I like to sell weekly naked alls and puts to generate cash each week, generally I do this late Wed at the earliest and I'll do them heavy on Thursday and Friday (If I can still get premiums). Obviously I try to sell the options where I think there is very little chance at SPY closing within those strike prices by Friday's close.

This week after the sell off I'm interested in selling some Puts (not calls), which expire on Friday. Today SPY closed at $143.29, and here's a list of option prices that expire on Friday. As you look at the Puts, the 138 strike price is selling for 6 - 8 cents, that's $5.5 dollars lower or about 55 SPX points, which I see as unlikely. If I sell 100 of those puts for 7 cents, that's 700 dollars that I get to keep as long as SPY doesn't close at or below $138 by Friday's close. Intra day today at the lows the premiums were of course higher. The 139's and 140's also interest me. I did a few today but will be looking to sell more tomorrow.

Realize that this takes up a lot of margin and there's risk (selling naked options). I do this week after week to generate case on my cash holdings - but again it takes some cash to do this, you can only sell about 75 options per 100K, don't expect to do this if you are trading with a $25K account, or an IRA or retirement account. Since I never have all my money in the market at one time, I do this each week to generate some cash - it's not a lot but better than bank interest, about 25% a year or so.

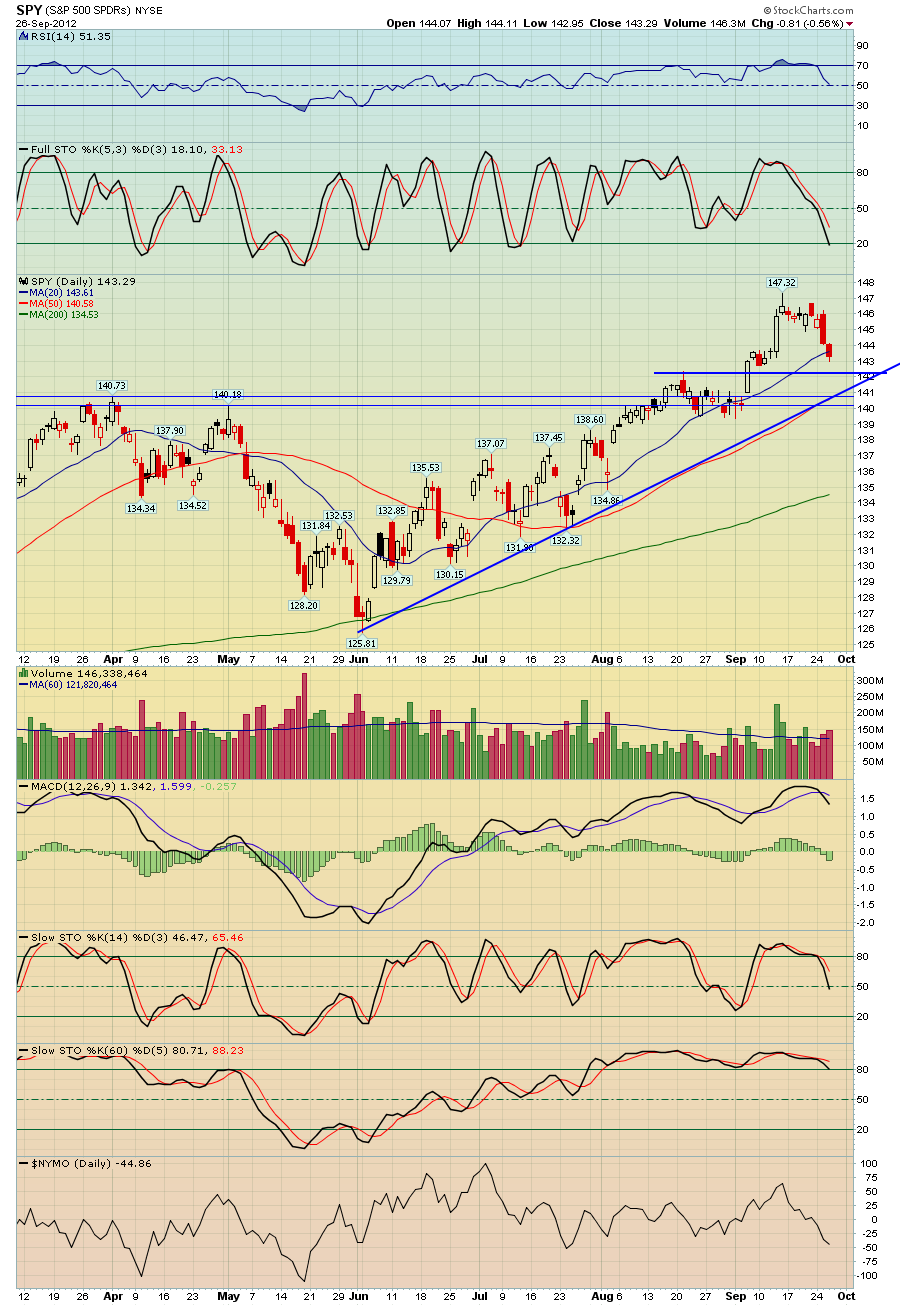

I've also attached a SPY daily chart, as you can see there should be some strong support just below at the trendlines

No comments:

Post a Comment