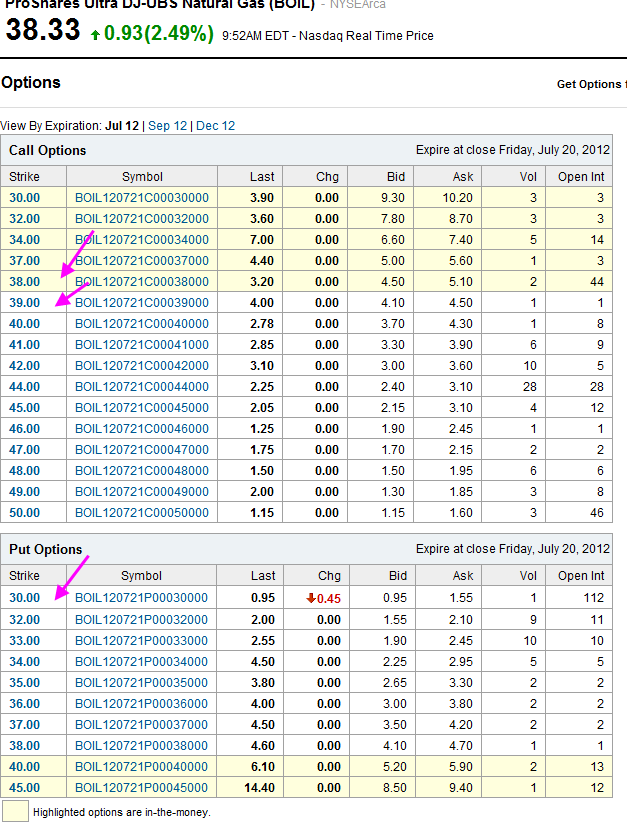

here's the option chain for BOIL, the premiums are very higher

for example one could buy the stock and sell the 39 call strike for $4.1 for a covered call.

If you thought that the bottom was in for Natgas and BOIL, one could sell the 30 puts and still get a buck even though BOIL is trading for over $38, could be free money. If someone was willing to buy BOIL at $34 on a pullback, you can sell the 34 puts for $2.24, anyway some nice premiums, and if it's put to you not big deal, you were going to buy it anyway.

No comments:

Post a Comment