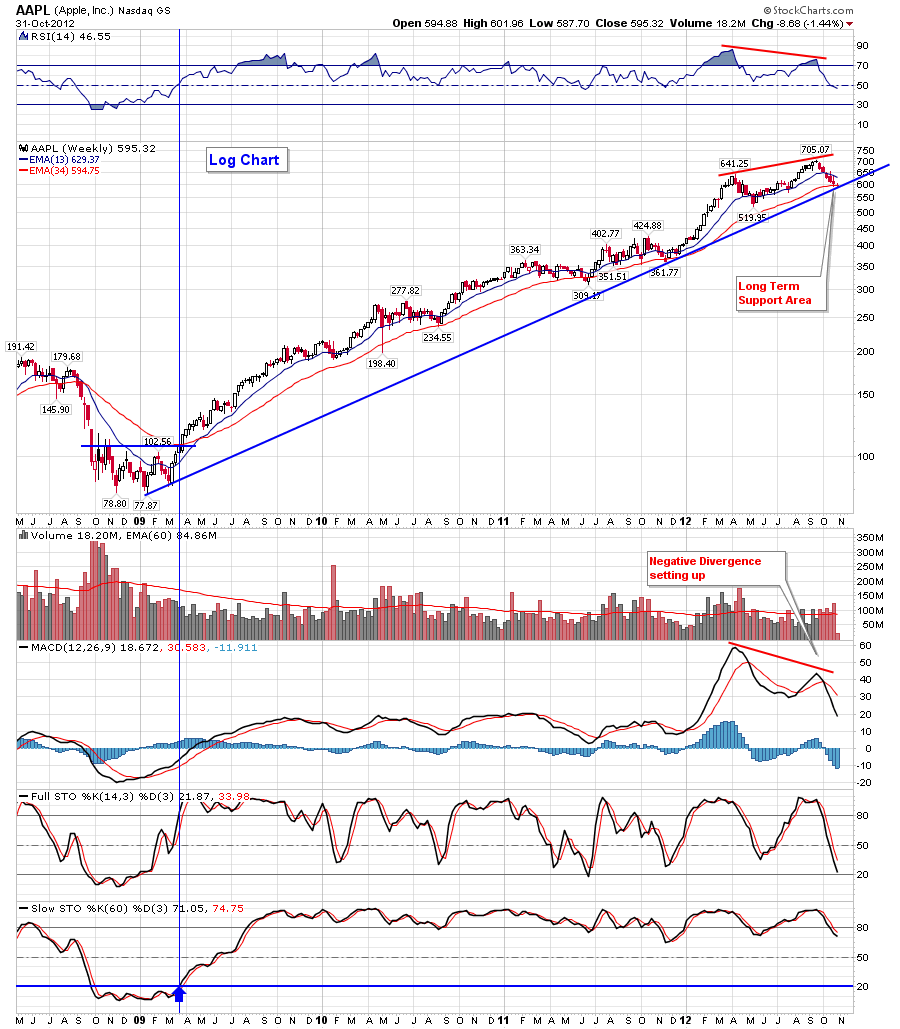

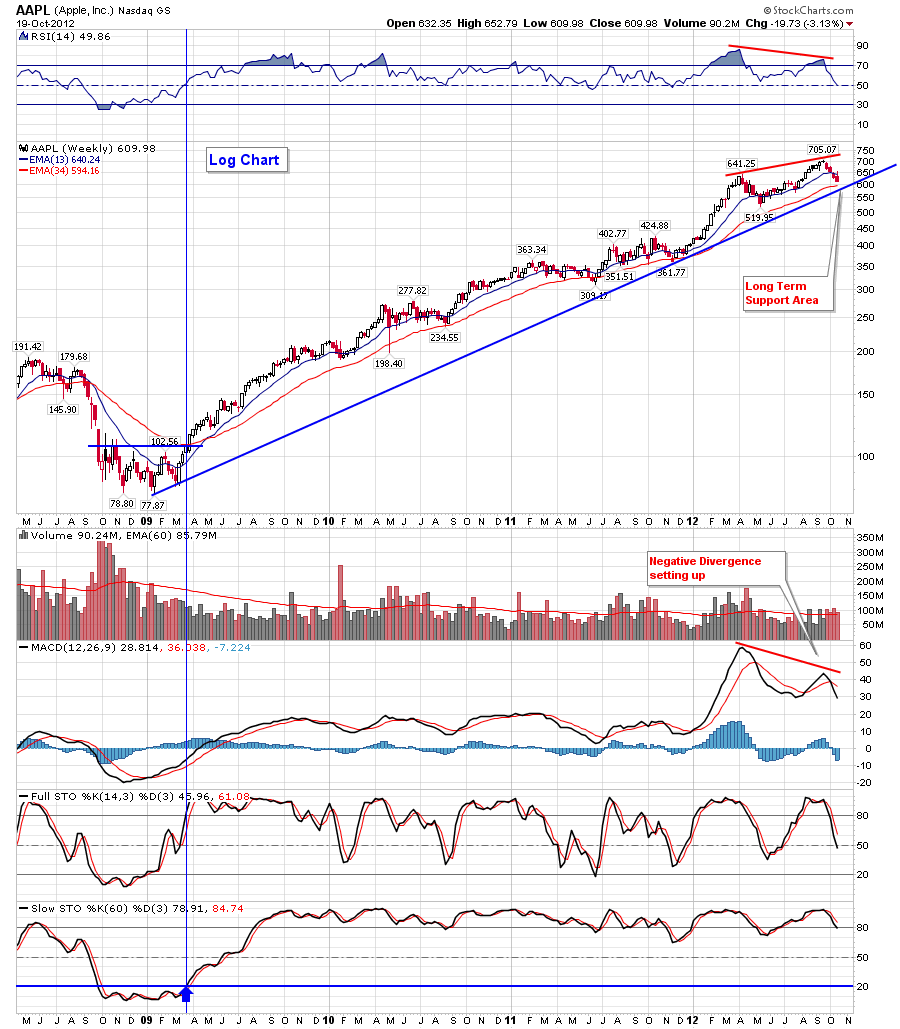

Here's a weekly and a daily chart of AAPL, note that AAPL is near a weekly uptrend line and the 200 day MA is very close.

Newsletter Signup

Search

Followers

Blog Archive

-

▼

2012

(207)

-

▼

October

(22)

- APPL charts near support

- There\'s a Moon cycle tomorrow

- BPT EMA RSI 2 System

- just to show for clarification - 1st entry of 30% ...

- BPT EMA RSI 2 system

- Our Recent Newsletter

- Nasdaq 60 min chart market comments

- RSI 2 S&P 500 mechanical systems update

- AAPL charts

- AAPL weekly chart comments

- Nasdaq comments

- Market Newsletter and Trade ideas

- SPX daily and SPY follow up to Oct 10th post

- Another RSI 2 strategy

- Some Trade Ideas to monitor

- NEM and RSI weekly chart follow up

- SPX RSI 2 reversion to mean system

- Market Comments

- Wednesday Oct 4th, 2012 Newsletter

- RSI 2 Statistics follow up

- Daily S&P 500 chart and trade comments

- Educational Example - applying the BPT whipsaw to ...

-

▼

October

(22)

Wednesday, October 31, 2012

Sunday, October 28, 2012

There\'s a Moon cycle tomorrow

$SPX - Chart Link - Moon cycle tomorrow, lately the market has been reacting to the moon cycles, will this moon cycle market a temporary bottom??

Otherwise remember the RSI 2 system went long an initial entry of 30% last week. There are a total of 4 entries, the system will scale in to the other trades ONLY on lower prices below the first entry.

Thursday, October 25, 2012

BPT EMA RSI 2 System

Yesterday, 10/24/12, Matt sent out an alert that the BPT EMA RSI 2 System entered an initial 30% long position on the close.

This

notification is to advise that the system will enter in a second long

entry of 30% (bringing the position to a total of 60%) if the S&P

500 closes below yesterday's close of 1408.75.

Wednesday, October 24, 2012

BPT EMA RSI 2 system

The EMA based RSI 2 system that I discussed before will be taking an initial long position today of 30% if the SPX closes negative or even flat. The system has a total of 4 potential scale ins if better prices are met (30%, 30%, 20%, 20%). Most of the trades end up having 2 entries. Currently the S&P 500 is down 5 points, again the closing price is the key.

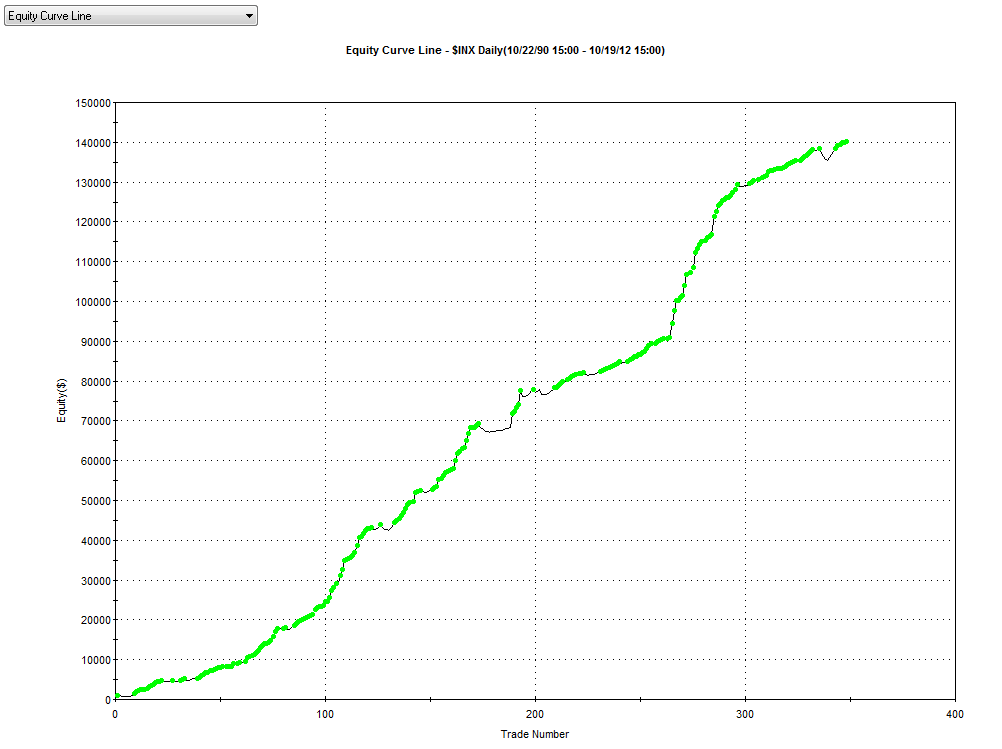

Key statistics - 21 years

349 trades

84% winning trades

Profit factor of 9.9

Average time in trade is about 8 days

**CLick Here** to see a full statistics report including a list of all the trades. NOTE** this must be opened in Internet Explorer ONLY not Chrome or Firefox

-----

Modified RSI 2 system -uses an EMA based RSI 2:

Longs:

When price is above the 160 SMA, go long when the RSI 2 falls below 10% for 2 days in a row.

Exit Long when modified RSI closes back above 80%

Exception (I use a trending indicator to hold trades for longer periods of time under certain conditions).

Shorts:

When price is below the 160 SMA, go short when the RSI 2 closes above 90% for 2 days in a row.

Exit short when modified RSI closes back below 40%.

Exception (I use a trending indicator to hold trades for longer periods of time under certain conditions).

**Note** For all the statistics below, all trades were 100K for simplicity purposes with no compounding. Additionally, this is presented for informational purposes only, do what you feel is right and always use proper money management

Tuesday, October 23, 2012

Nasdaq 60 min chart market comments

Here's a 60 min chart of the Nasdaq, the tech sector has been much weaker than the Dow and S&P 500 and has been a major concern of ours. This 60 min chart of the Nasdaq recent broke down from a H&S topping pattern, if this pattern plays out to fruition (potential price target would be the pattern measurement shown via the shaded area), then this market has more downside to go.

Also as a follow up to my RSI 2 post below, none of the RSI 2 systems went long yesterday, however if today ends up being a strong down day, then the RSI 2 systems will go long and take a 1st entry (30%) stake, the system can enter a total of 4 scales ins, 30%, 20%, 20%, 30%.

If you would like to receive more timely updates to these mechanical systems, please sign up to our free newsletter by filling out the box on the upper left hand side, or sign up for a membership to Breakpoint trades. Currently our 6 month membership is 50% cheaper per month than our standard monthly rate, it's the best deal by far.

Monday, October 22, 2012

RSI 2 S&P 500 mechanical systems update

Hello everyone, here's a follow up to various RSI 2 reversion to the mean S&P 500 mechanical systems that I've discussed at various times throughout the year. With he market sell off last week, we need to keep on these systems because if the market sells off again this week, they will go long - I will of course alert you if they do, this is just an early heads up.

**Click here to view my newsletter** with tons of chart examples and statistics.

Friday, October 19, 2012

AAPL charts

Here's a slew of AAPL charts:

AAPL - Chart Link - weekly chart 1, this is a logarithmic chart, uptrend line approaching around the 600 or high 500's range.

AAPL - Chart Link - weekly linear chart, long long term support much lower below, but no reason to discuss this trendline at this time, though eventually I bet it will test it.

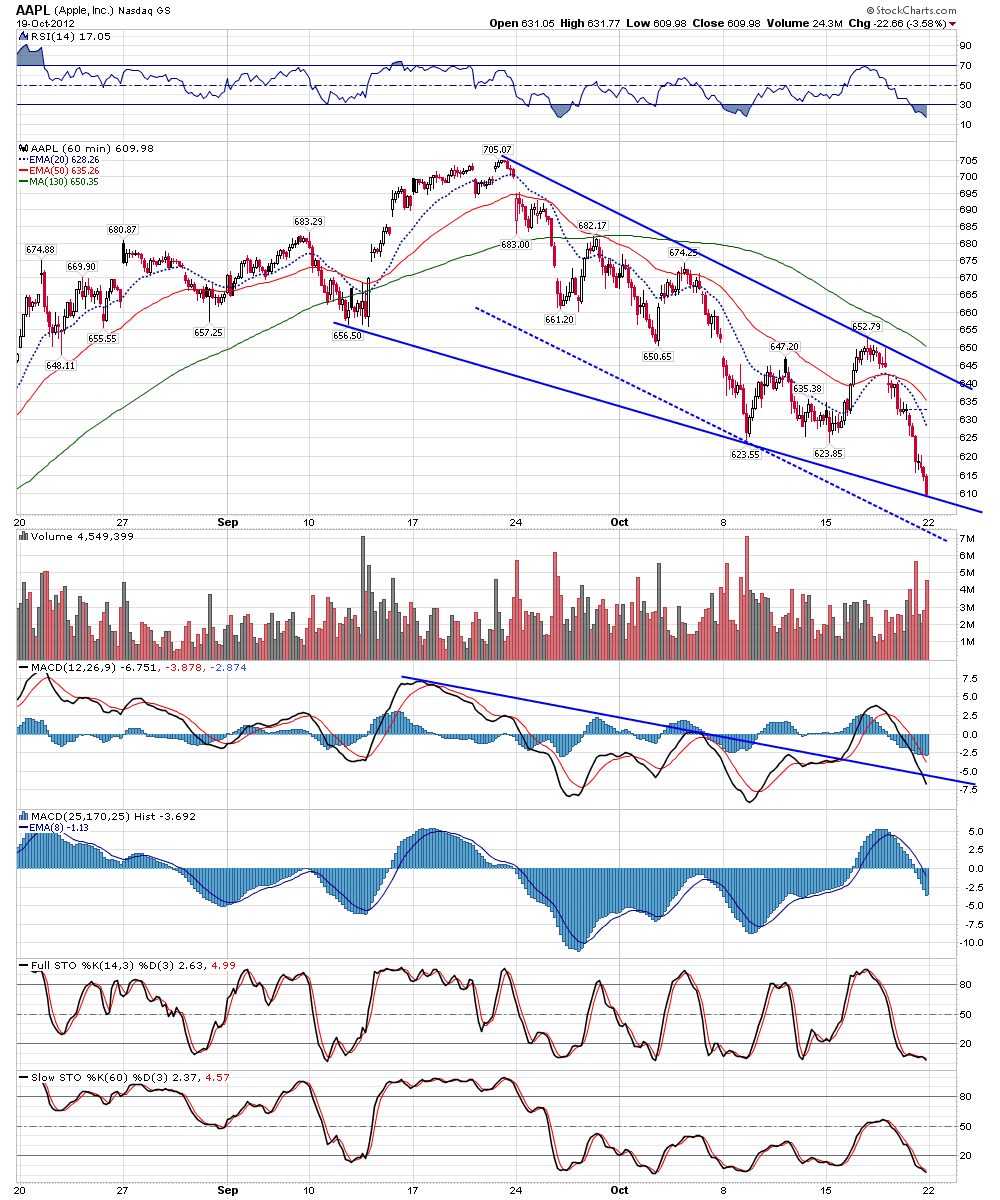

AAPL - Chart Link - daily chart shown weeks ago, had a little H&S top, obviously played out, then broke an uptrend line. The 200 day MA is below and might be a target over time. Or short term might get a bounce back to back test the broken uptrend line.

AAPL - Chart Link - daily wave count that I showed months ago, clearly that wave 5 played out.

AAPL - Chart Link - 60 min view

AAPL - Chart Link - 15 min view, still no positive divergence.

AAPL weekly chart comments

Here's a weekly chart of AAPL, as you know it has been very weak lately as we have been covering. the weekly chart shows a long term uptrend line approaching soon near the 600 - to high 500's. Will that area provide some support?? You can see the clear negative divergence that was present on the MACD

Nasdaq comments

$COMPQ - Chart Link - weekly chart, no doubt arguing that the weekly chart is ugly with negative divergence and a bear wedge. Though honestly one more eventual push up within the wedge would make the pattern much more complete with 5 waves.

$COMPQ - Chart Link - There is an uptrend line below and of course the 200 day MA

we'll see...

Wednesday, October 17, 2012

Market Newsletter and Trade ideas

Hello everyone, here's our most recent market analysis newsletter

Click here to view the newsletter - make sure you have your audio on

good trading,

Matthew Frailey

SPX daily and SPY follow up to Oct 10th post

Last week on Oct 10th, I posted a daily S&P 500 chart, showing major support around the 1425 area, as you can see the market has bounced nicely off support, provided a low risk long entry

Here's the link to that post

Tuesday, October 16, 2012

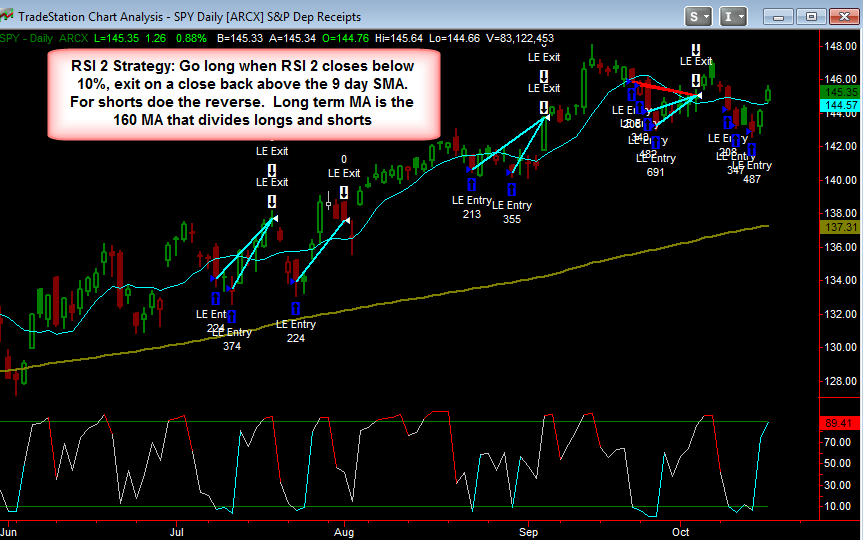

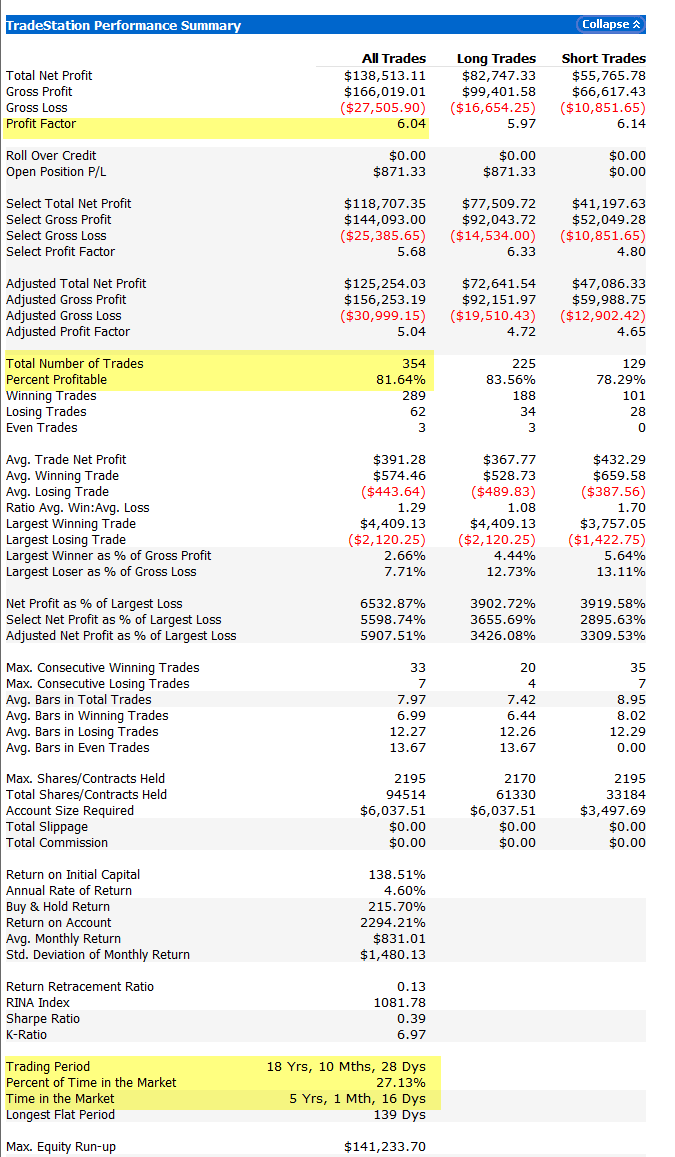

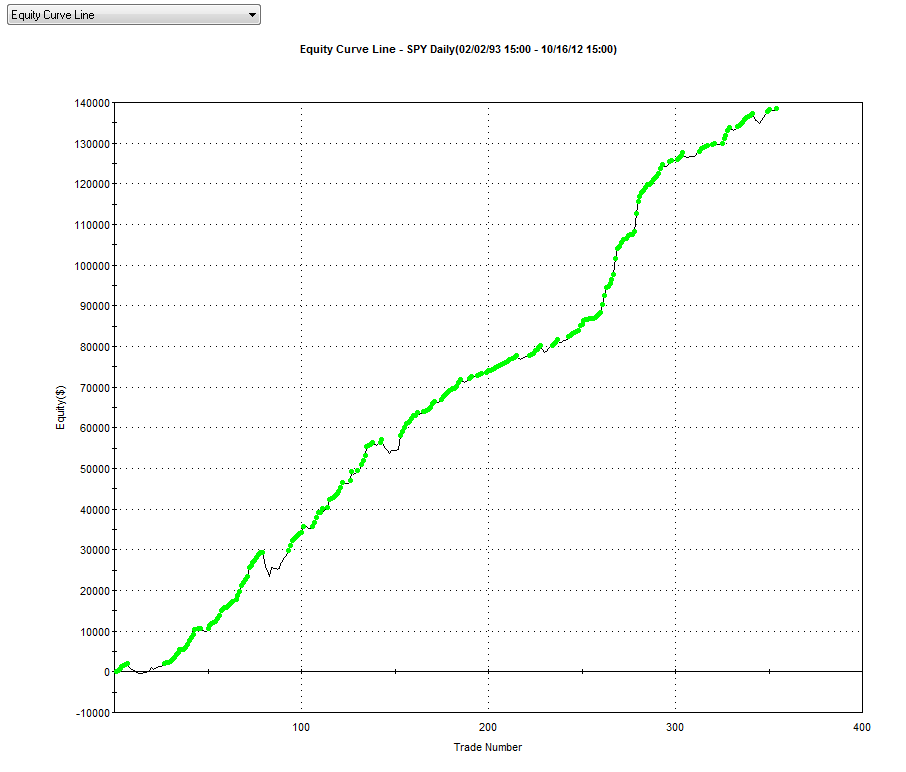

Another RSI 2 strategy

Here's another RSI 2 strategy, it went long on the market pullback last week as well. This one is slightly different than the previous one that I posted. This one uses just a standard RSI 2 (not EMA based). Also this one exits on a close back above the 9 day SMA (vs the RSI 2 getting overbought). Price needs to be above the 162 MA for longs and below the 162 for shorts. Like the last system, this one also scales in for a total of 4 parts: 30%, 20%, 20%, 30%. Each successive scale in needs to be at a lower price than the previous one.

Since price is clearly going to close well above the 9 day SMA today, therefore the system will exit today on the close

The statistics are decent at a profit factor of 6, 354 trades over 18 years, and 81.6% winning trades.

Monday, October 15, 2012

Sunday, October 14, 2012

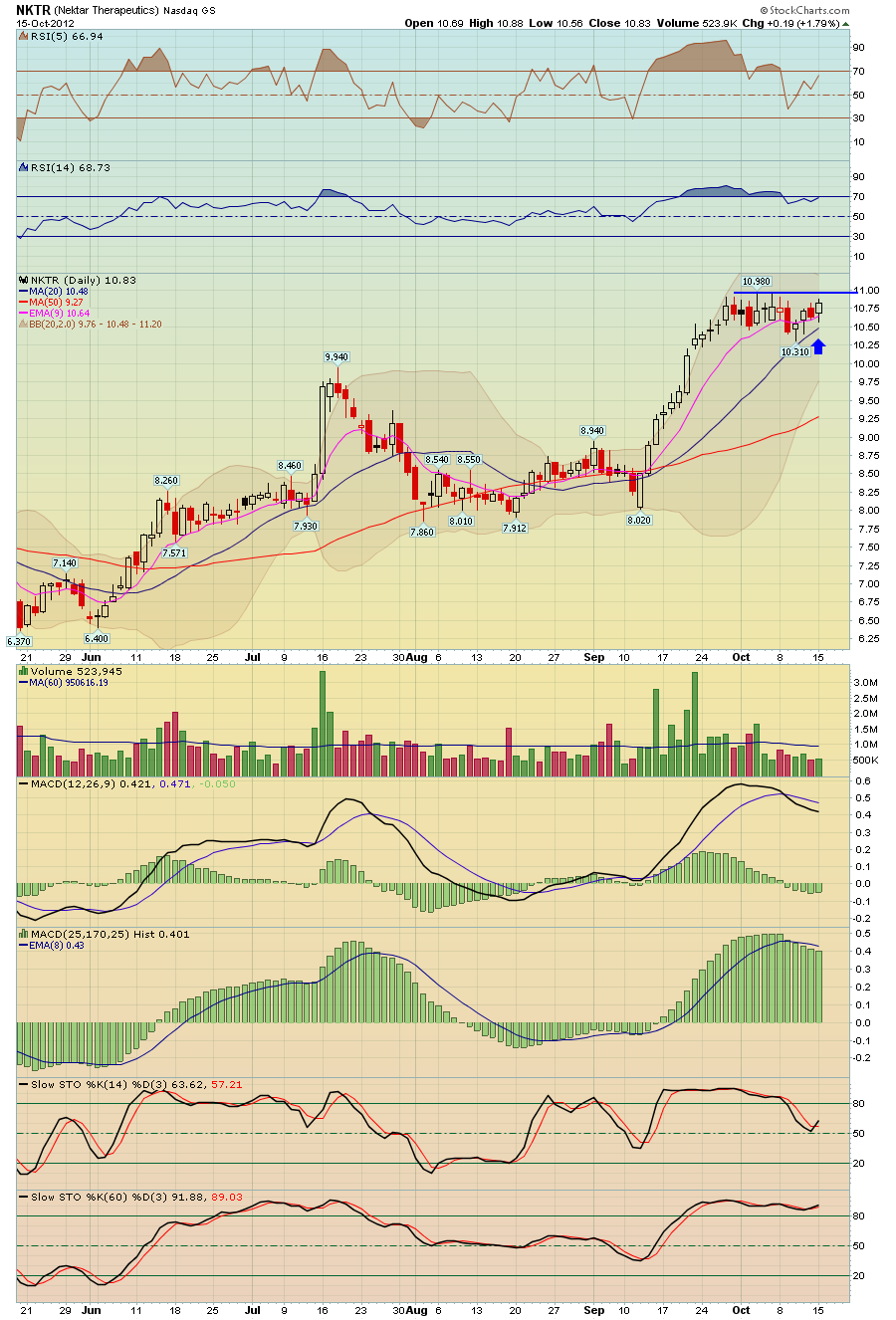

NEM and RSI weekly chart follow up

Here's a weekly chart of NEM with the standard RSI 14 indicator plotted at the top. Back on May 17th I posted this chart on this blog and showed how historically NEM has always put in a tradeable bounce/rally when the RSI 14 becomes oversold on the weekly chart. As you can see this played out nicely, I hope some of you to took note!

Here's a link to my original post from back in May

http://blog.breakpointtrades.com/2012/05/new-weekly-chart-with-rsi.html

Wednesday, October 10, 2012

SPX RSI 2 reversion to mean system

I posted this system earlier today on the trading community blog. This is an RSI 2 reversion to the mean system for the S&P 500, similar to RSI 2 systems that were popularized by Larry Conners. The system took an initial 30% position at today's close because the RSI 2 was oversold below 10% for 2 days in a row.

However, I'm using a slightly modified version of RSI, I'm using an RSI that has an EMA component to it, which makes it a little more responsive than the standard RSI. This system scales into trades in 4 parts of 30%, 20%, 20%, 30%, however in most cases you don't get 4 scale ins, most of the trades end up being 2 - 3 scale ins. Also most of the 1st entries are early and have at least one more scale in (see the detailed statistics and trades below provided in the performance report). Total position size is 100K, but that's with 4 entries, obviously most trades are not 4 entries and so some trades would be 30K (one entry) or 50K (2 entries) etc, again I only used 100K because then the math is easy for % gain calculation, 10K could have been used or any number. The system will exit when RSI 2 closes back over 80% in most cases, however some trades hold for longer periods of time because I have a a trending indicator that will allow the system to hold the trades and ignore the RSI 80% exit.

System Stats:

- Total # of trades is 347 over 21 years.

- 83.86% winning trades

- Profit factor of 9.29 which means on average the system make 9 dollars for every 1 dollar lost.

- Average hold time for the trades is about 8 days, with an average of 33 days between trades.

For the complete statistics and trade history, click on the URL below:

**Click here** to view system statistics and trade history - each trade 100K

The file will open ONLY in Internet Explorer, it shows 7 pages of statistics, trade history, etc.

**as always, this is posted for informational purposes only**

Market Comments

$SPX - Chart Link - as you know, the market has had a nice pullback/correction over the last few weeks, here's a follow up daily SPX chart to one I posted last week.

This daily SPX chart shows a major confluence of support below at the uptrend line, the 50 day MA, and the April highs around 1325 - let's see if a bounce can transpire from these areas

Wednesday, October 3, 2012

RSI 2 Statistics follow up

The RSI 2 example that I posted last week closed out today. Remember last week the SPX got oversold enough to cause the 2 length RSI to close below 1% while still over the 160 day MA, something which has only occurred 7 times in the last 24 years. The exit rules for the system is to exit on a close back above the 8 day SMA i.e. revision to the mean as the rubber band stretches back. Today the SPX closed back over the 8 day simple MA and closed out the trade - now there has been 8 examples of this over the last 24 years, all 100% winning trades.

Tuesday, October 2, 2012

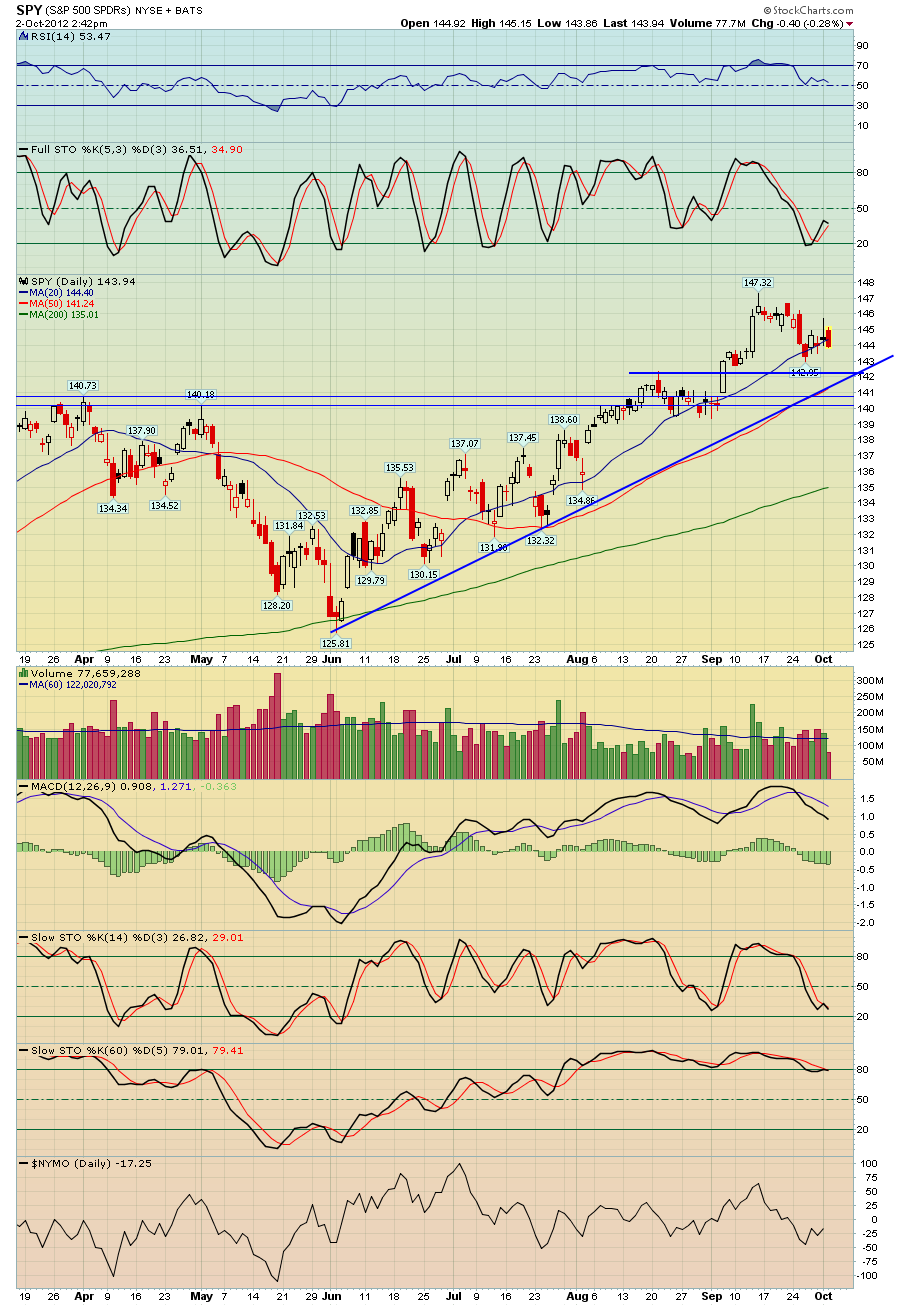

Daily S&P 500 chart and trade comments

$SPX - Chart Link - here's a daily chart of the S&P 500, it's been in correction mode for the last 2 weeks, which should surprise no one, it was quite bought and closed above the upper Bollinger Band with an inverted hammer. As you can see on the chart, there are three 'key' technical support levels below that all match up right around the same place: 1. The uptrend line, 2. the 50 day MA, 3 the horizontal support line. I would buy a buyer near those areas.

SPY - Chart Link - Here's the daily ETF, SPY

Monday, October 1, 2012

Educational Example - applying the BPT whipsaw to the 9 EMA

Here's an education example where I apply the BPT whipsaw method to the 9 day EMA to stay in a strong trend. I also show the method applied to various other indicators. I've shown this method before applied to MA crosses, MACD etc, this one focuses on the 9 EMA. Again treat it as a useful tool for your traders toolbox only, not as the end all holy grail which it is not