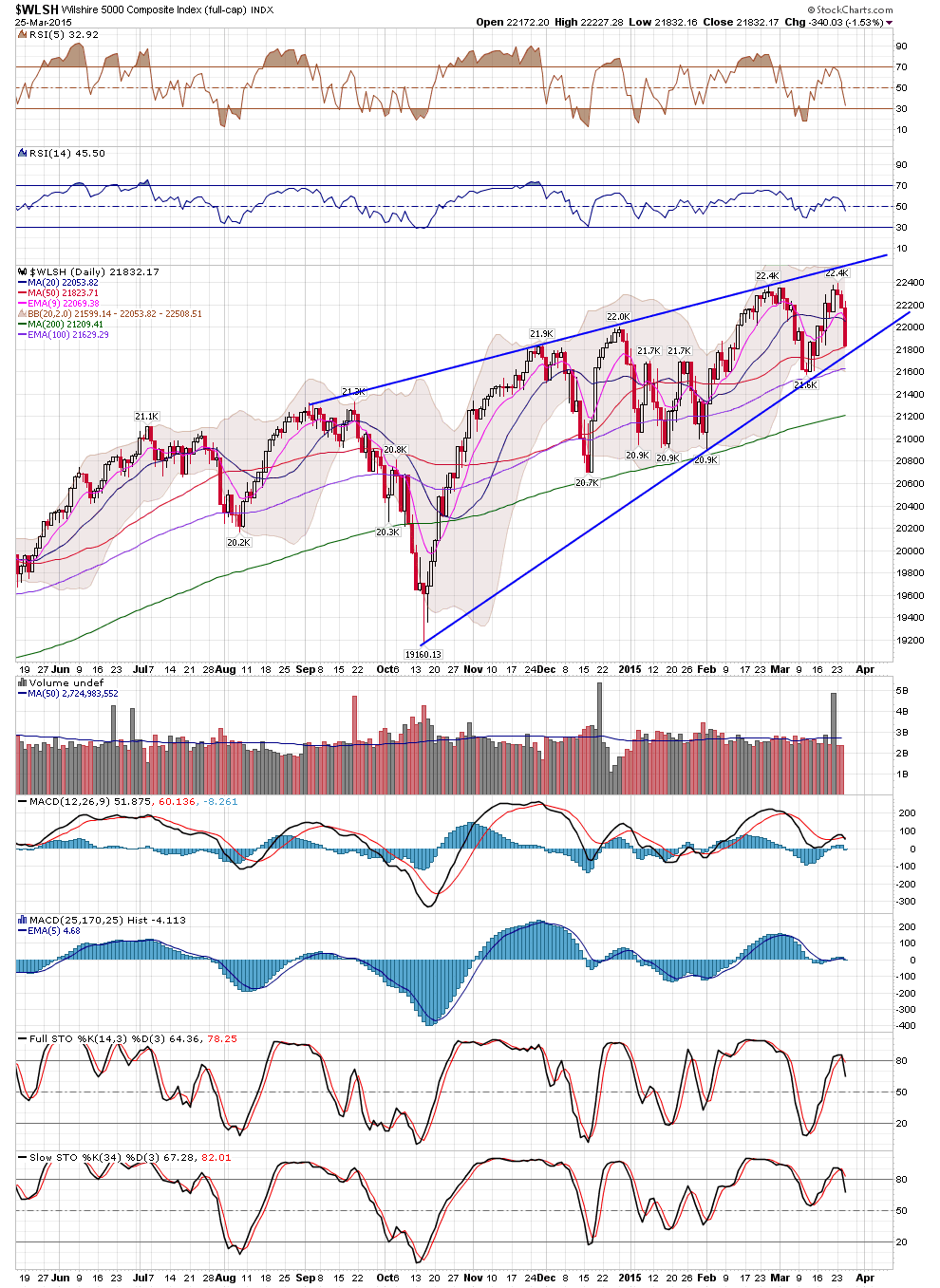

- $WLSH, Wilshire 5000, price closed on the 50 day M...

- Daily Index Views

- $MDR follow up to our long play from weekend, it's...

- $OIH, despite the market sell off today, the energ...

- $SPX daily chart, big sell off today, that rising ...

- - http://bit.ly/1CPivvF $SRS Tagged initial target...

- - http://bit.ly/1CPinwf $SOXS Nice move from last ...

- Tran Views

- - http://bit.ly/1FFXrKe $IBB testing 20 day

- - http://bit.ly/1FFXfuy

- - http://bit.ly/1FFXdmd

- SPX daily

- $SPX, 60 min view, here's another scenario to moni...

- $SPX, 60 min view of SPX, notice that it closed ri...

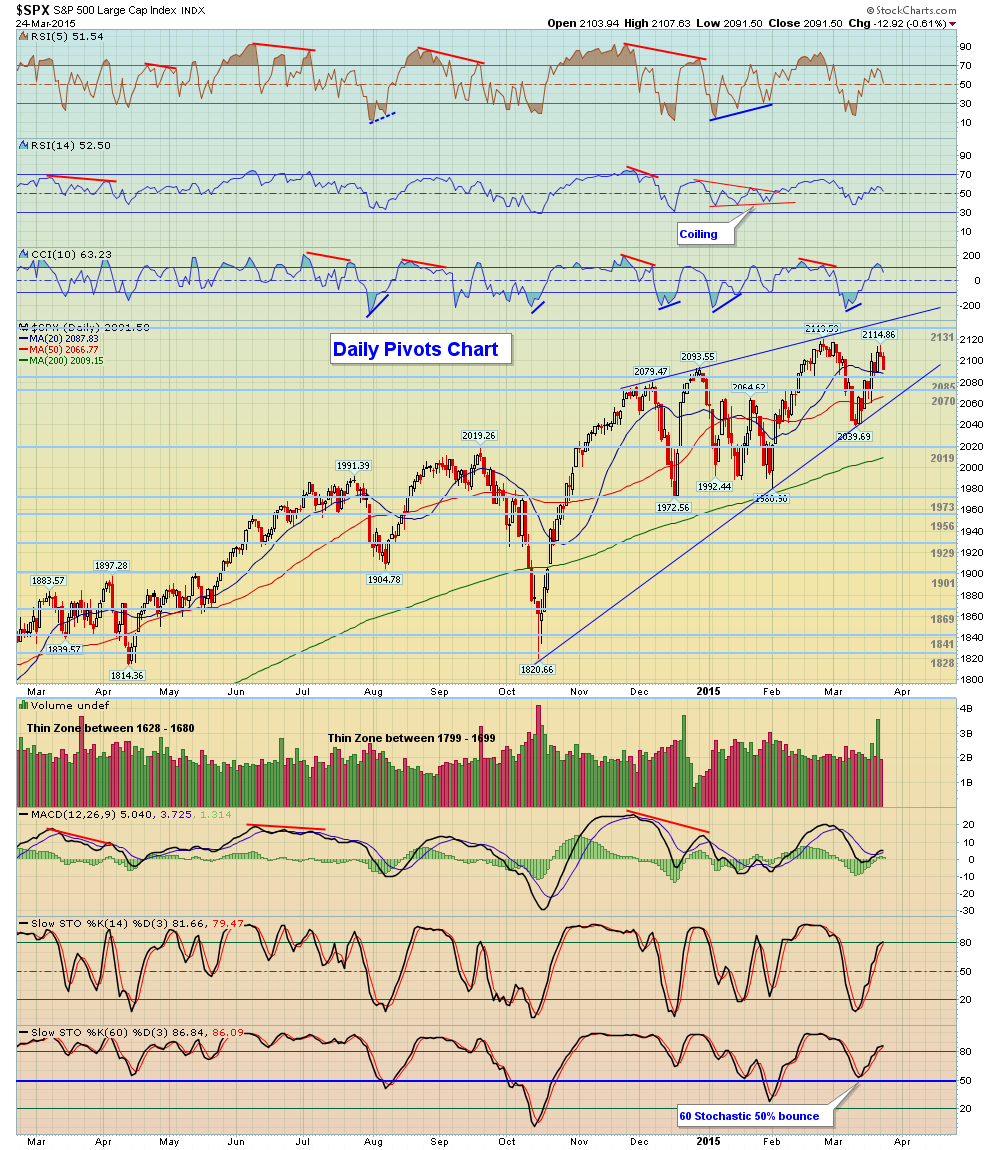

- $SPX, here's the daily SPX chart with the pivots, ...

- $SPX, Nice pullback today in the makret, SPX close...

- SPX 60 min views

- $MDR, nice breakout from this pattern! Remember p...

- $MDR - nice long idea, pennant triangle and an ope...

- $OAS, oil stock, looks weak, could lose shelf supp...

- $SOL, nice basing pattern, one to monitor for a lo...

- $DBA agriculture ETF, keep an eye on this sector, ...

- $COPPER, wow huge rally in copper today! Followed...

- Nice comparision chart of the US Dollar vs the CRB...

- $USD, another nice pullback in the US Dollar, it's...

- $SOX, this weekly chart of the Semiconducators con...

- $IBB, The Biotech Sector finally pulled back today...

- Copper had a big day and follow through from Friday

- SPX Intraday Views

- $COMPQ, Nasdaq Monthly chart - that Mar 2000 high ...

- $GDX 60 min, follow up to the bottoming triangle p...

- $SPX 60 min, the bullish case is that we are in so...

- $UUP US Dollar ETF, remember on Monday I said to l...

- $USD, the US Dollar is still holding the parabolic...

- $AGEN biotech, hot sector latey, triangle forming,...

- $CYTK Biotech sector hot laterly, bull pennant for...

- $IMNP long idea of ours from last night, nice brea...

- $GOLD 240 min chart, keep an eye on this downtrend...

- $UNG Natural Gas ETF - http://bit.ly/1x7iges

- $WLSH Wilshire 5000 chart, potential rising wedge ...

- IMNP follow up

- Here's our Market Newsletter

- Here's My Free Newsletter - VERY comprehensive loo...

- $WLL, long idea of ours breaking out today - http:...

- $PVA follow up, long setup of ours that broke out ...

- $DBA Agriculture ETF, one to monitor for a long, p...

- $OIH Oil Services ETF, looks like a low risk long ...

- $Natgas breaking out of small triangle - http://bi...

- $GASO, gasoline rallied up uptrend line - http://b...

- 50 min chart of $UUP, Dollar ETF, look to now shor...

- Monthly View of US Dollar, pulling back from measu...

- $USD nice pullback today though still in long tern...

- $SPX Daily chart - huge reveral after the FOMC, ho...

- $OIH had a nice rally off support, stop could go b...

- SPX daily chart, rallied off support trendline las...

- $SPX 60 min chart, obviously FED was cataylist for...

- - http://bit.ly/1HZY1As

- The 60 min bear flag on the SPX that I tweeted out...

- - http://bit.ly/1HZr7zR $SPX Bear Flag Playing Out...

- ERI, nice reversal on high volume off the 20 day M...

- US Dollar - http://bit.ly/1HYODx7

- 60 min view of SPX, resistance is in light blue ju...

- Daily SPX chart with piviots, bounced off support ...

- As a visual confirmation, the SPY Pro and Ver 2 ...

- SPX 120 Minute

- SPX Intraday Views

- PVA nice setup to monitor, bull pennant pattern - ...

- AMPE turned into one heck of a trade for us from l...

- US Dollar, black candle some neg div via RSIs - ht...

-

▼

March

(168)

Tuesday, March 31, 2015

Monday, March 30, 2015

SPY Pro system 1st scaleout achieved

Hello everyone, the SPY Pro system achieved it's first scaleout! Remember this system scales out of 20% of it's position after a 1.25% gain in profit. This leaves 80% of the shares still in a long trade. So far nice trade from the lows of last week! Had someone simply bought 100 shares of SPY, one would nearly have paid for a 6 month membership.

For the SPY Pro combined system - since this system combines all three SPY systems (SPY Pro, Ver 2, and RSI 2), you would sell only 8% of your shares and still have 92% of the position.

By the way, the next scaleout comes in at a 2.5% gain for the SPY pro where it will sell another 20%, and of course another 8% for the SPY Pro combined system

Sunday, March 29, 2015

Friday, March 27, 2015

Thursday, March 26, 2015

Wednesday, March 25, 2015

Tuesday, March 24, 2015

SPX 60 min views

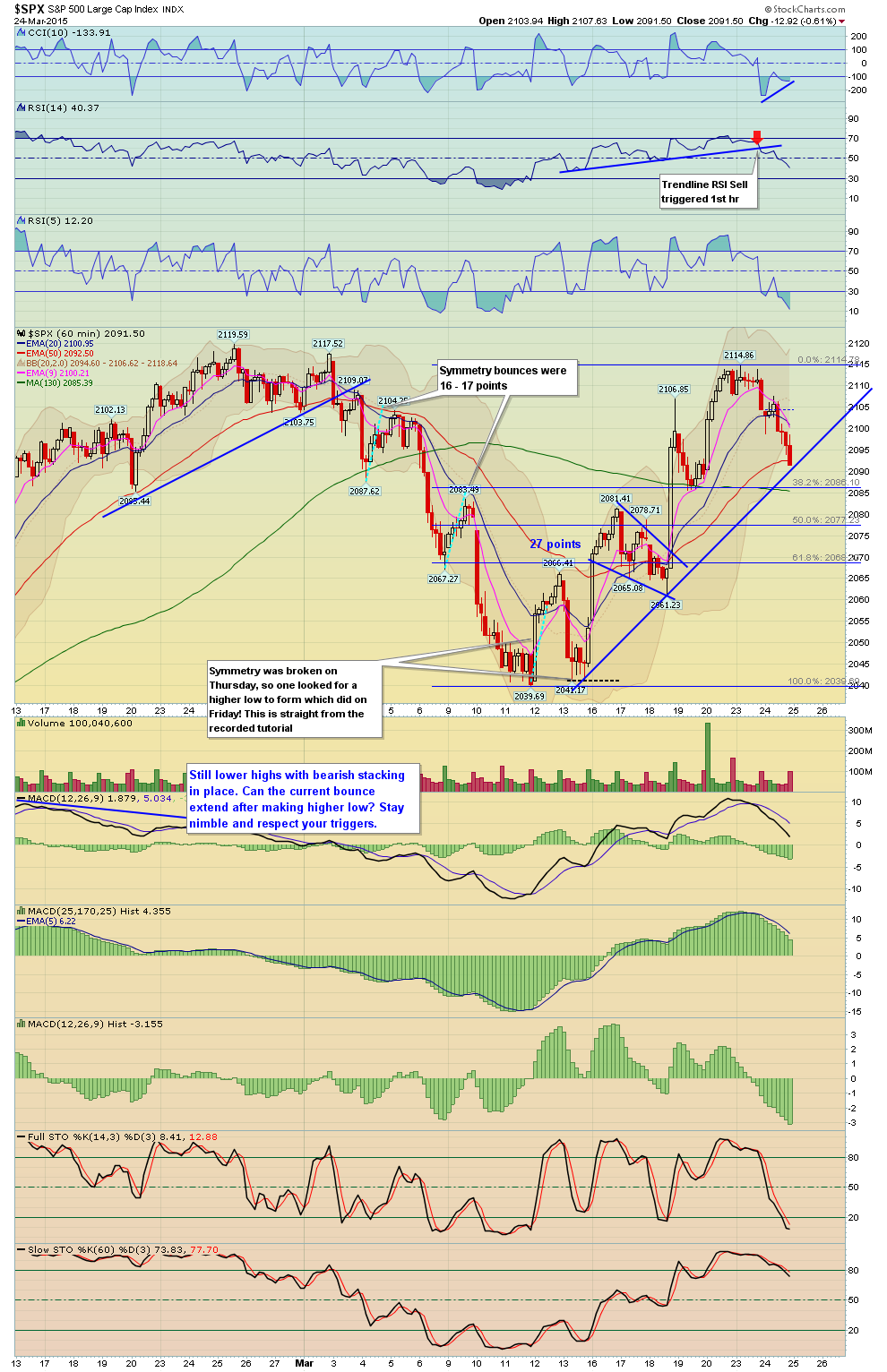

$SPX - Chart Link - with Fibs, first off that RSI trendline break occurred the first hr. Anyway an uptrend line from the lows here to monitor, some div on the CCI

$SPX - Chart Link - another view shows how a RS could form of a H&S pattern, notice we closed right on that uptrend line. However under this scenario notice the neckline would be slanted up, so another thing that could occur if there as some morning weakness (but not too much) that would allow the neckline to be flat vs slopped up, then bounce to for a RS.

again too much sell off would negate it and I'm simply throwing out things to monitor

Monday, March 23, 2015

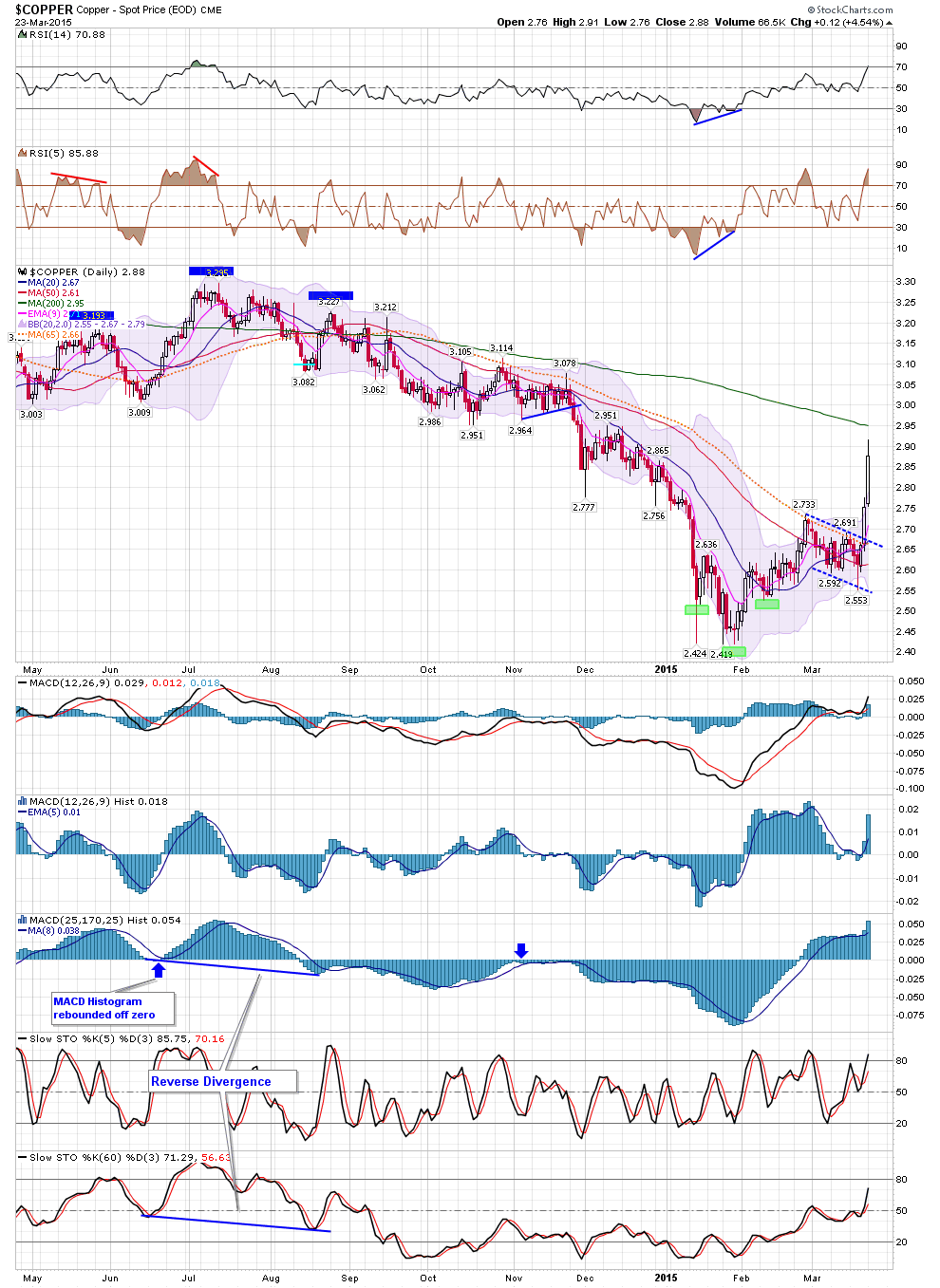

Copper had a big day and follow through from Friday

$COPPER - Chart Link - big follow through from Friday's gain

JJC - Chart Link - ETF

FCX - Chart Link - long idea we've had on the list - as expected with the symmetry break it made a higher low, continue to monitor this one going forward

SCCO - Chart Link - there's not a lot of copper stocks, most are in Canada, here's a couple to monitor should they follow suit

Friday, March 20, 2015

Thursday, March 19, 2015

Wednesday, March 18, 2015

Here's our Market Newsletter

CLICK HERE to view the Newsletter

Matthew Frailey

Tuesday, March 17, 2015

As a visual confirmation, the SPY Pro and Ver 2 ...

As a visual confirmation, the SPY Pro and Ver 2 systems closed out their trades on the market open and went to cash. All three systems closed out profitable trades albeit the profit was tiny for the SPY Pro, however the other two with their second entries made nice profits.

Also just to be clear for those of you who might be new or new to the systems - The action of the SPY systems exiting their long positions and going to cash should NOT be construed as a sell or short signal for the market! Do not short the market based on the SPY systems going to cash. Remember the goal of the SPY systems is to simply identify a trade situation, get in and get out, that's it. These are not trend following systems, they are reversion to mean systems that attempt to buy pullbacks in uptrends or short rallies in downtrends - get in and get out.

The system has very specific short signals, which are not in effect at this time.

SPX 120 Minute

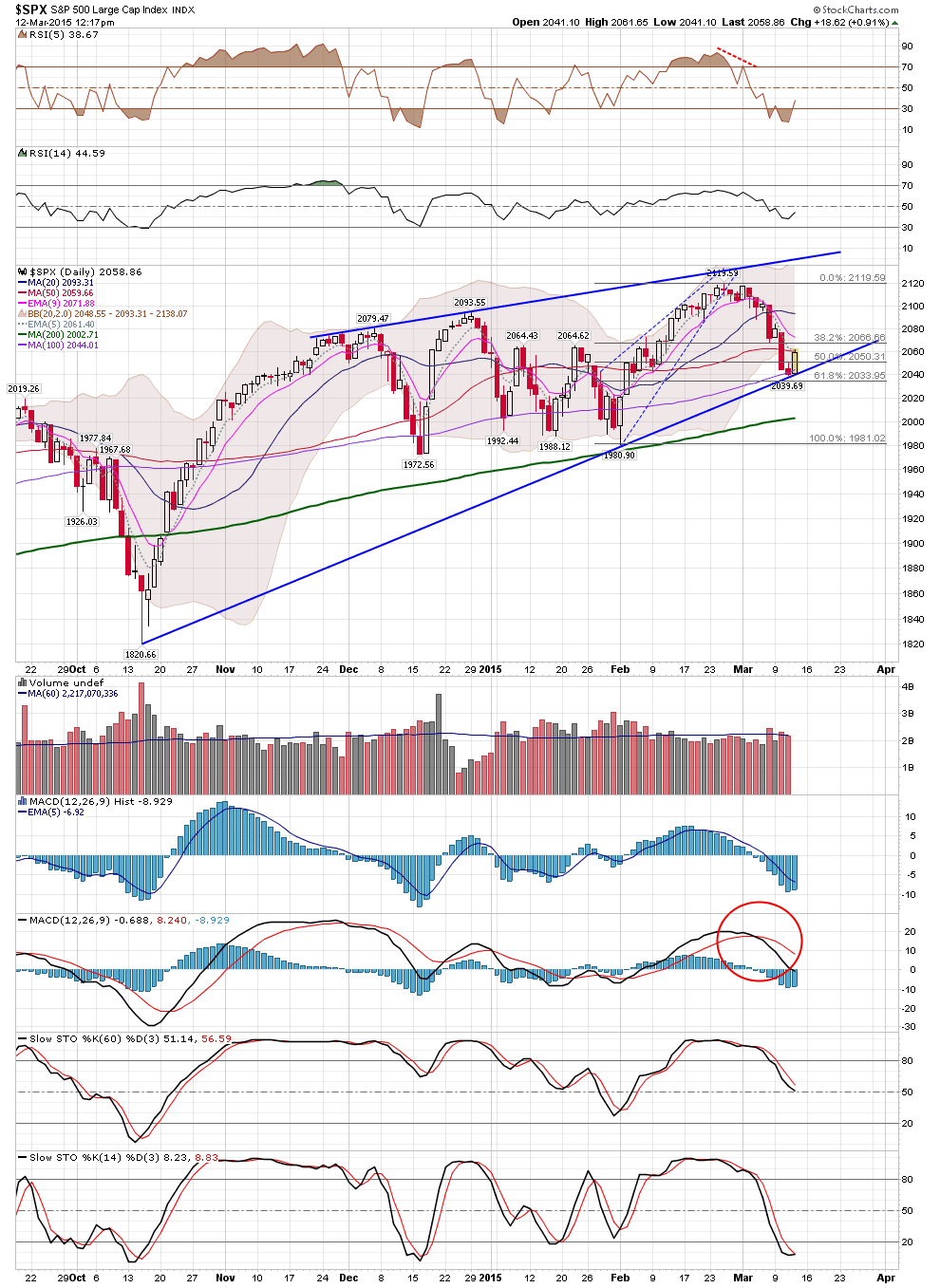

Possible backtest of trendline? Keep an open mind and respect your triggers. Internal readings (breadth) are solidly in bears camp now...continue to monitor.

SPX Intraday Views

Filled open gap yesterday which had the index quite overbought and today pulling back (Matt pointed out bear flag below)

Monday, March 16, 2015

Sunday, March 15, 2015

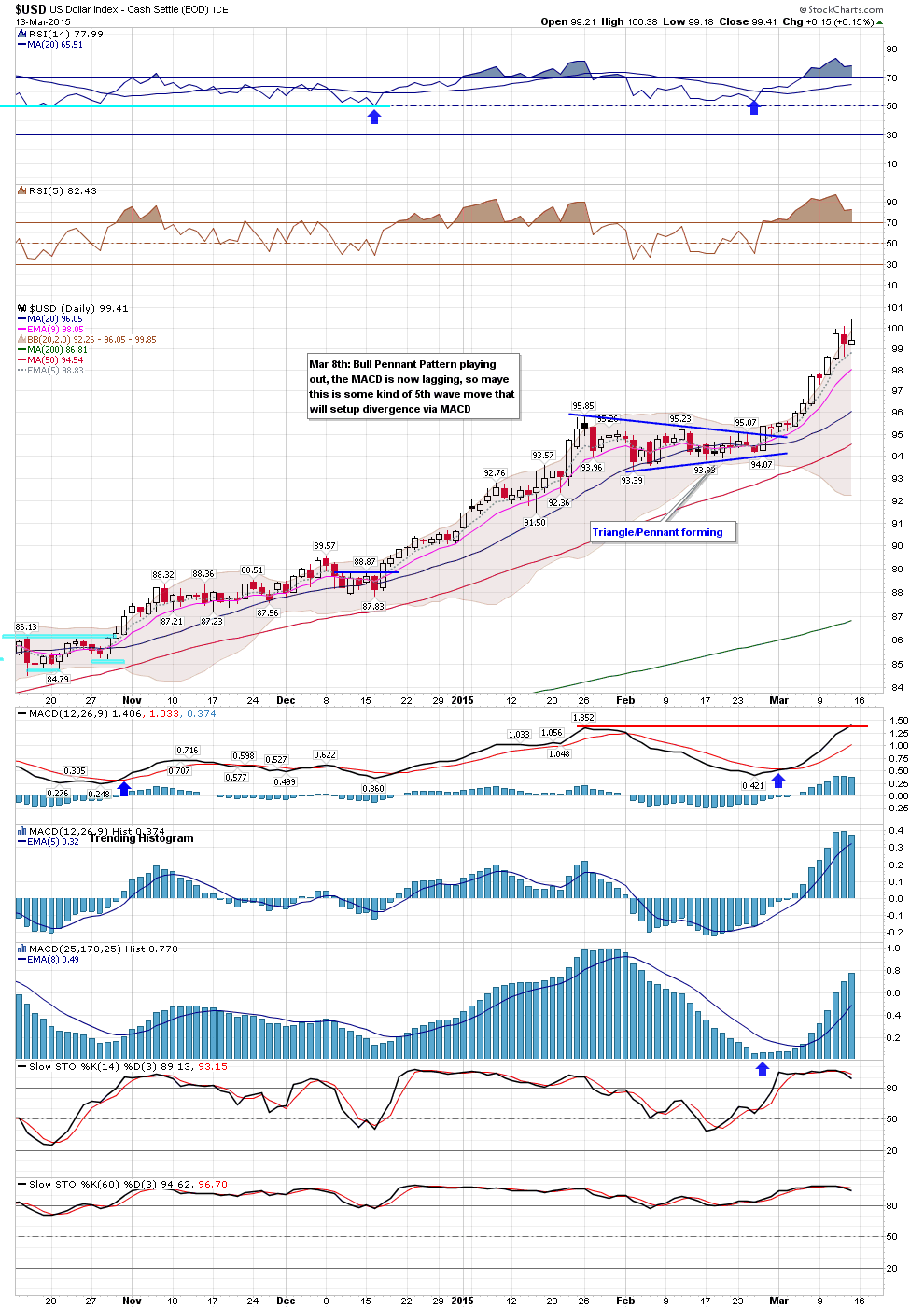

Dollar Views

Notice the inverse relationship between the USD and CRB since last July.

Friday, March 13, 2015

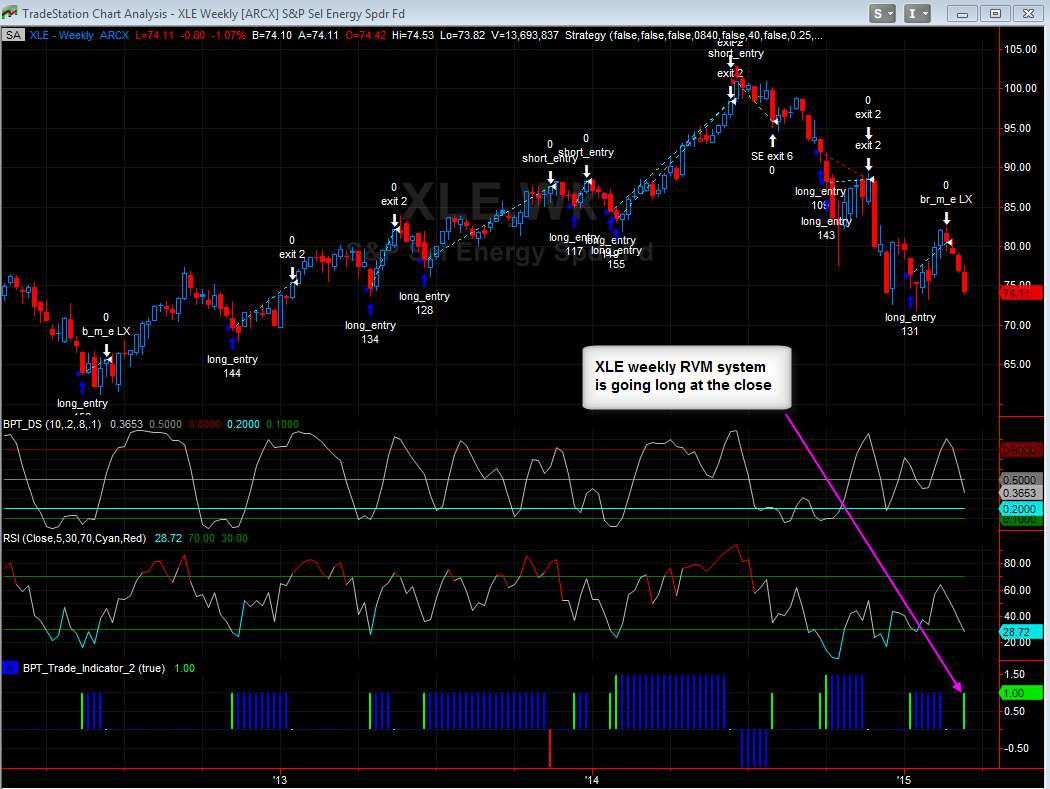

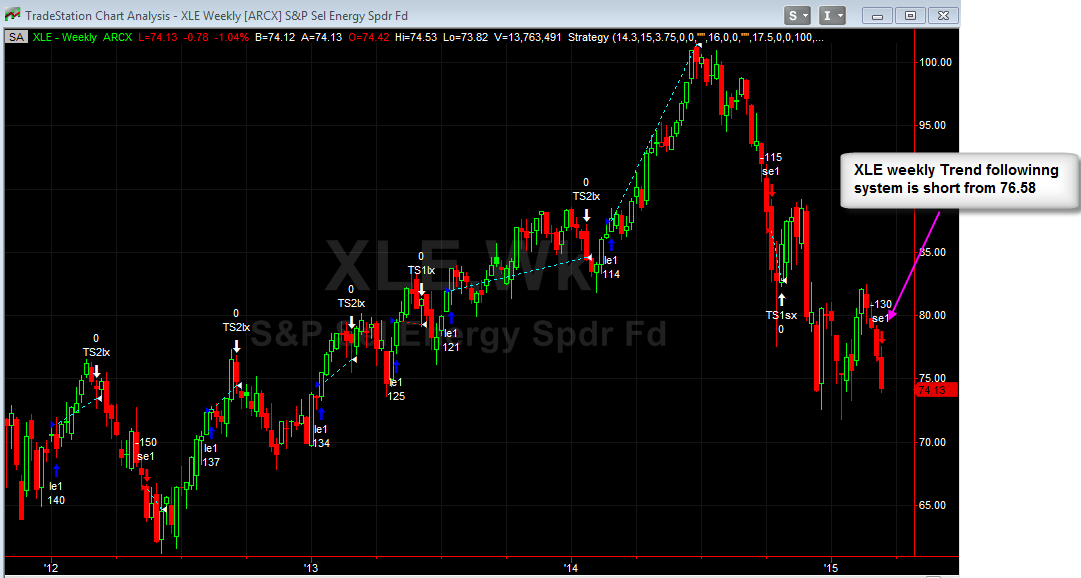

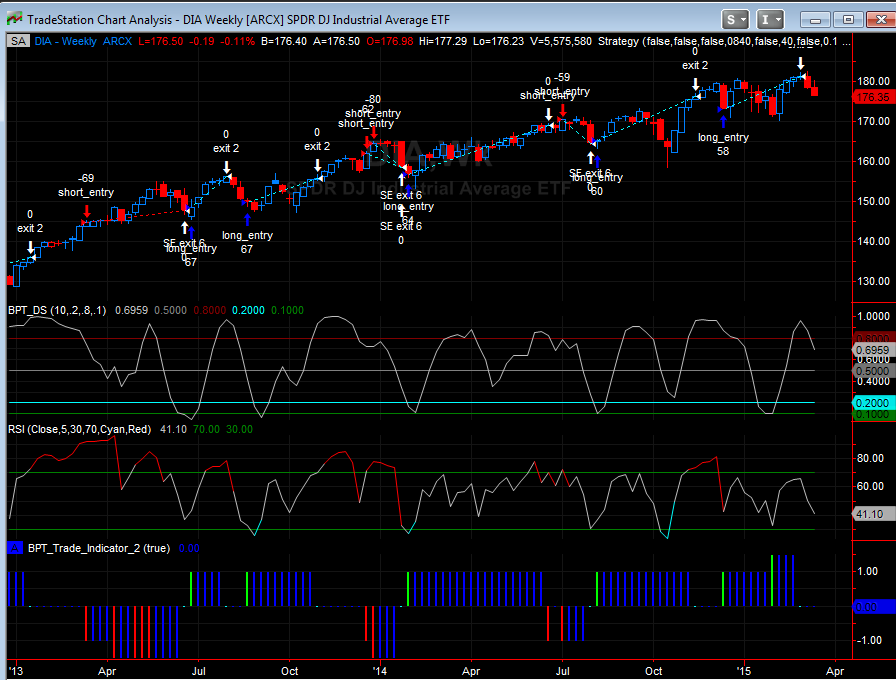

Weekly ETF systems - example

So here's an interesting example to point out: As I sad I have a basket of these weekly ETF systems, I run two different systems on them, one reversion to mean and one trend following or breakoutt - so each ETF has two systems running on it on two different charts, so if there are 10 ETF's, there would be 20 charts, with 10 of them running the RVM system and 10 of them running the trend following system. At times you will get both systems long or short, or you can get cases when one is short and one is long.

Here's an example on XLE, the energy ETF:

The first chart shows XLE running the RVM system, notice that it closed out a profitable long trade just over 3 weeks ago, however now it's going to go back long today at the close, see the green indicator bar at the bottom of the chart.

The second chart shows XLE running the trend following system, notice that it's already short, it went short at 76.58 on Monday, so it's up nicely.

Anyway what's going to happen when the RVM system goes long today at the close is that the short profit will have been locked in and you will have a 'Net Zero' position since they both cancel each other out. Should the market continue selling off and XLE goes to new lows, it cancels the early RVL long trade, or vice versa should XLE rally next week.

anyway just showing an example of what will happen at times once I release these systems, you will have trades that are both long and short at the same time

SPX 1 and 5 min

$SPX - Chart Link - unable to break symmetry thus far on any bounce

$SPX - Chart Link - 5 min still quite ugly, some RSI div but not really on MACD

Thursday, March 12, 2015

SPX Daily View

Bounced off trendline and moved up to 50 day MA...on pullbacks would prefer to see it hold 50% of today's range to suggest continued upside momentum.

Wednesday, March 11, 2015

Our Most recent newsletter

Hello everyone, here's our latest newsletter, this one is longer than normal because along with my general market analysis, I also discuss some new mechanical systems, educational examples, as well as trade ideas.

CLICK HERE to view the Newsletter.

Also please consider taking advantage of the 20% Sale we have going on right now.

Matthew Frailey

GDX comments

GDXJ - Chart Link - besides the positive divergence and symmetry break on the intra day charts, these charts were setup via the daily charts via a trigger taking back 50% of the candle range a a trigger for those who have watched the tutorials.

The Weekly ETF systems have done great

They sold out of their long positions 2 - 3 weeks ago, most didn't short though XLV is in an exhaustion short