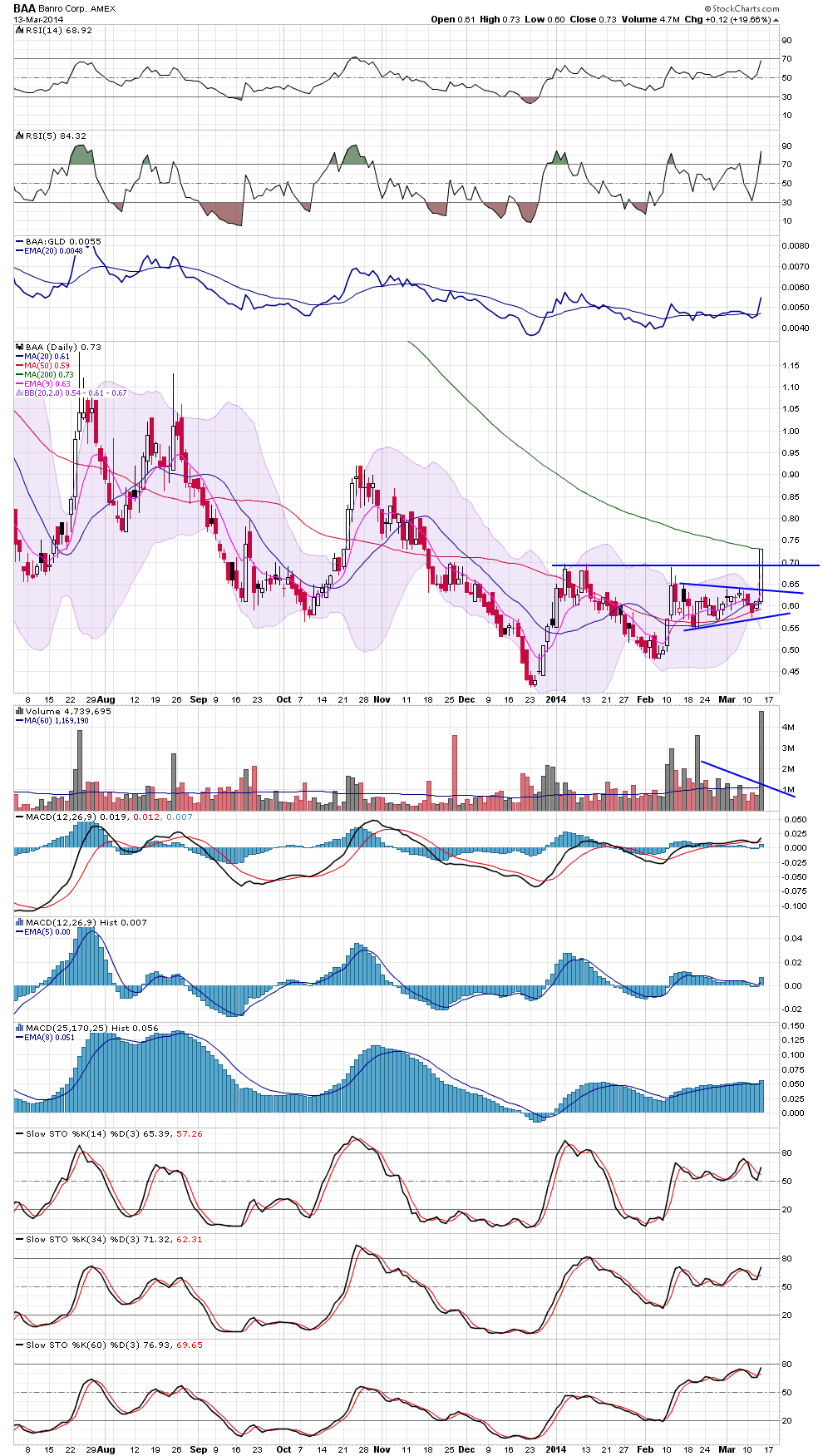

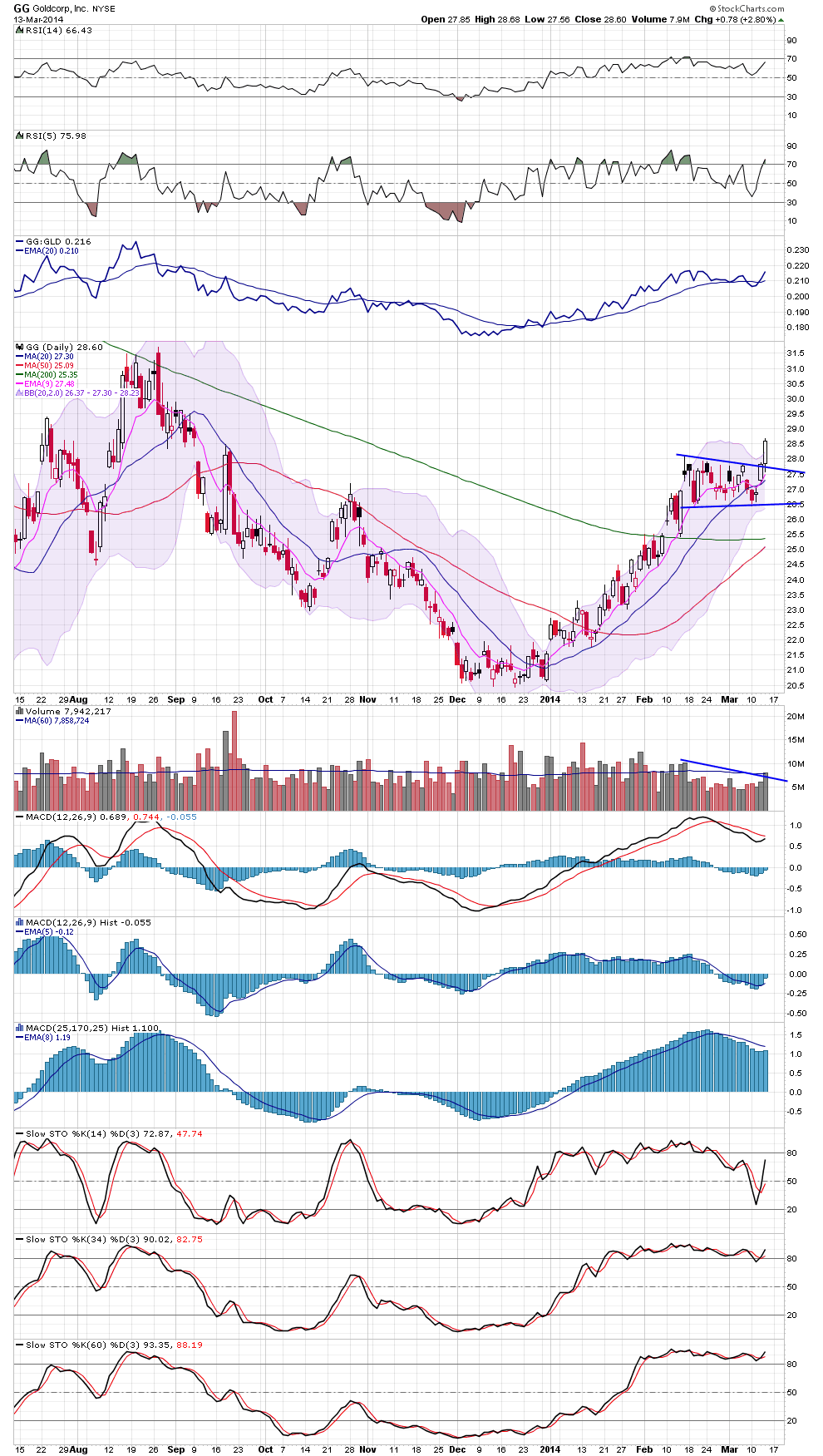

BAA - Chart Link - clearly was a pretty awesome day if you took some gold stocks home from yesterday or bought some first thing this morning as they started off flat with GDX only up a few cents.

Newsletter Signup

Search

Thursday, March 13, 2014

Sunday, March 2, 2014

BPT 401K Long Tern System goes to cash

Hello everyone, first off I hope you're have a nice weekend! Here's a detailed newsletter which covers my long term 401K paint dry system, which just went to cash on Friday. I explain the system in great detail, so please have a look, it's also a very nice system for you to give your family and friends who don't trade but want to beat the pants off 'buy and hold' but still catch long term trends and be out and safely in cash during bear markets.

CLICK HERE to view the Newsletter

Matthew Frailey

Wednesday, February 26, 2014

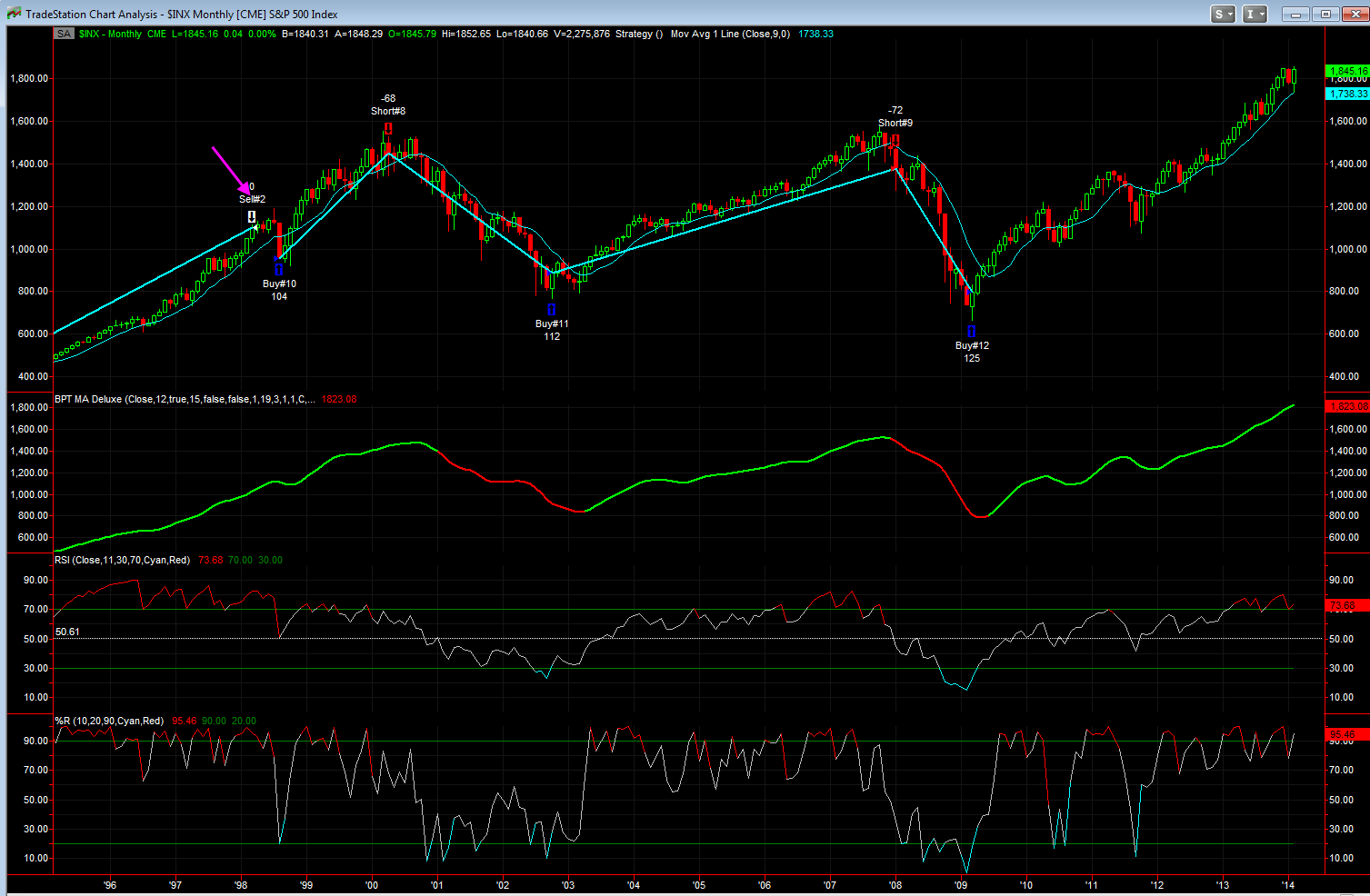

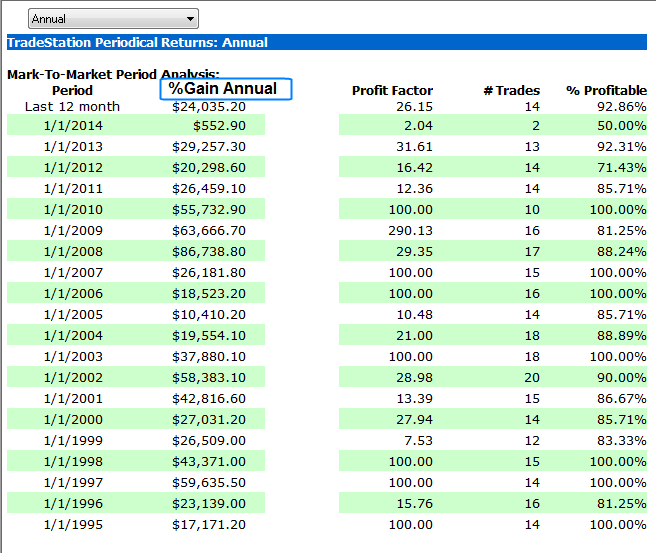

Long Term 401K paint dry system is going to cash end of month

Hello everyone, as you know, a while back I developed a long term system based on a monthly chart of the S&P 500, it's affectionately called the 'paint dry' system because the trades can last for years. I designed it not for traders, but for family and friends, neighbors who do not trade the market and will never trade the market, but want to do better than buy and hold. The system is designed to keep you in entire bull markets but have you out for bear markets, for example the system went to cash in Jan 2008 and then went back long on Mar 31st 2009 just 3 weeks off the bear market bottom and is still long almost 5 years later. My Long only version of the system, from 1962 to present your money grew by 289 times the original investment vs 30 times buy and hold. For my long/short version your money increased by 534 times vs 30 times buy and hold - see the attached tables where the trade and stats are listed.

Currently the system has been in this long trade for 1794 days, the average is 1235 days, however the trade from Oct 2002 to Jan 2008 lasted 1918 days, while the long from Aug 31st 1984 to Aug 31st 1984 lasted 2191 days.

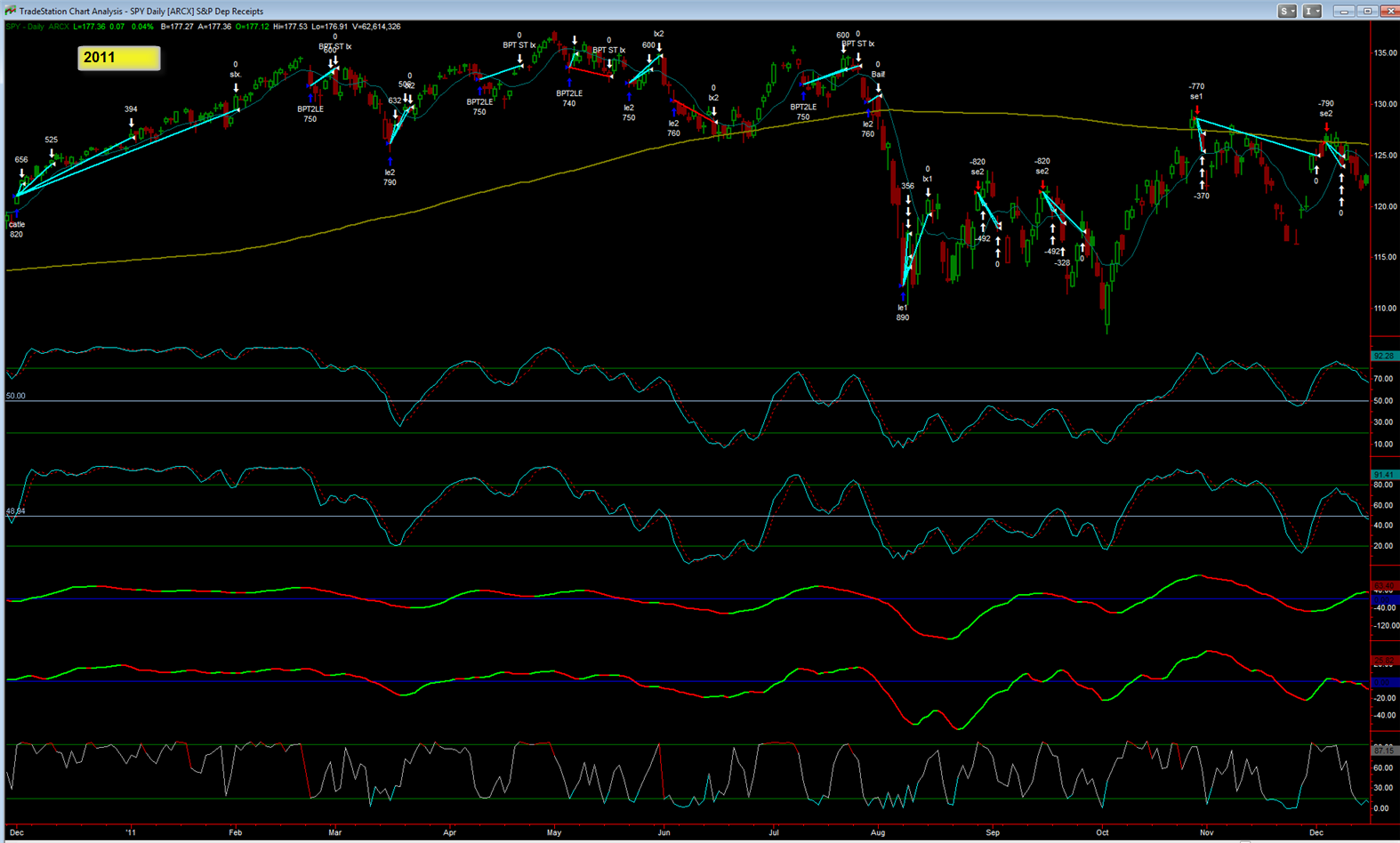

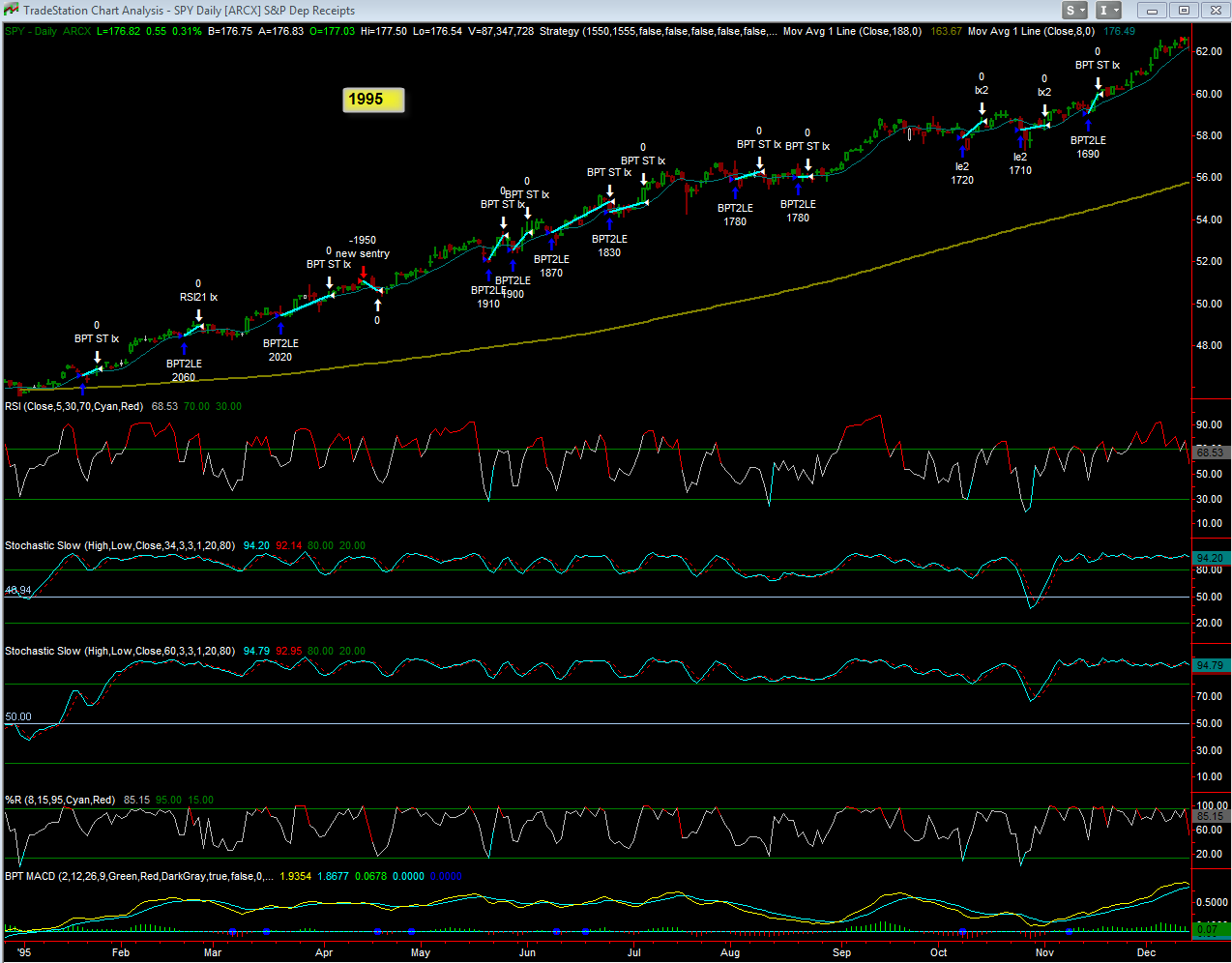

HOWEVER the system is going to go to cash at the end of this month because of a technical situation that has occurred with the market. It has to do with price closing for 20 months consecutively above the 8 MA along with the Willams% indicator above 90%. The system will be going to cash at the close of this month and will then look to buy a pullback. The last time the system did this was in Mar 31st 1998, it then bought the sharp pullback and went back long on Aug 31st 1998 (see the 3rd chart). Over the weekend I will discuss in more detail what this technical signal is. Do NOT take this is a sell short signal right now, and also the previous time this occurred the market stayed out for 3 - 5 months before having a hard pullback, if history holds true then maybe this portends to our market having a strong correction either in May or fall time frame for general seasonality.

I will discuss this briefly in tonight's newsletter, however I will discuss it in more detail on the weekend in a separate newsletter.

Wednesday, February 12, 2014

Feb 12th, 2014 Market Newsletter

Hello everyone, here's my most recent newsletter, I discuss the general market action, precious metals, and of course my powerful BPT MA Deluxe trending indicator and some amazing educational pieces, so make sure to check it out!

You can view the Newsletter Here.

Matthew Frailey

Monday, February 3, 2014

Market Comments Feb 3rd 2014

Jan closed the month red - that is a bearish start for the year and generally how the market finishes Jan is a good barometer of how the market will do for the year - so not a good start!

Anyway here's a few S&P 500 charts - a few weeks back we were showing a bear wedge developing on the S&P 500, clearly that's played out nicely now. Also OPEX clearly marketed a nice top in Jan (notice from the 4th chart how options expiration has been a good guide at marking infection points (tops and bottoms) in the market.

The S&P 500 is now testing an trendline line, see the second chart - if this trendline is lost the next logical support area is the 200 day MA - which by the way hasn't been tested in a long time and is over due.

I've you've listened to my newsletters, I've stated many times over the last 1 - 2 months that I think the market will have a 10 - 15% correction or more in the 1st quarter of this year or in April/May which is typically the weak time of the year - maybe it's starting?

We are now 5 years into this bull market which began in March 2009, getting a bit long in the tooth - 2014 won't be the 'cake walk' that 2013 was, the gains will be much harder.

stay tuned...

FAZ trade idea follow up

The market is really selling off as of late, not that we are surprised! anyway nice move on this trade idea of ours FAZ from last week

Thursday, January 30, 2014

SPY Professional system acheives its first exit!

Hello everyone, as you know the SPY Professional system went long yesterday at the close and the market is up nicely today, here's an important trade notification regarding this system, click the newsletter link before for more details about the system and this current trade!

This system has 96% winning trades - if you are not a member to Breakpoint Trades - subscribe to your 6 month membership and start receiving email trade notifications to this system!! Just one winning trades more than pays for your membership and had you been a member for the last year, you would have paid for your membership for many lifetimes and would have made many 1000's of dollars.

CLICK HERE to view the Newsletter

----

(Click here to read more about the SPY Pro system)

Matthew Frailey

Sunday, January 26, 2014

Jan 26th Market Newsletter and Automated systems

With the recent market sell off from last week, here's my most recent newsletter, and there is also discussion of our automated systems

Sunday, January 5, 2014

Powerful Free 3 1/2 hr Education Tutorial

Thursday, January 2, 2014

Updated Market Statistics for last year and something to monitor for the new year

Hello all, as you know the market is nicely down today, not surprised with the divergence that was in place.

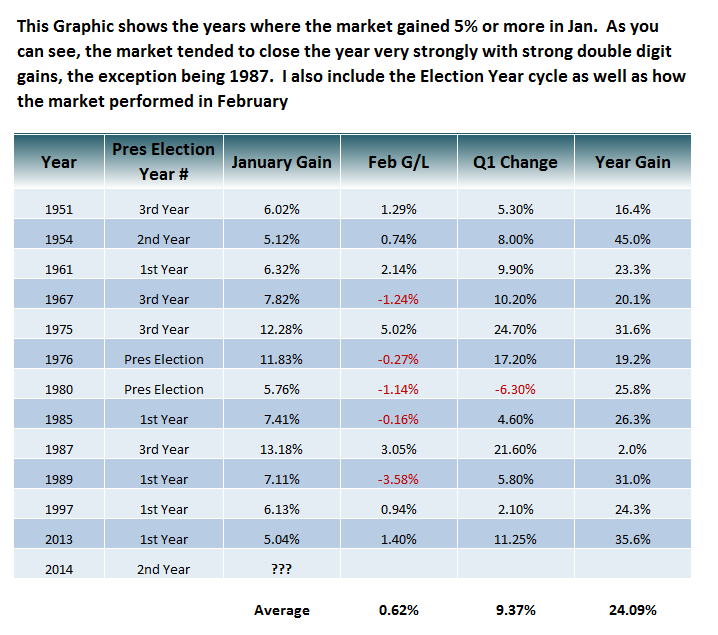

Anyway I have updated the market statistics that I like to show at the first of the year and into 1st quarter - we showed these table last year in early Jan (for the Jan stats) and in march for the (1st quarter) which also ended very strong, both foretold that the market would likely end the year very strong and it did - Dow gained 35.6% for the year as you can see after after a strong 5% gain in Jan and 11.3% gain by the 1st quarter.

Now it will be interesting how these look this year, clearly not a good start today LOL

Sunday, December 29, 2013

Commodity Newsletter Dec 30th, 2013

Hello everyone, first off I hope that you enjoyed your weekend! Here's my weekend commodity newsletter, however please note that 1st 1/3 of it is devoted to admin comments relating to the SPY systems, so please make sure to look it over as it may answer some lingering questions that you may have.

CLICK HERE to read the newsletter

enjoy the rest of your evening and see you tomorrow on the trading community blog

Matthew Frailey

Wednesday, December 18, 2013

Wednesday Dec 18th, 2013 Newsletter and SPY Pro system Discussion

Hello everyone, as you know it was a wild day for the market! Tonight I discuss the market and my thoughts along with some trade ideas, HOWEVER I also discuss the SPY Pro and other SPY systems which have another nice winning trade as they went long last week.

enjoy the remainder of your evening,

Matthew Frailey

CLICK HERE to view the Newsletter

--

Sign up to Breakpoint Trades and you start receiving the signals to our SPY Professional System that has 96% winning trades!! The system takes an average of 1 - 2 trades a month with an average hold time of 14 days, and makes on average about 36% a year. See the images for the statistics and trade examples from years back

Sunday, December 15, 2013

Breakpoint Trades Market Newsletters

Monday, December 9, 2013

General Market Newsletter

Also in addition to our Commodity Newsletter, here's our general market newsletter