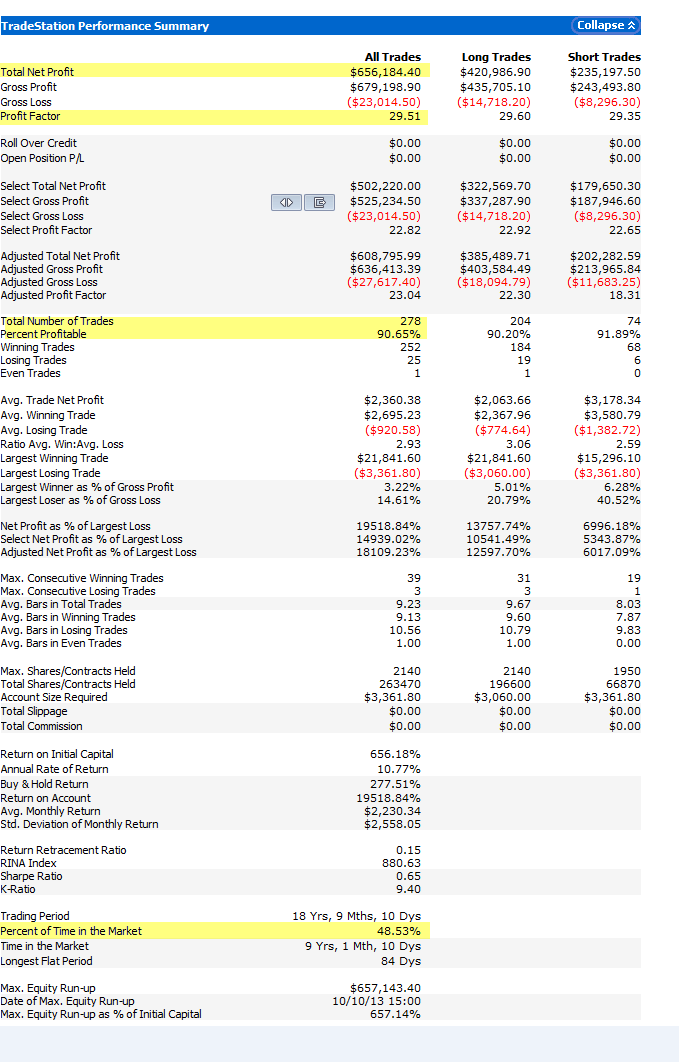

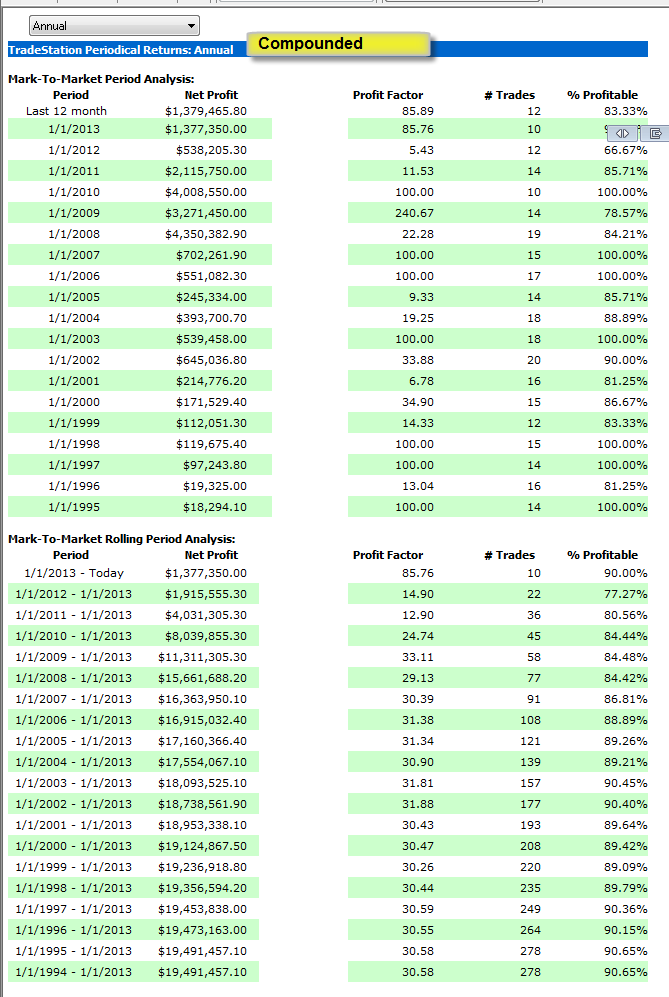

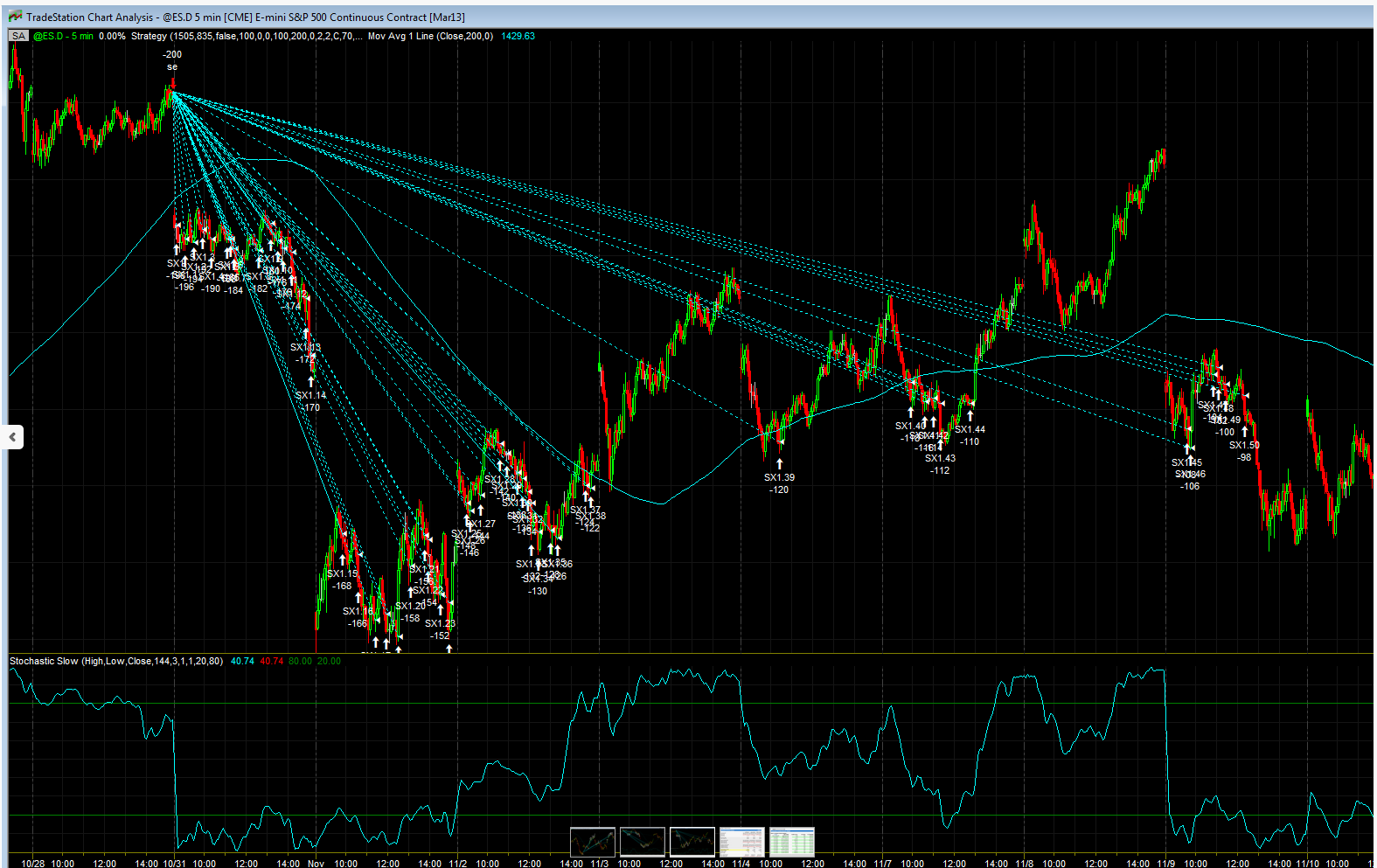

Here's a quick update on the SPY Pro additions, I will do a detailed update when I'm finished, I still have a few things to add, however here's a quick update. The images below show the original system stats and the new system stats, as well as the old yearly vs new yearly gains - the total has went up quite a bit from 615 -656K. The number of trades increased some and the percent of time in the market went up from 46.7% to 48.5% which shows the effect of some of the trades that now hold longer. Some of the additional changes that I'm going to make should increase this a little more because it will allow some long trades to hold for longer periods of time; the current work has been on the short side, now I have to work on the long side.

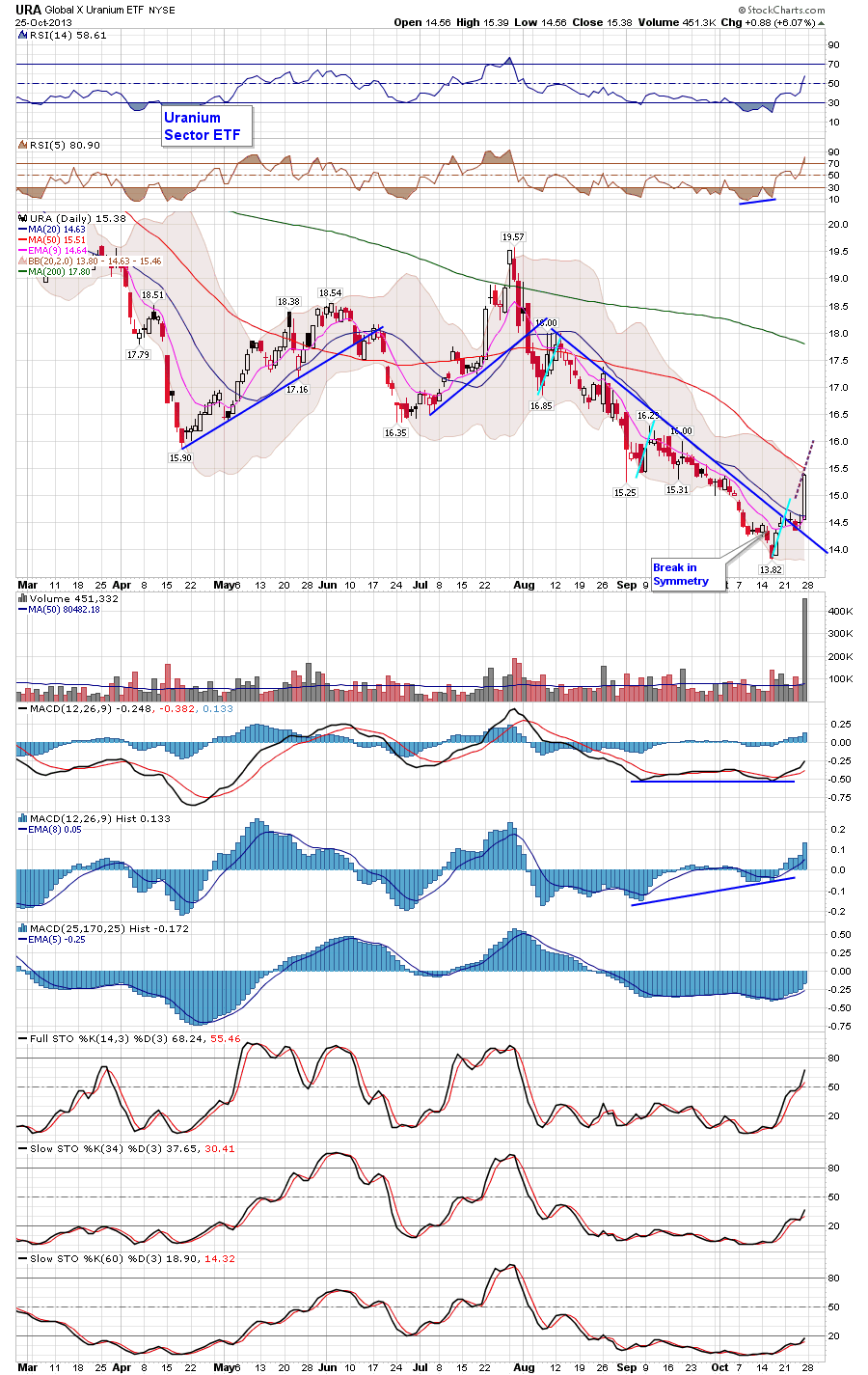

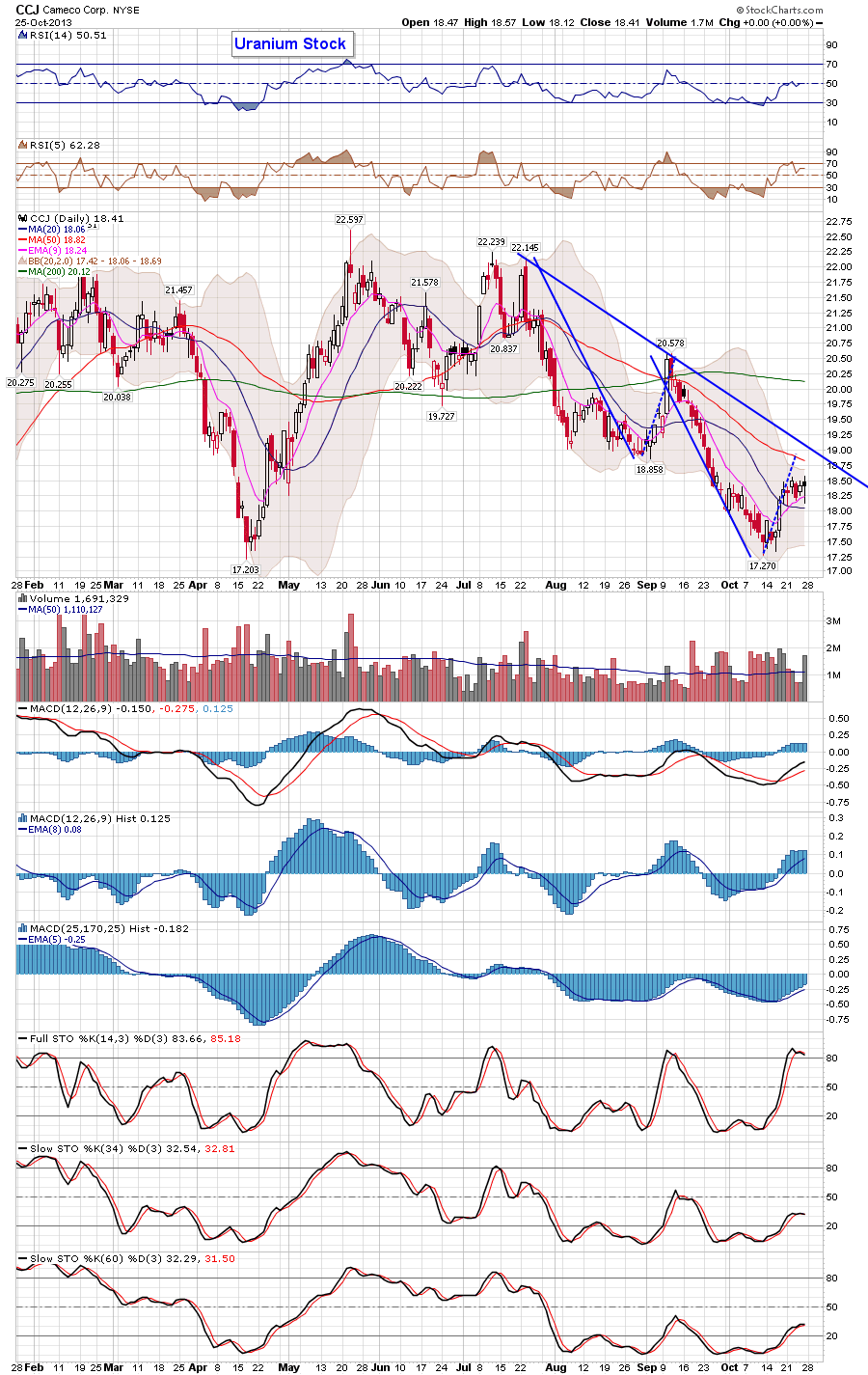

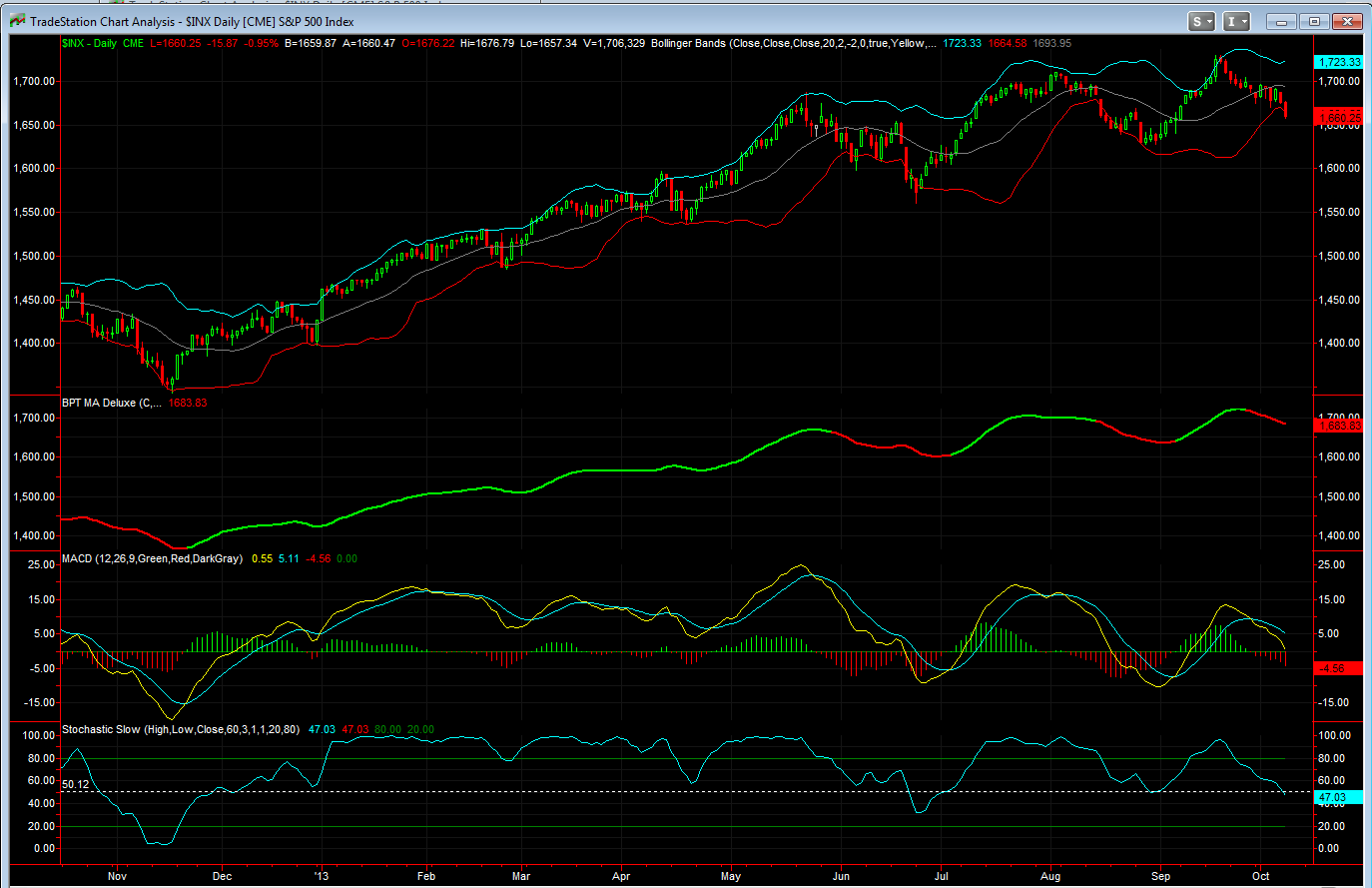

The rules I added were very simple, one of them focuses on the 60 length stochastic and taking low risk trades when it is very close to 50% or 80%, and you know that I use this Stochastic quite a bit in my analysis and trading, none of this was derived through back testing, because I don't need to back test, I just use the concepts that I already use