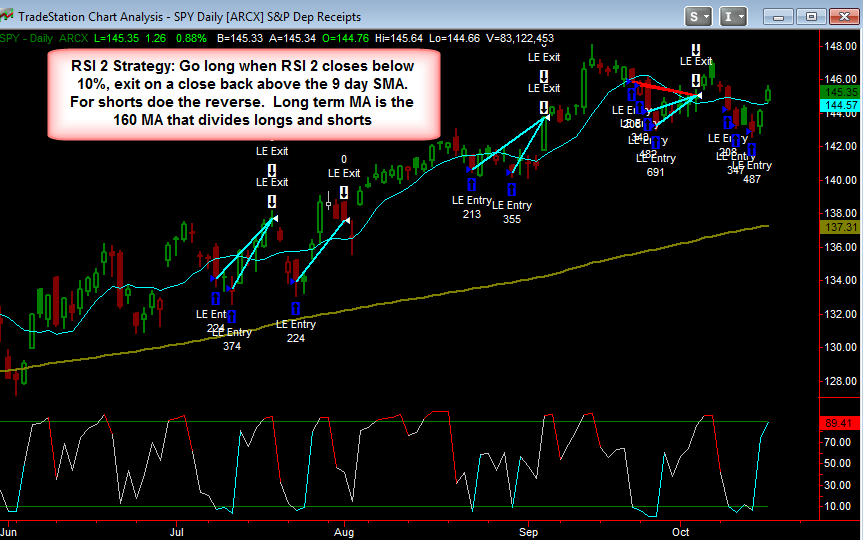

Here's another RSI 2 strategy, it went long on the market pullback last week as well. This one is slightly different than the previous one that I posted. This one uses just a standard RSI 2 (not EMA based). Also this one exits on a close back above the 9 day SMA (vs the RSI 2 getting overbought). Price needs to be above the 162 MA for longs and below the 162 for shorts. Like the last system, this one also scales in for a total of 4 parts: 30%, 20%, 20%, 30%. Each successive scale in needs to be at a lower price than the previous one.

Since price is clearly going to close well above the 9 day SMA today, therefore the system will exit today on the close

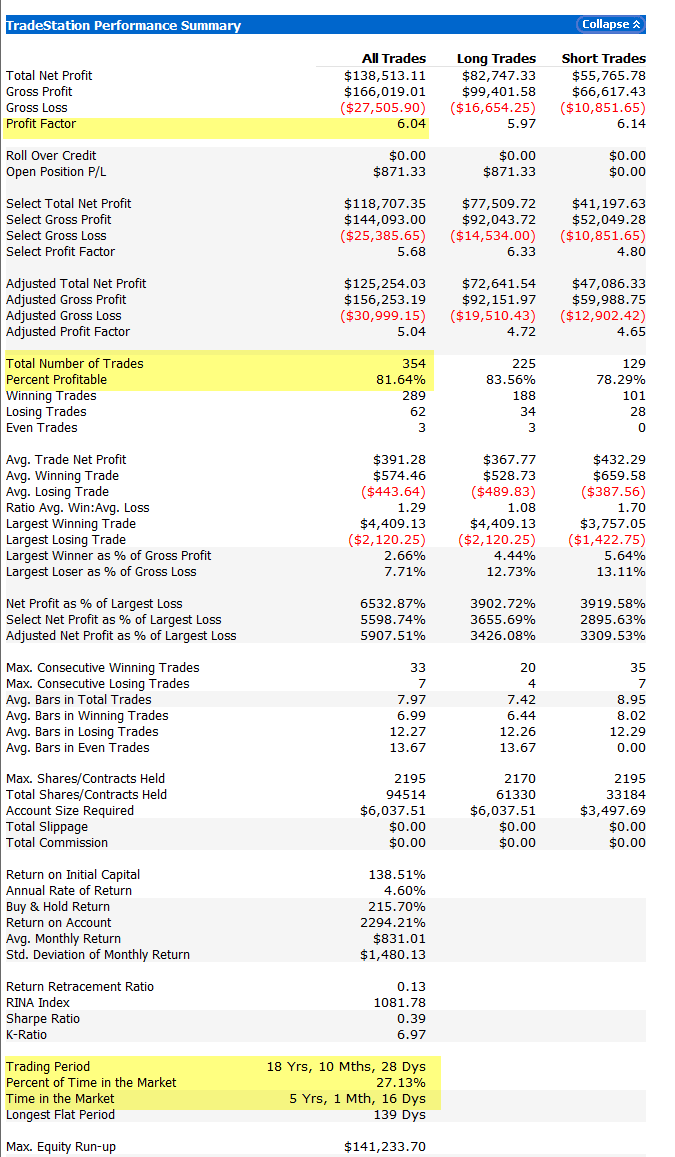

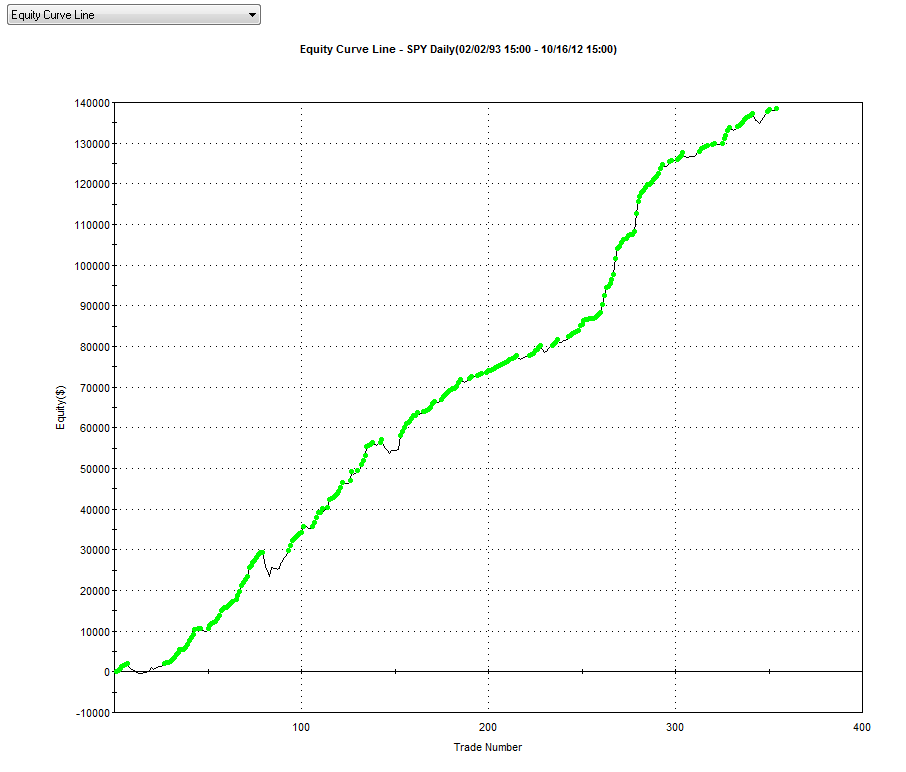

The statistics are decent at a profit factor of 6, 354 trades over 18 years, and 81.6% winning trades.

No comments:

Post a Comment