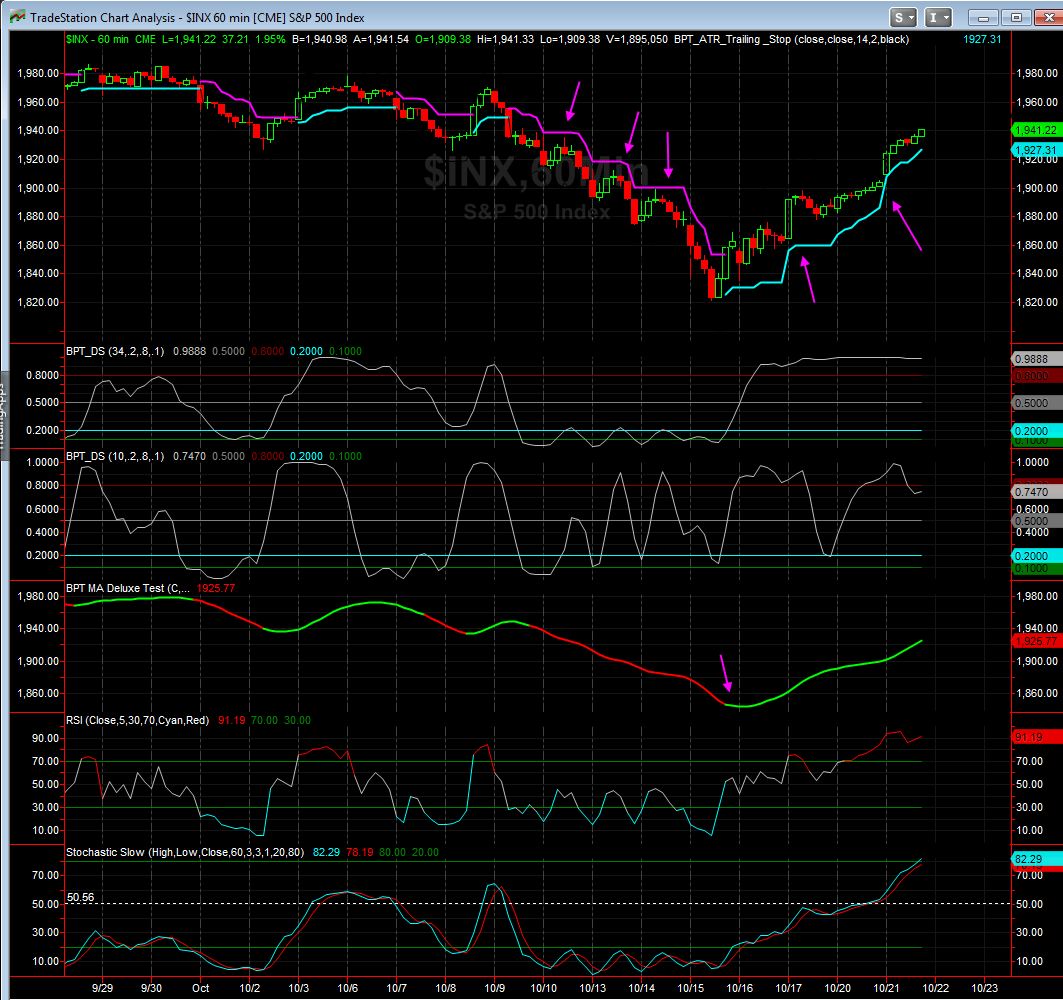

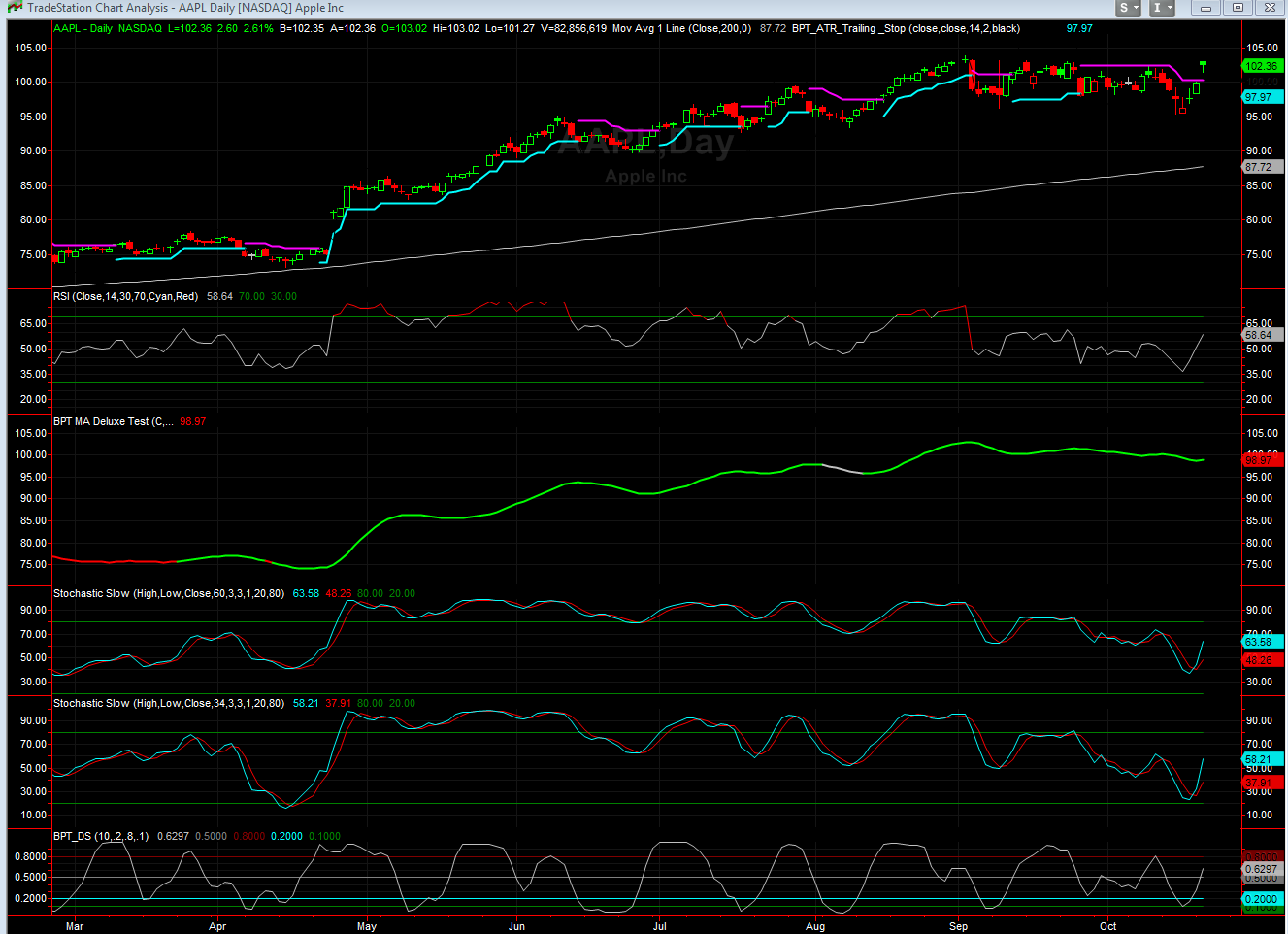

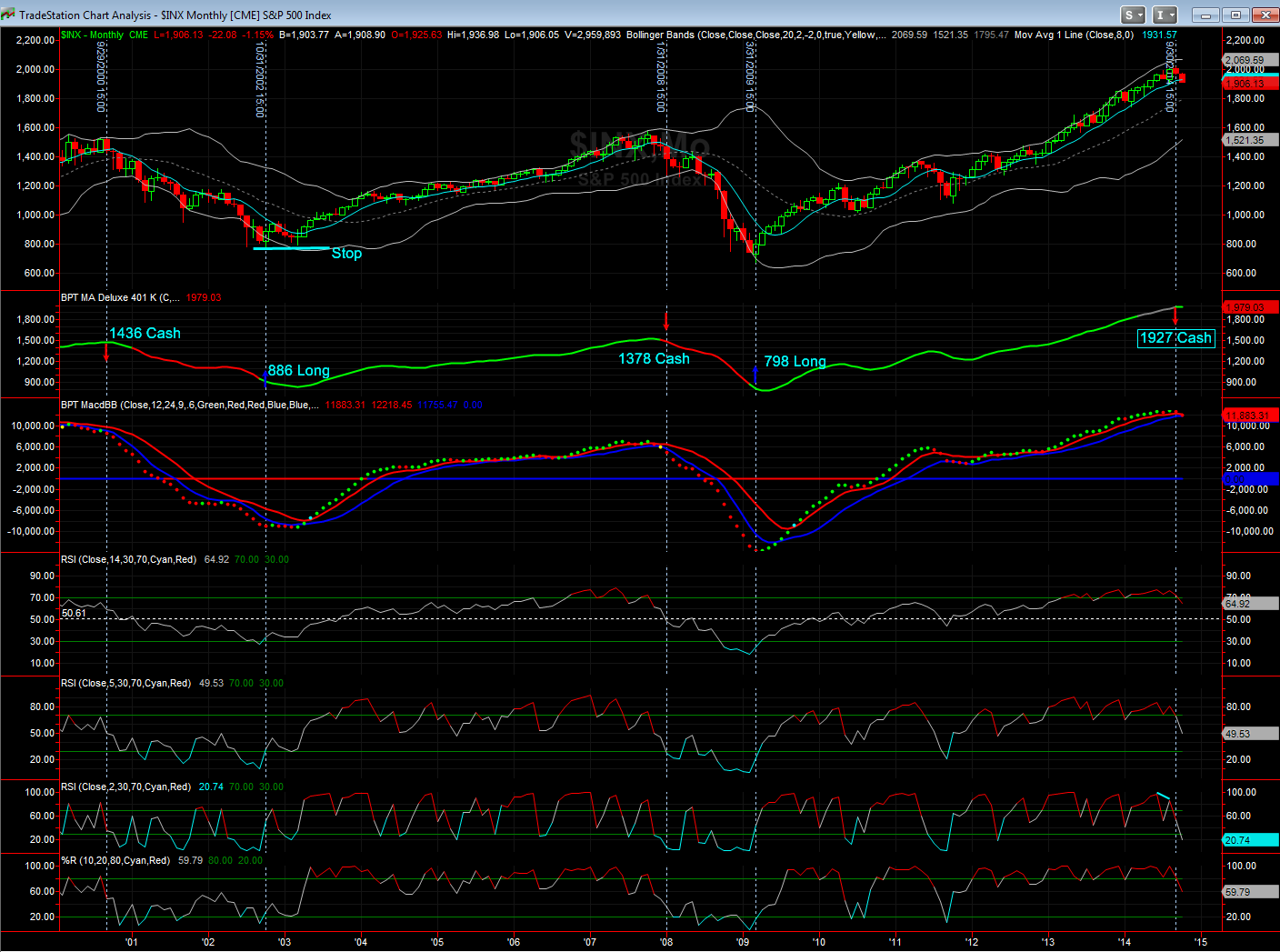

Hello guys, last weekend as you know I showed you some examples how when the daily BPT MA Deluxe gives a trade signal on the daily SPX chart, that one could zoom down to a 60 min chart to get better prices if the 5 and 14 RSI's were overbought (for longs) or oversold (for shorts), and you simply wait until the next day when these RSI's recycle. This of course is just common sense and could be improved upon a lot, however this exercise is to get you out of the 'robot mode' about taking the daily charts without looking at your intra day charts and other factors.

The first image shows you two tables, the one on the left shows you the trade signals based only on the daily chart. The table to the right shows you the dates and prices if you used a 60 min chart to get better prices a day later if the RSI's were overbought or oversold at the time of the daily signals. If you look at the table, not every signal is better or different, in fact many of them do not change the daily signal (if RSI was not at extreme levels on the 60 min chart at the time, I simply take the daily signal as is). For the columns, compare the dates, the # of days, and points better,and % Gain columns.

The difference you will see is that some of the trade signals you are able to get 10 - 17 points better prices on the SPX. Also you will note that the average trade time jumps from 43 to 46 days, which is just common sense since you are typically waiting a day or so longer using the 60 min.

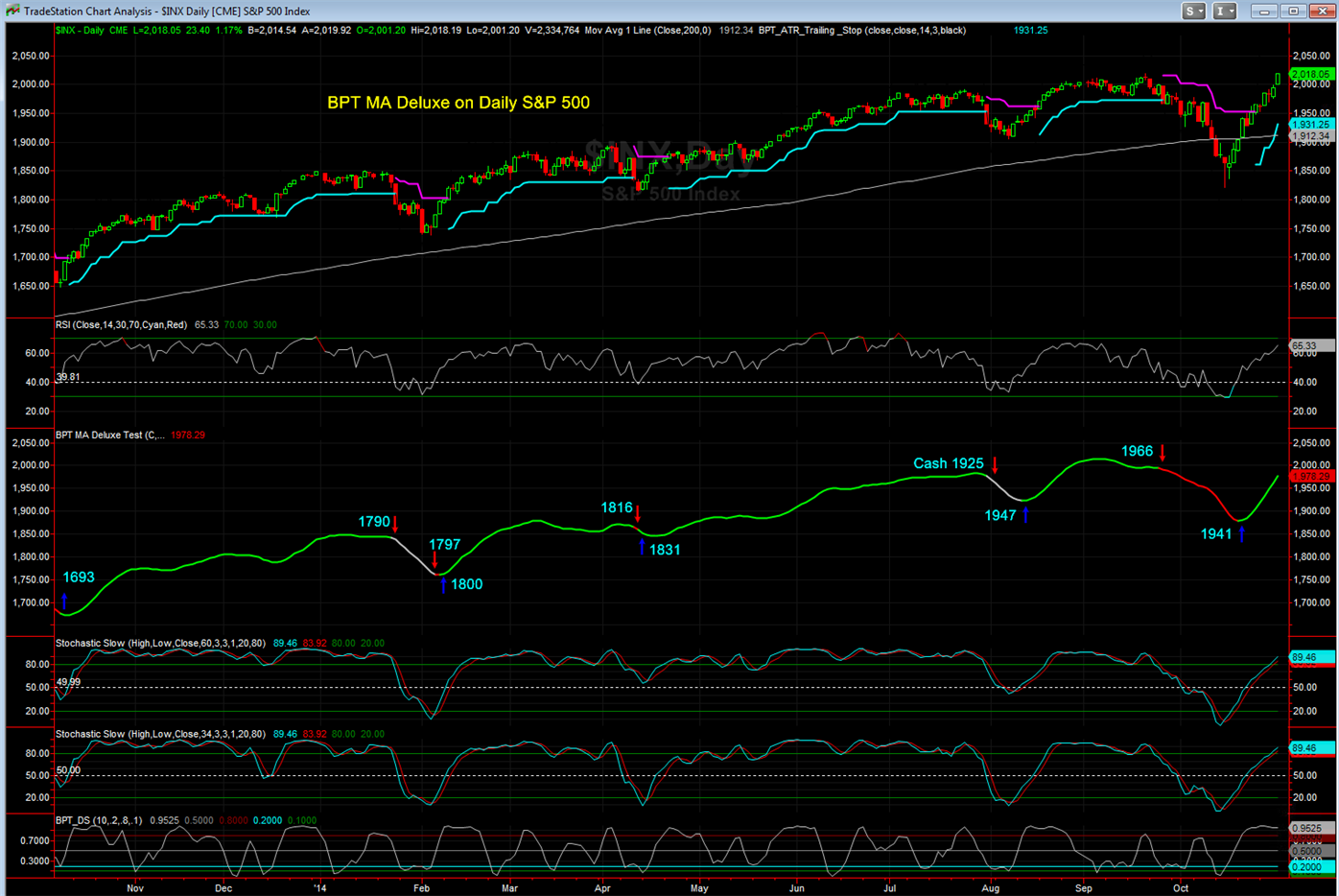

- The second image below shows you the daily SPX with BPT MA Deluxe signals noted (non - 60 min modified)

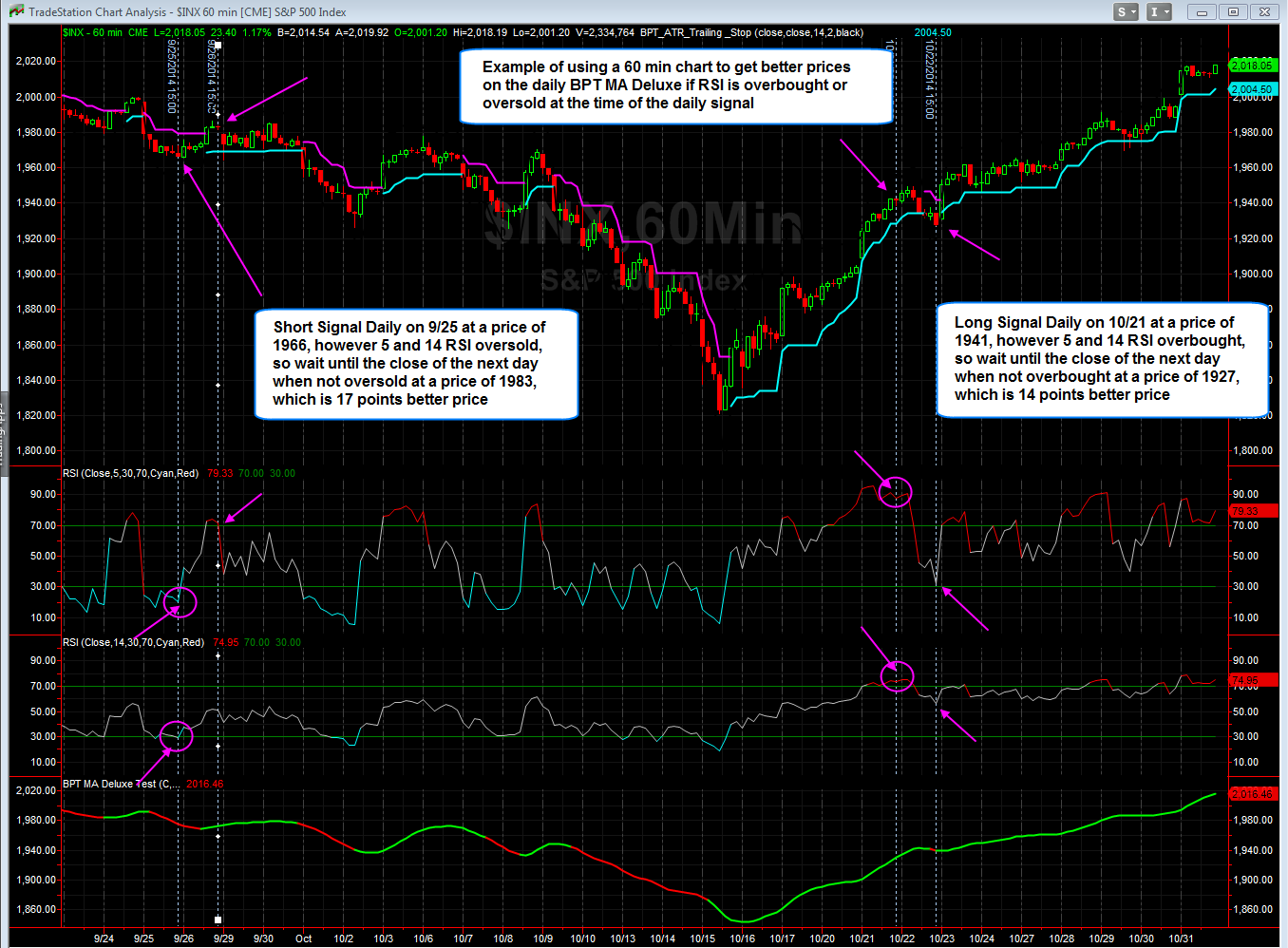

- The 3rd image below shows you the Current SPX with BPT MA Deluxe and the new signals based on 60 min

- The 4th image shows you a 60 min chart showing the current long trade, which would have been taken at 14 SPX points better prices, and the previous cash trade which would have been taken at 17 SPX points better prices.

I have not decided yet, I may in the future show the daily chart with the 60 min modification - however I would have to let you know in real time of course.