I have been pointing out to our BPT members for a long time now that commodities in general have been severely lagging relative to the general stock market for many months, which has been and is a concern of mine; let's take a look a few charts:

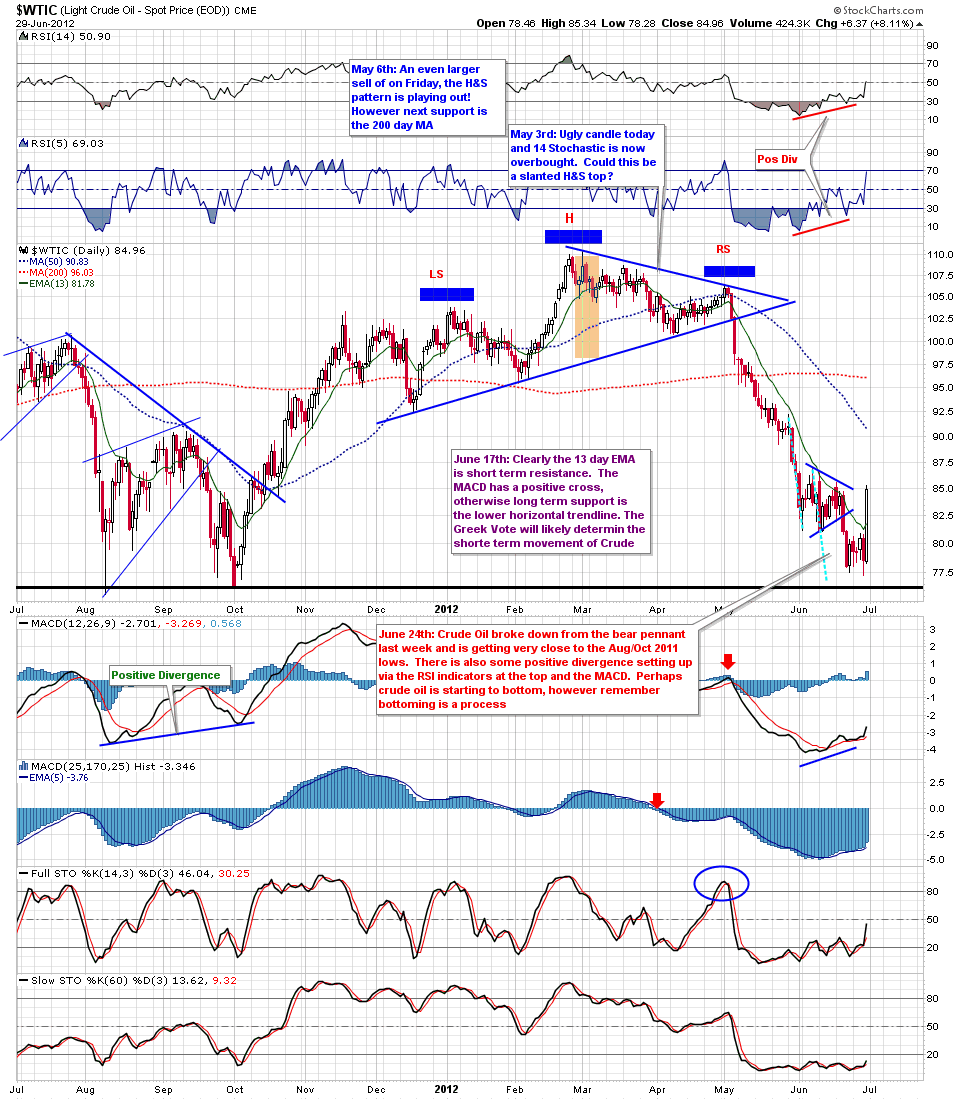

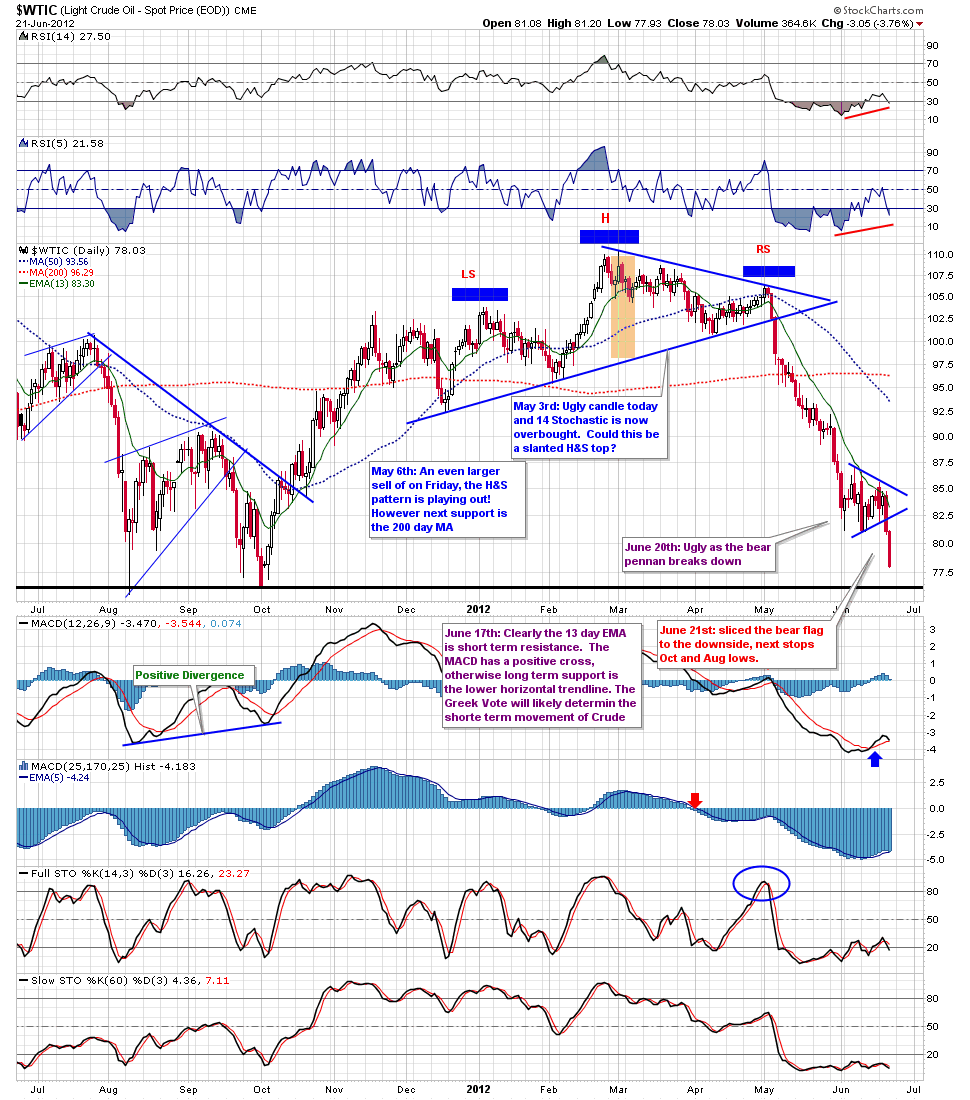

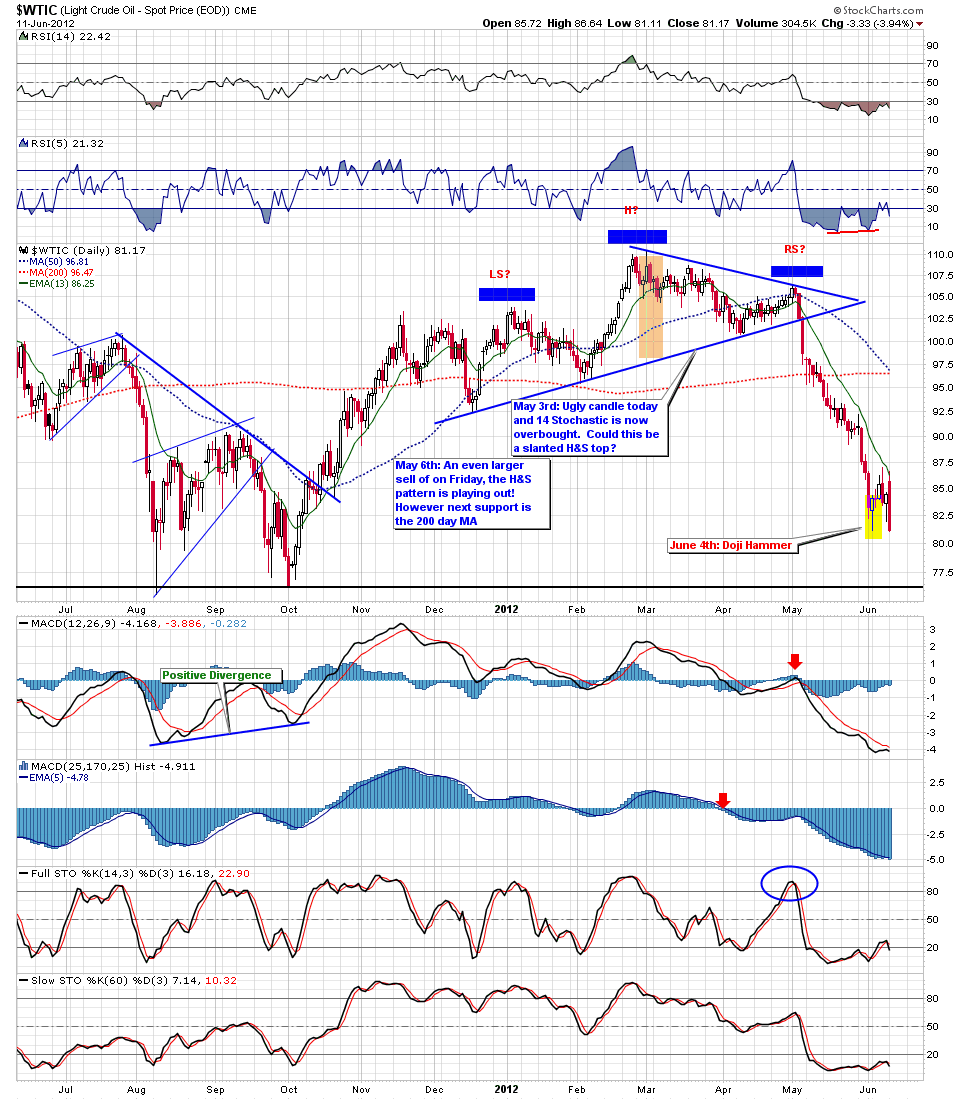

The first chart is a daily chart of crude oil; as you can see it broke down from a bear pennant pattern yesterday and sold off strongly today, the next major support is the Aug/Oct 2011 lows. Also note the very clear H&S pattern that was in place by April and early May, this was shown to BPT members in April and early May and has more than played out. Otherwise currently the next major support level is clearly the Aug/Oct 2011 lows marked via the horizontal black line

Next here's a daily chart of the CRB Commodities Index which is a composite of 17 various commodities and therefore gives us a broad view of the commodities market in general. Back in March we pointed out to our members the very clear H&S bearish pattern. Today the CRB index broke down from a bear flag.

The last chart shows longer term view of the CRB index. As you can clearly see, the CRB index has been in a major downtrend since April 2011.

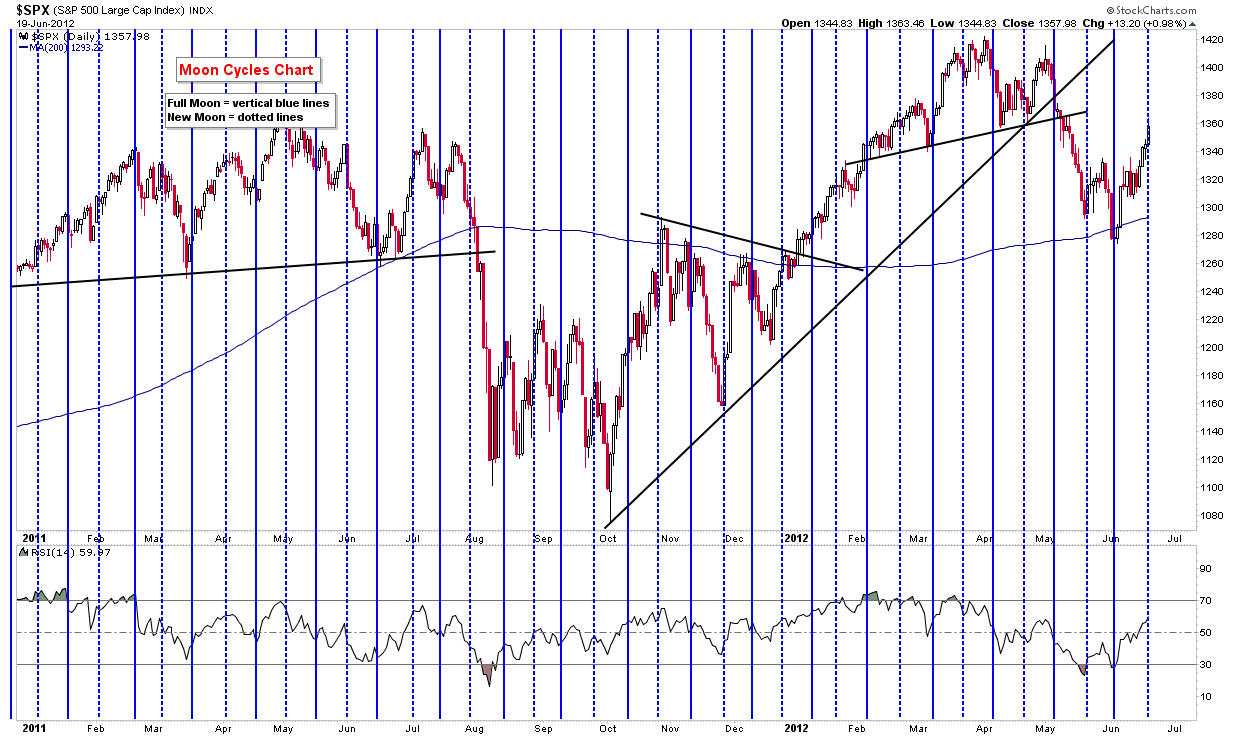

In short, commodities in general have been MUCH weaker than the general market (Dow/SPX) for a long time. My major concern is that this is not simply because the US Dollar has been stronger, that's only recently been the case since late April. My major concern and worry is that the weakness we have been seeing in commodities is being caused by a world wide economic slow down, hence less demand i.e. simply supply side economics. Anyway this is definitely some cause for concern for the future, maybe we are heading for a world wide recession/depression eventually? Something to think about.....