most of the RSI 2 revision to the mean systems closed out on Friday. You can't analyze the market based on those, just pointing out that they closed out on Friday as I had some questions.

There are a lot of variations to the RSI 2 systems by Larry Conners: Here's two of them:

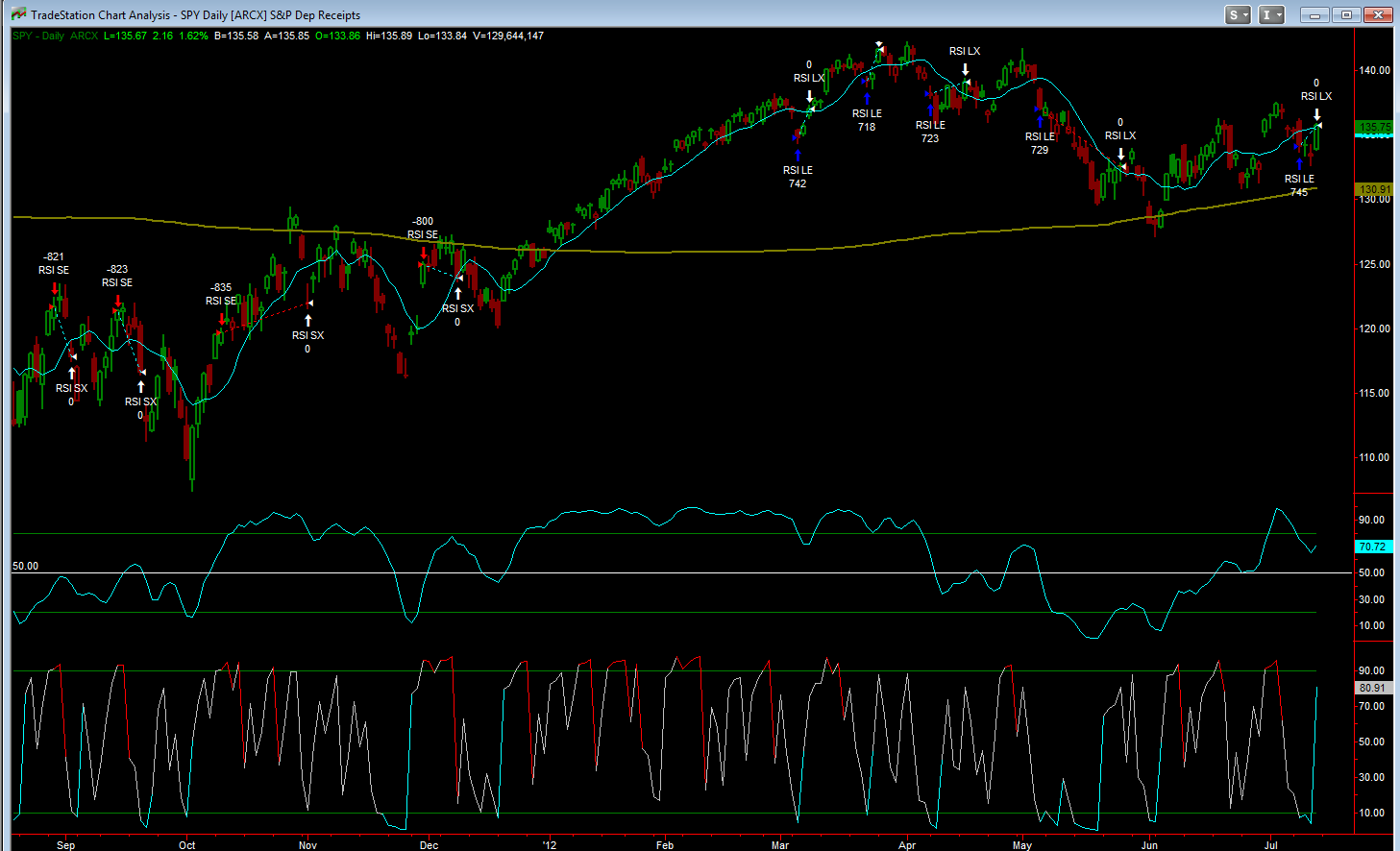

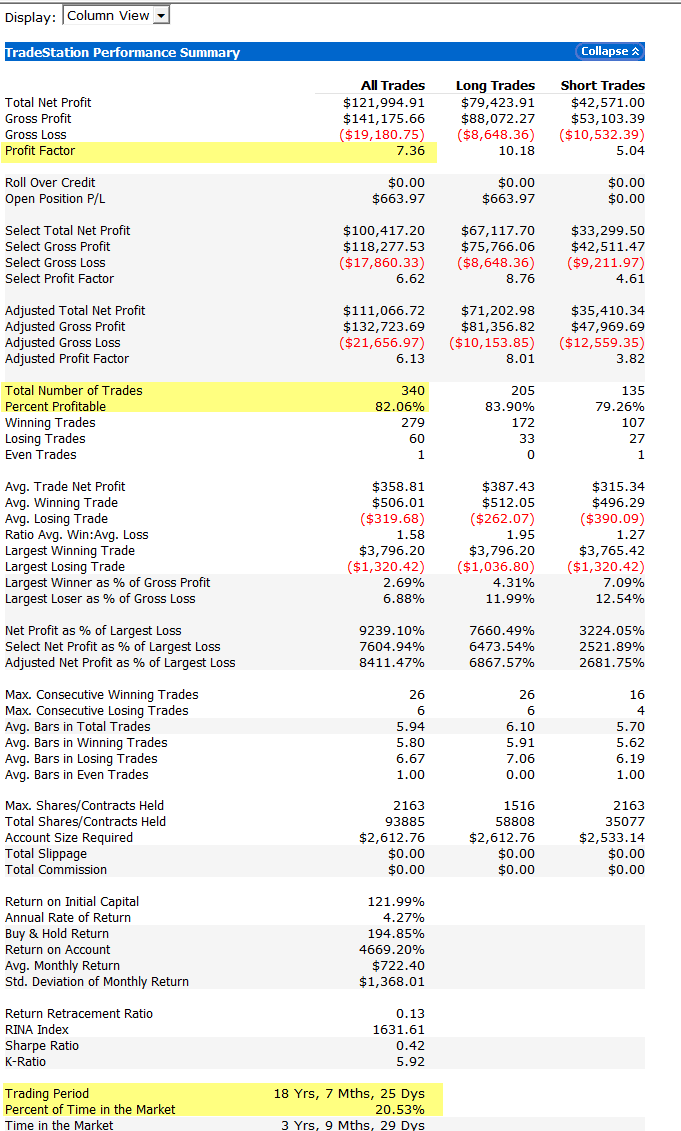

The first chart and stats shows SPY, Longs: when RSI 2 falls below 10%, exit on a close above the 9 SMA (price must be above the 200 day MA). Shorts: Price must be below the 200 day MA, short when RSI closes above 90%, exit price closes back above the 8 day SMA.

The 3rd chart and 4th stat shows a scale in version, however prices are exited when RSI closes back above 80% for longs, and back below 40%

No comments:

Post a Comment