Newsletter Signup

Search

Tuesday, April 29, 2014

SPY Professional System Scaleout Discussion

Monday, April 28, 2014

Market Comments, FB etc

SPX is flat, Nasdaq is down -0.7%, RUT is down 0.96%, techs and small caps continue to under perform badly vs the SPX and Dow large caps:

AMZN - Chart Link - mono high pe stocks still weak

FB - Chart Link - FB looks like it's going to test its 200 day MA. However could it be a large H&S pattern that measures much lower??

$RUT - Chart Link - Rut weak testing 200 MA again

Sunday, April 27, 2014

General Market Newsletter Weekend of April 27th, 2014

Hello everyone, first off I hope you had a nice weekend! Here's my general market newsletter, I cover the 'big picture', and short term views of the market, as well as some indicators and systems, and trade ideas.

CLICK HERE to View the Newsletter

enjoy the remainder of your evening,

Matthew Frailey

Tuesday, April 15, 2014

Monday, April 14, 2014

Monday April 14th Newsletter

Hello everyone, nice bounce in the market today from oversold conditions, here's my thoughts, and I also cover some educational examples

CLICK HERE to view the Newsletter

Matthew Frailey

Wednesday, April 9, 2014

Most recent Newsletter

Hello everyone, here's tonight's newsletter, also please note that I discuss a few administrative thinks like our SPY Professional system which went long on Monday and hit it's first profit target scaleout today, and our world class BPT MA Deluxe trending indicator. The SPY Pro system and the BPT MA Deluxe are more than worth the tiny cost of a paid membership.

CLICK HERE to view the newsletter

take care,

Matthew Frailey

Wednesday, April 2, 2014

BPT Market Newsletter

Hello everyone, here's my recent market Newsletter

You can view the newsletter here.

Matthew Frailey

Sunday, March 30, 2014

Key Market Statistics In-Depth Discussion

CLICK HERE to view the Newsletter

Matthew Frailey

General Market Newsletter Mar 30th, 2014

Hello everyone, here's my comprehensive general market newsletter covering the recent market action, what to watch for and expect, various market statistics, BPT MA Deluxe indicator, and a few short term trade ideas.

CLICK HERE to view the newsletter

Also some of you have asked questions regarding my long term 401K paint dry system, I also discuss that here as well.

Matthew Frailey

Wednesday, March 19, 2014

I had some appointments this morning and so I just ...

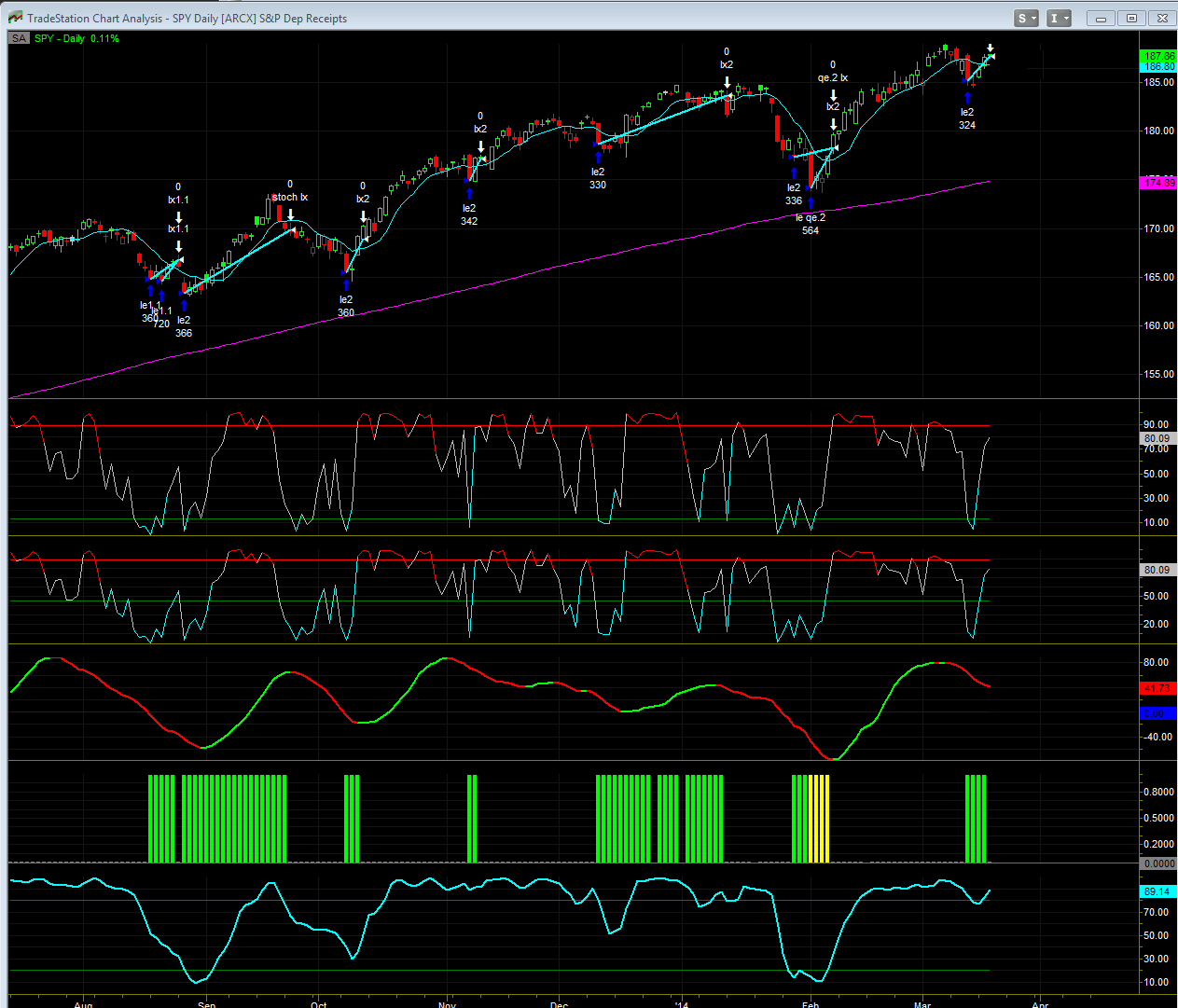

I had some appointments this morning and so I just now updated the trades for the systems to reflect the SPY Pro and Ver 2 systems closing out their trades, also here's two charts of the SPY Pro and Ver 2 systems

CLICK HERE to see all the system trades

Sunday, March 16, 2014

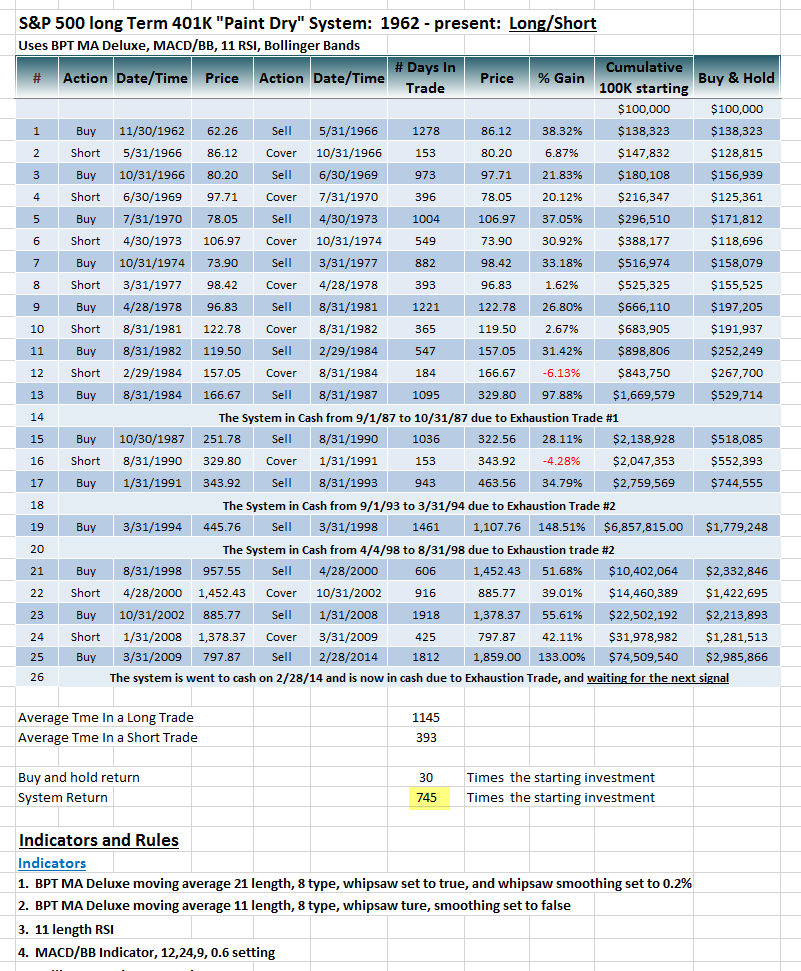

Long Term 401K paint dry system is 401K system section done etc

I have completed the 401K system section with text, current chart, statistics, and past charts.

The long only version of the system, your money grew by 421 times the original investment vs 30 times via buy and hold.

and for the long/short version, it grew by 745 times wow. Also what's nice is that I can take this method all the way back to 1922 using the Dow Jones and the system performs beautifully, even avoiding the 1929 crash. I will put together that table one day however not today obviously. Also I am going to add these long term rules to the BPT MA Deluxe to catch these

CLICK HERE to view the section

Note I have not yet completed the BPT MA Deluxe tab but will do so either tonight or early this week. I have both newsletters this weekend so my time is limited.

Thursday, March 13, 2014

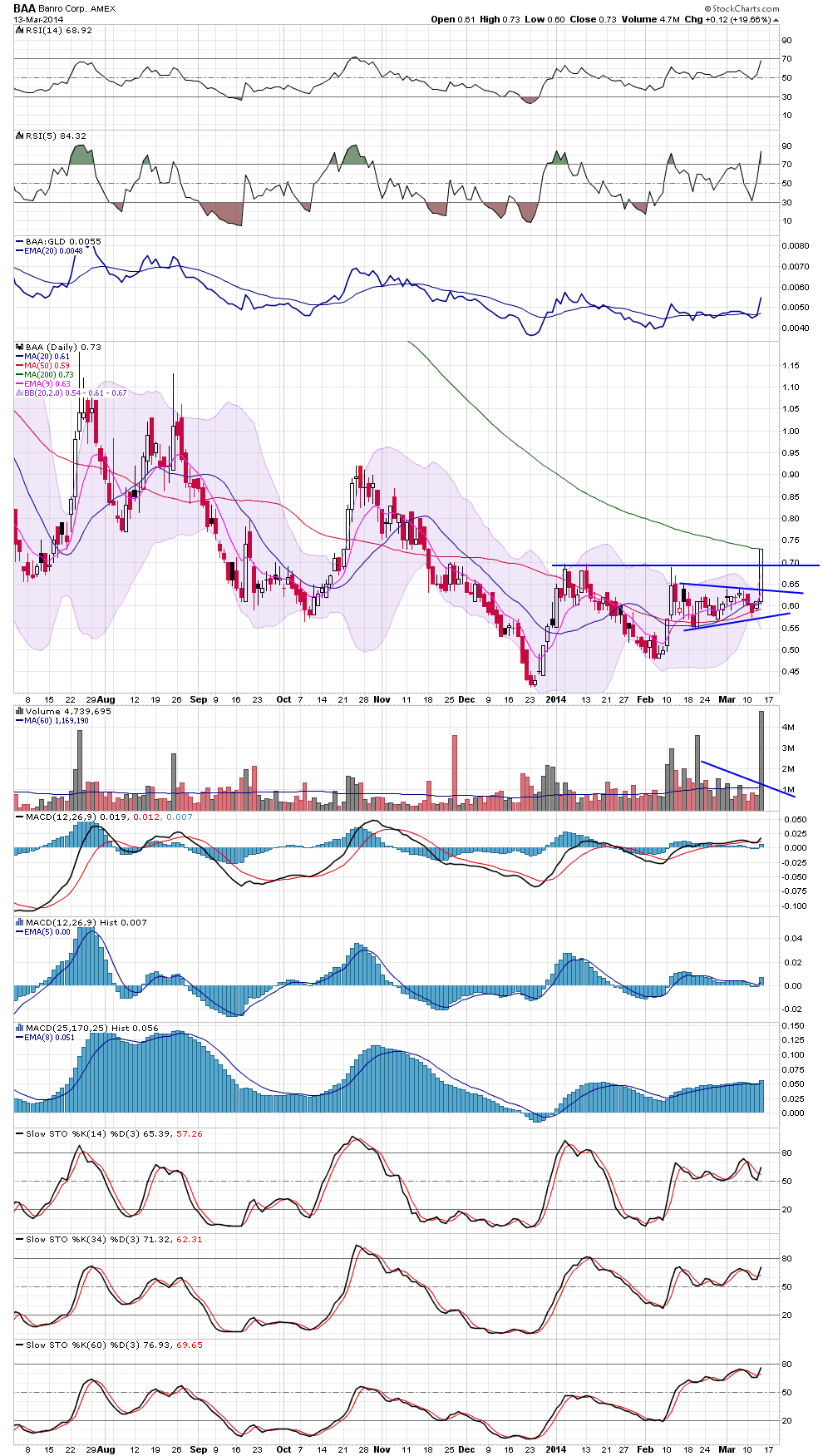

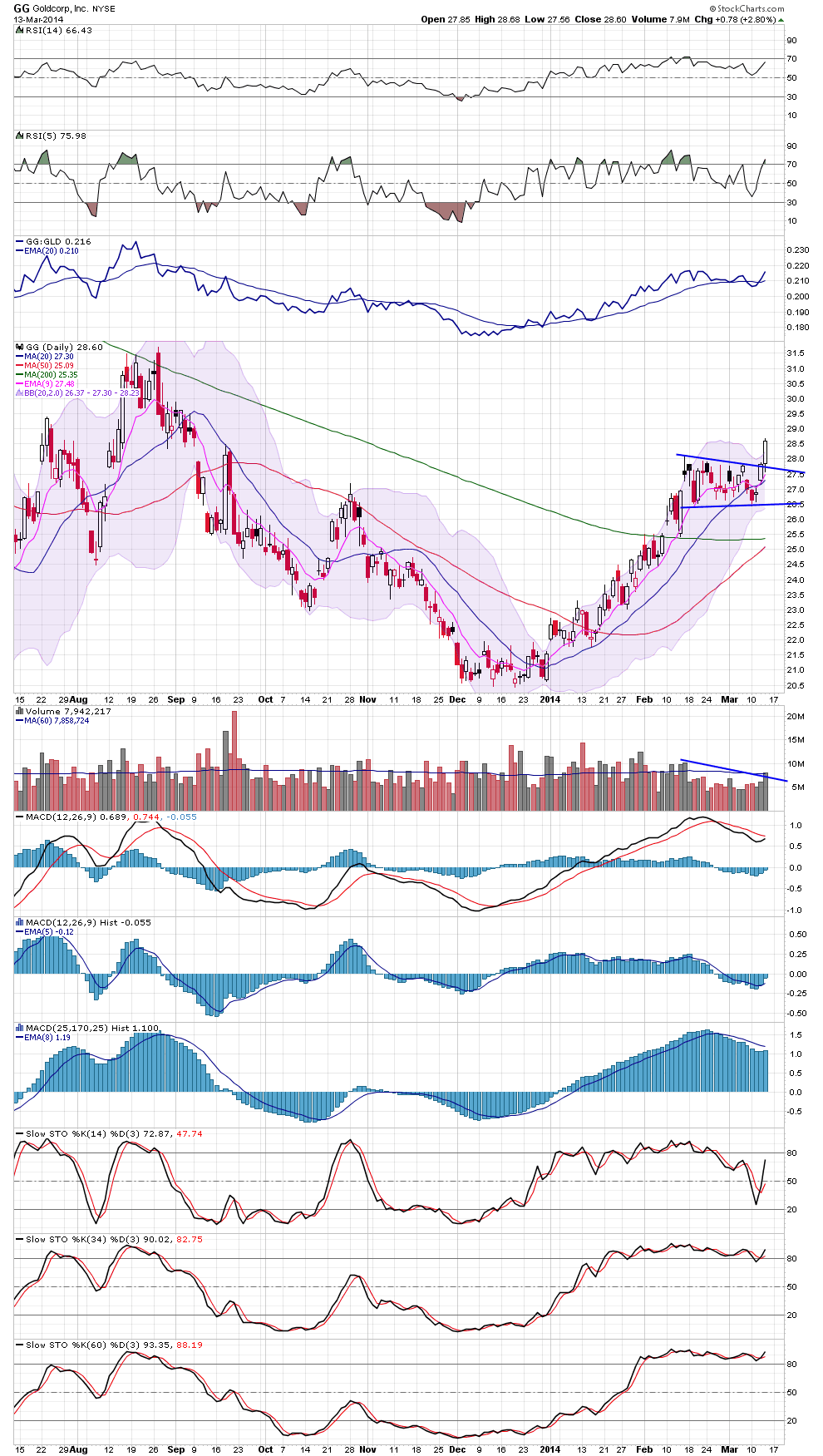

gold stocks

BAA - Chart Link - clearly was a pretty awesome day if you took some gold stocks home from yesterday or bought some first thing this morning as they started off flat with GDX only up a few cents.

Sunday, March 2, 2014

BPT 401K Long Tern System goes to cash

Hello everyone, first off I hope you're have a nice weekend! Here's a detailed newsletter which covers my long term 401K paint dry system, which just went to cash on Friday. I explain the system in great detail, so please have a look, it's also a very nice system for you to give your family and friends who don't trade but want to beat the pants off 'buy and hold' but still catch long term trends and be out and safely in cash during bear markets.

CLICK HERE to view the Newsletter

Matthew Frailey

Wednesday, February 26, 2014

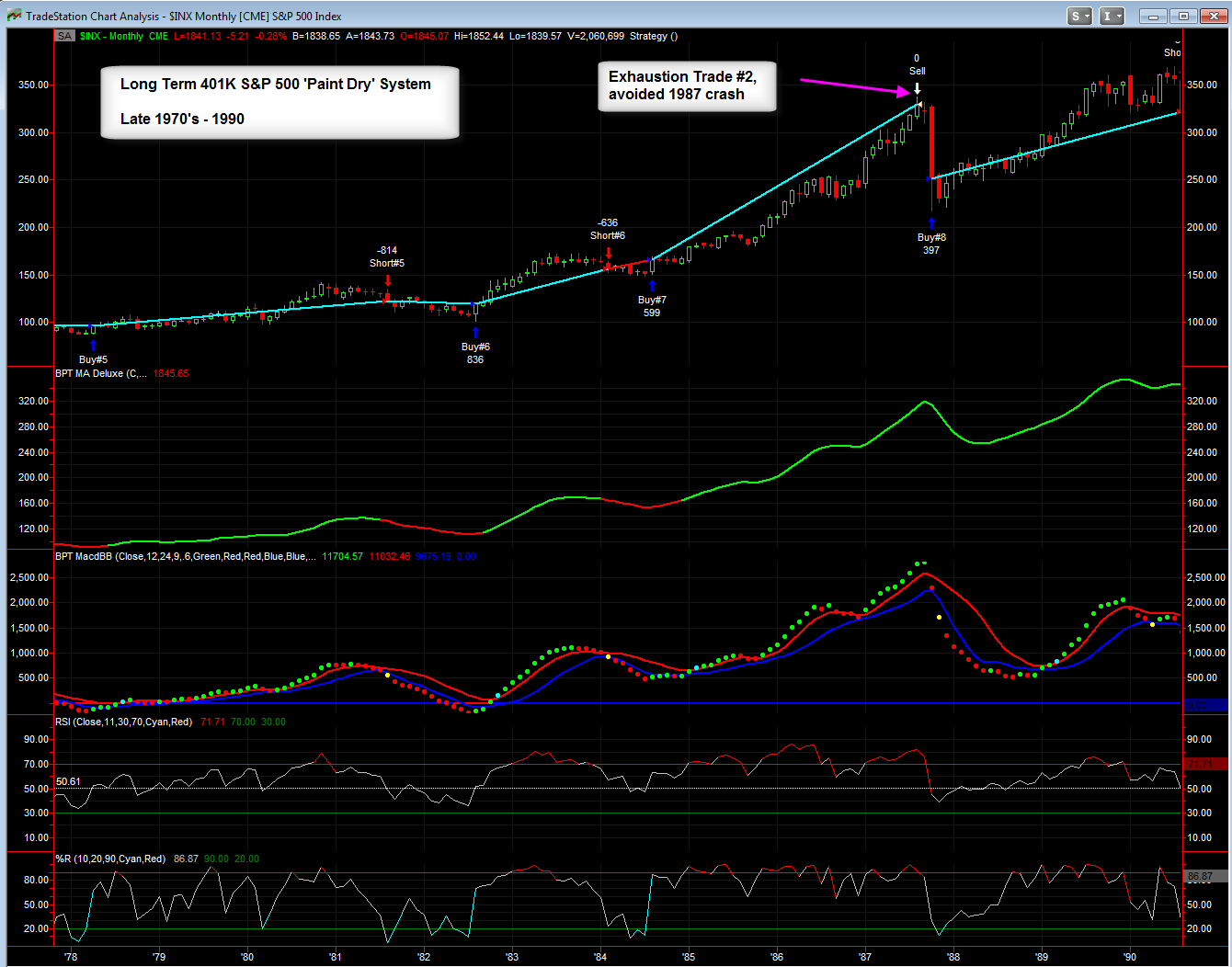

Long Term 401K paint dry system is going to cash end of month

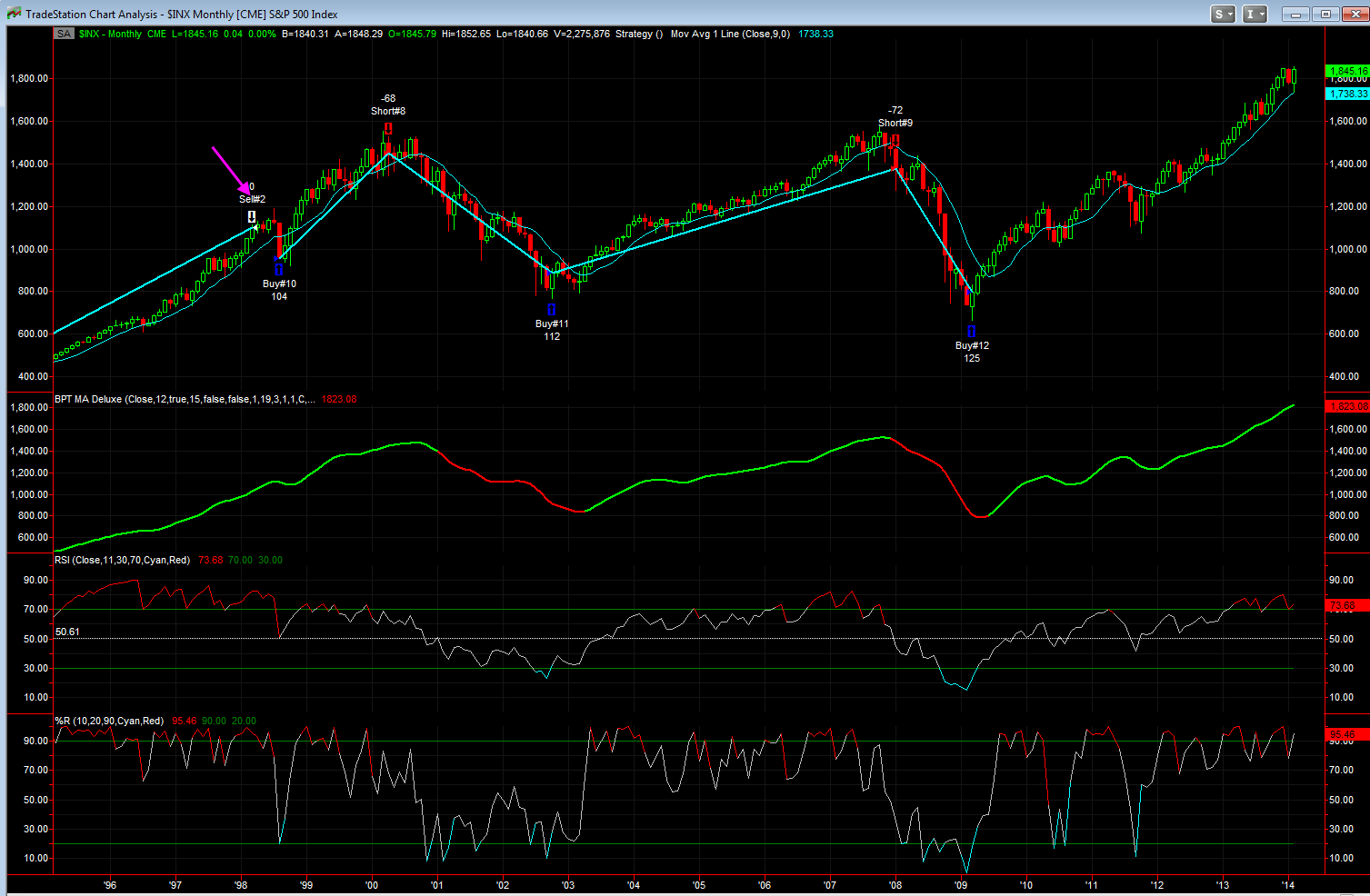

Hello everyone, as you know, a while back I developed a long term system based on a monthly chart of the S&P 500, it's affectionately called the 'paint dry' system because the trades can last for years. I designed it not for traders, but for family and friends, neighbors who do not trade the market and will never trade the market, but want to do better than buy and hold. The system is designed to keep you in entire bull markets but have you out for bear markets, for example the system went to cash in Jan 2008 and then went back long on Mar 31st 2009 just 3 weeks off the bear market bottom and is still long almost 5 years later. My Long only version of the system, from 1962 to present your money grew by 289 times the original investment vs 30 times buy and hold. For my long/short version your money increased by 534 times vs 30 times buy and hold - see the attached tables where the trade and stats are listed.

Currently the system has been in this long trade for 1794 days, the average is 1235 days, however the trade from Oct 2002 to Jan 2008 lasted 1918 days, while the long from Aug 31st 1984 to Aug 31st 1984 lasted 2191 days.

HOWEVER the system is going to go to cash at the end of this month because of a technical situation that has occurred with the market. It has to do with price closing for 20 months consecutively above the 8 MA along with the Willams% indicator above 90%. The system will be going to cash at the close of this month and will then look to buy a pullback. The last time the system did this was in Mar 31st 1998, it then bought the sharp pullback and went back long on Aug 31st 1998 (see the 3rd chart). Over the weekend I will discuss in more detail what this technical signal is. Do NOT take this is a sell short signal right now, and also the previous time this occurred the market stayed out for 3 - 5 months before having a hard pullback, if history holds true then maybe this portends to our market having a strong correction either in May or fall time frame for general seasonality.

I will discuss this briefly in tonight's newsletter, however I will discuss it in more detail on the weekend in a separate newsletter.

Wednesday, February 12, 2014

Feb 12th, 2014 Market Newsletter

Hello everyone, here's my most recent newsletter, I discuss the general market action, precious metals, and of course my powerful BPT MA Deluxe trending indicator and some amazing educational pieces, so make sure to check it out!

You can view the Newsletter Here.

Matthew Frailey