The EMA based RSI 2 system that I discussed before will be taking an initial long position today of 30% if the SPX closes negative or even flat. The system has a total of 4 potential scale ins if better prices are met (30%, 30%, 20%, 20%). Most of the trades end up having 2 entries. Currently the S&P 500 is down 5 points, again the closing price is the key.

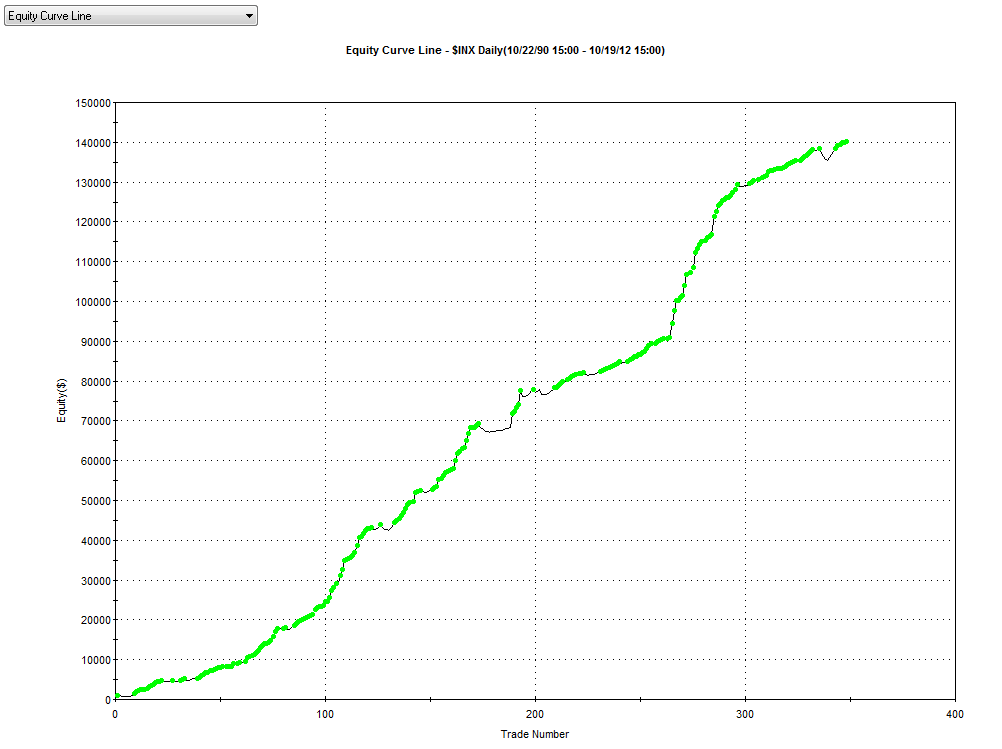

Key statistics - 21 years

349 trades

84% winning trades

Profit factor of 9.9

Average time in trade is about 8 days

**CLick Here** to see a full statistics report including a list of all the trades. NOTE** this must be opened in Internet Explorer ONLY not Chrome or Firefox

-----

Modified RSI 2 system -uses an EMA based RSI 2:

Longs:

When price is above the 160 SMA, go long when the RSI 2 falls below 10% for 2 days in a row.

Exit Long when modified RSI closes back above 80%

Exception (I use a trending indicator to hold trades for longer periods of time under certain conditions).

Shorts:

When price is below the 160 SMA, go short when the RSI 2 closes above 90% for 2 days in a row.

Exit short when modified RSI closes back below 40%.

Exception (I use a trending indicator to hold trades for longer periods of time under certain conditions).

**Note** For all the statistics below, all trades were 100K for simplicity purposes with no compounding. Additionally, this is presented for informational purposes only, do what you feel is right and always use proper money management

No comments:

Post a Comment