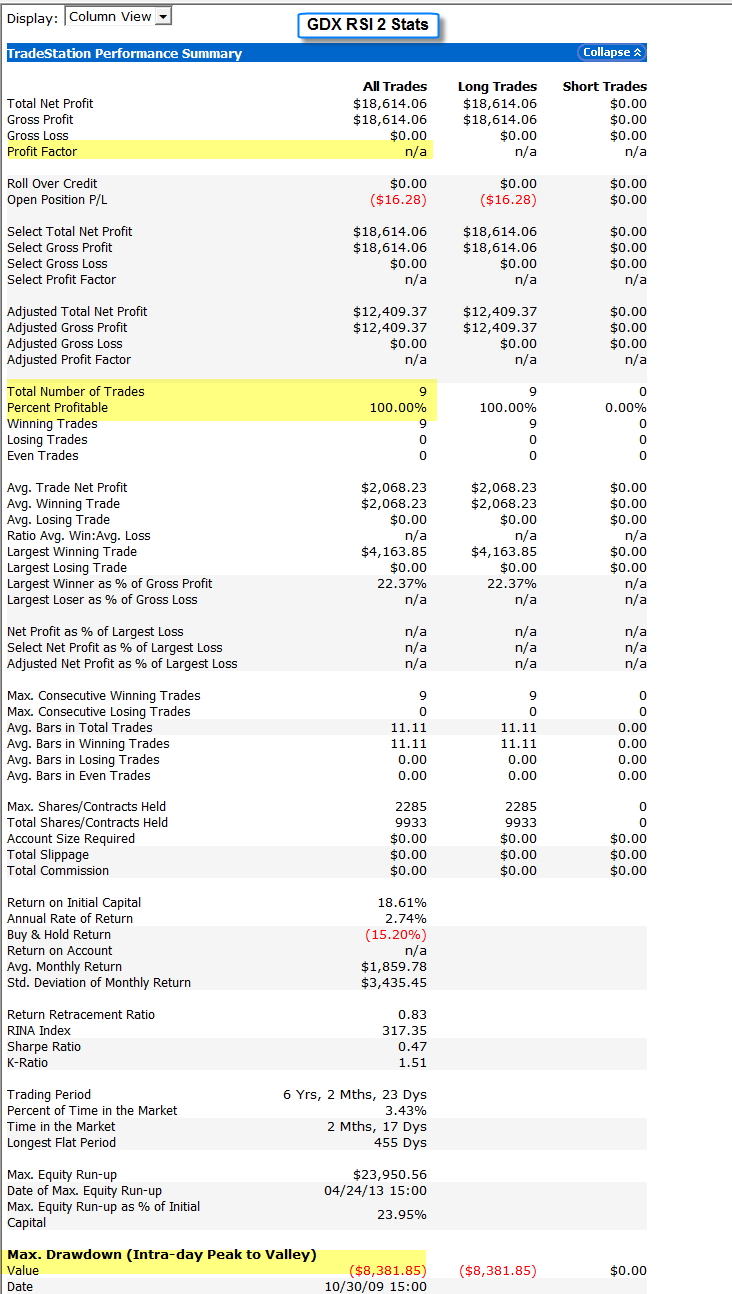

Regarding the GDX RSI 2, the system will look to exit the trade whenever the RSI 2 Close is back above 80%, unless my custom momentum indicator turns green, which the system would then hold the trade via until the momentum indicator turned red.

I'm posting this information, because some of you asked me questions and I thought I should post my responce publically. I don't list this as an official mechanical system of the website in the Tradestation systems section of the website, but I had posted it a while back because back in early April when the RSI 2 had closed below 1% on GDX - and at that time I ran my system to find the probability of a bounce.

Though as you can see, most of the trades did take some initial heat even though every one of them eventually closed out profitably