Late last week on Thursday and Friday I posted charts of the NYLOW and NAMO and NYMO market breadth indicators, which had spiked to levels generally associated with some kind of tradeable bottom - as you know so far we've had a nice rally off the lows, especially on Monday.

The first chart below shows the NYLOW indicator, as of Thur/Fri last week it had a large spike up, which as you can see generally marketed at least a short term tradeable bottom - basically the rubber band got too stretched and was due to snap back, or a reversion to the mean.

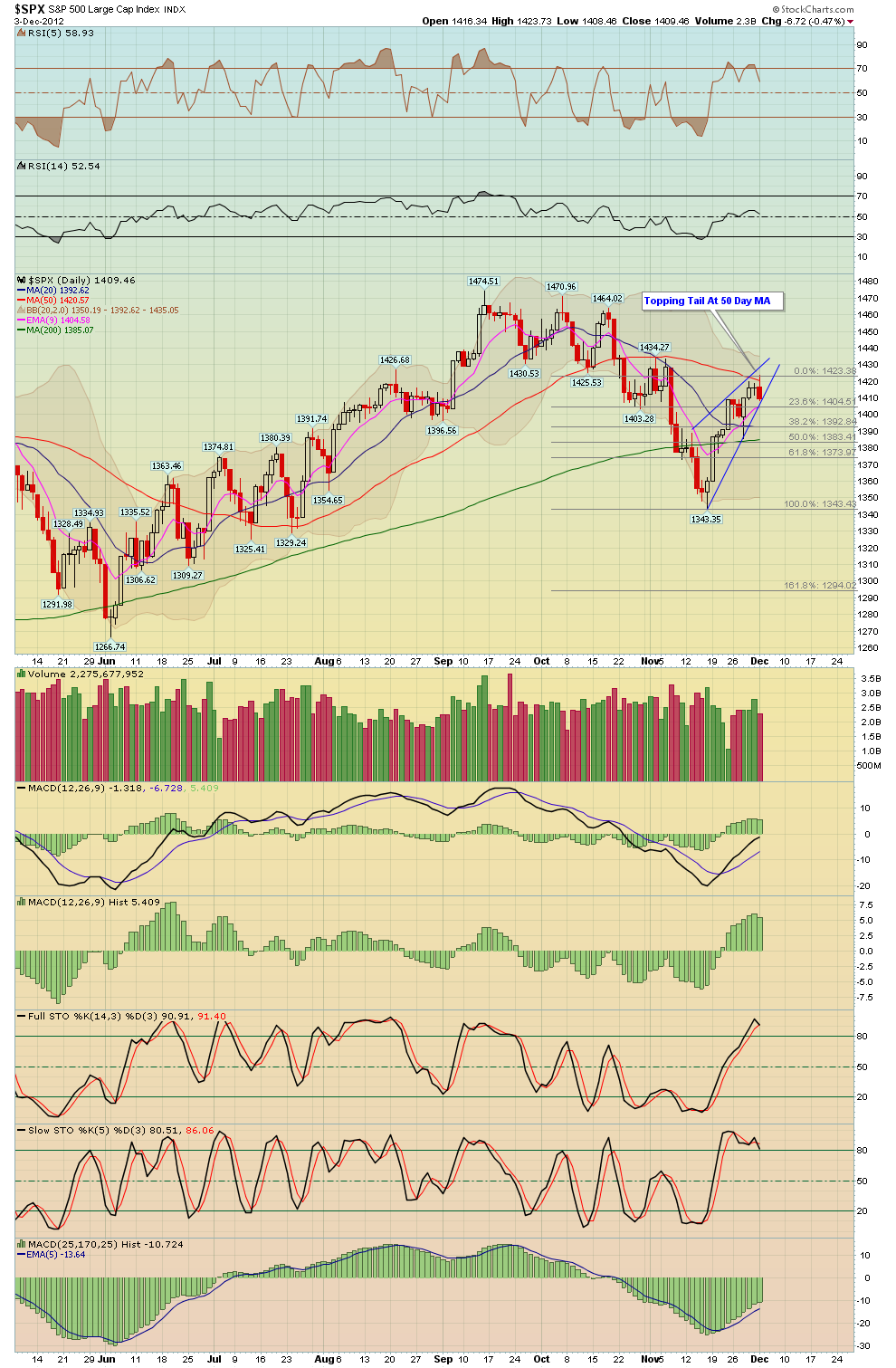

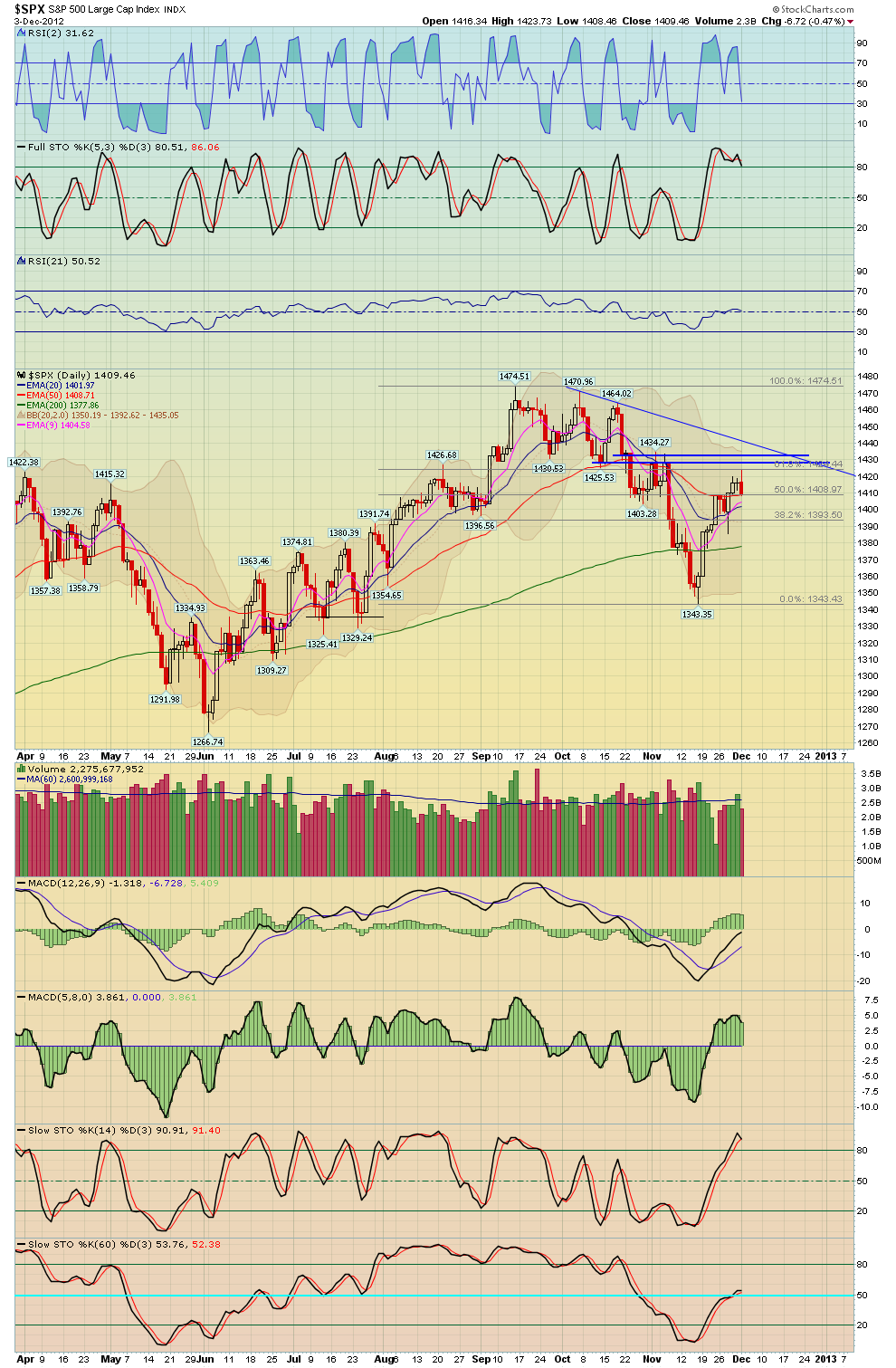

The second chart below is a daily S&P 500 chart, last Friday the S&P 500 closed well off the lows to form a hammer reversal candlestick and note that it logically occurred right off the 61.8% Fibonacci retracement. The next major resistance for the S&P 500 is the 20 day MA and of course the think blue horizontal line between 1403 - 1405, this is an area to watch for a potential pullback again.

The third chart is a 60 min SPX chart, note the bull wedge that had formed at Friday's lows last week - next resistance are the Fibs and the downtrend lines.

And lastly the 4th chart shows a 15 min chart of the S&P 500, if the market has put in a low, one bullish pattern that could set up is an inverse H&S pattern, currently the RS is developing, but still too early to say for sure and anything goes at this point.

Otherwise congrats to anyone who went long Thur or Friday last week for a tradeable bounce!

If you like our charts and analysis, please consider signing up to our website, also ask about our 25% coupon end of year special!!

Happy Thanksgiving!!

BPT