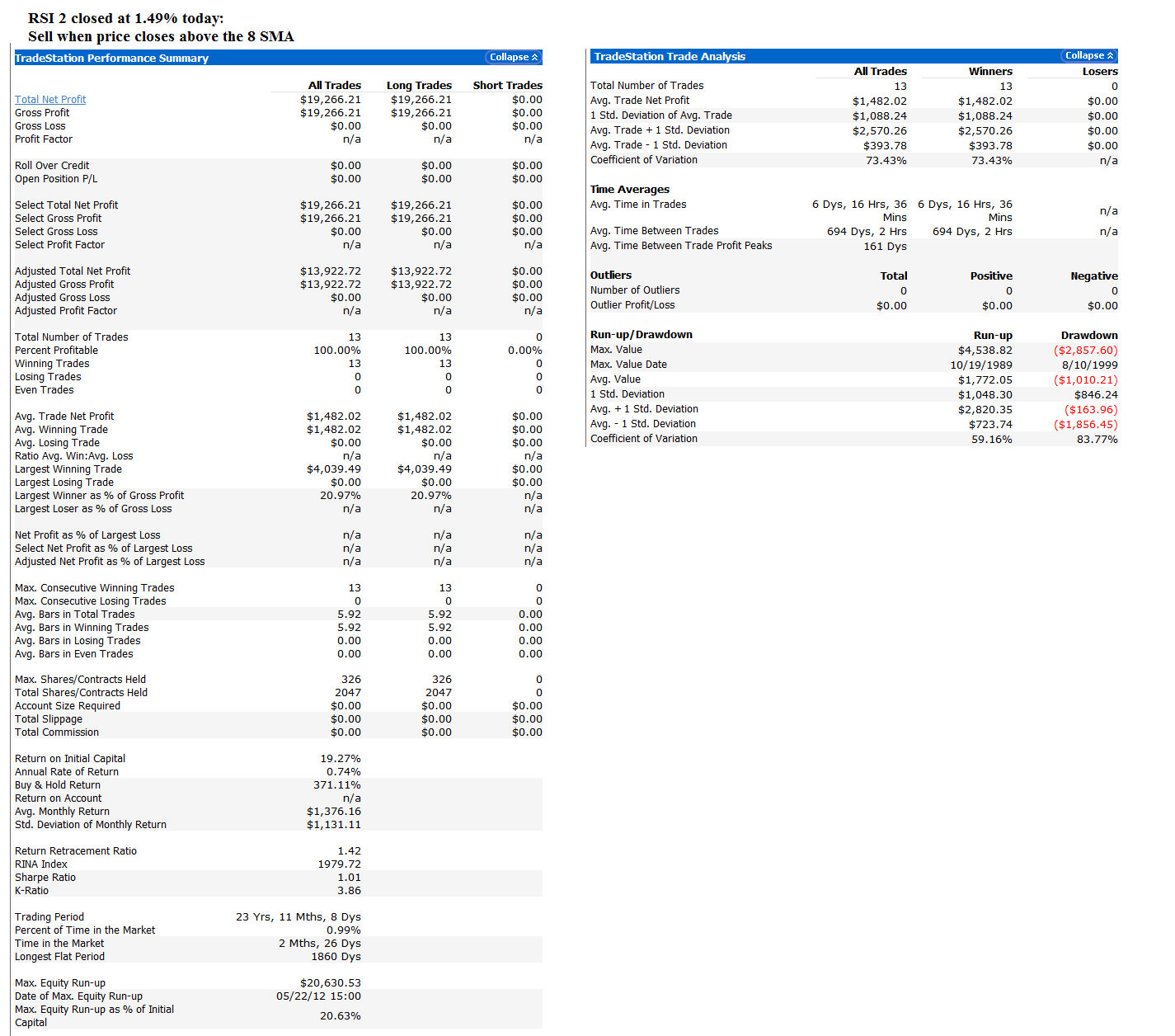

The RSI 2 on the daily SPX closed at 1.49%. I ran some numbers and here are the statistics:

This has occurred only 13 times since 1988 or 24 years while price was above the 162 day MA. If you went long the SPX when RSI 2 closed below 1.5% and sold when price closed back over the 8 day SMA, 100% of the trades were winners, the largest intra day draw down was 2.8% in 1999. For the statistics, each trade was taken with $10,000 to make conversion to percent gain/loss easy - i.e. multiples of 10.

Most trades had some draw downs, which means price generally went lower for a short time before finally bouncing (see the second graphic via the Runup - Rundown column). The dollar gain/loss is of course the same as % gain loss since each trade was $10K.

the average time in the trades was about 7 days.

No comments:

Post a Comment