Newsletter Signup

Search

Thursday, February 28, 2013

Wednesday, February 27, 2013

Our NYMO BB system gave a buy signal yesterday

Our NYMO / BB system gave a buy signal yesterday that clearly played out. As you can see on the chart, when the NYMO closes below the lower bollinger band, the market is generally do for a bounce and we clearly got that today with the SPX closing up 19 and the Dow up 175

BPGDM and gold stocks getting quite oversold and our system

The BPGDM (bullish percent gold miners index) is now 3.33%, that's extremely low, remember that a bullish percent chart can only trade between 0% to 100%, and rarely does it ever get to 0% or 100%, or even this low. Our mechanical system has been short since Oct 12th. When the system goes long we will let you know - this is a nice swing system.

Our GDX RSI 2 system closed out of its long ...

Our GDX RSI 2 system closed out of its long yesterday, it took a long last Wednesday. This is why you should consider becoming a member of Breakpoint Trades - because you will get these trade updates in real time!!

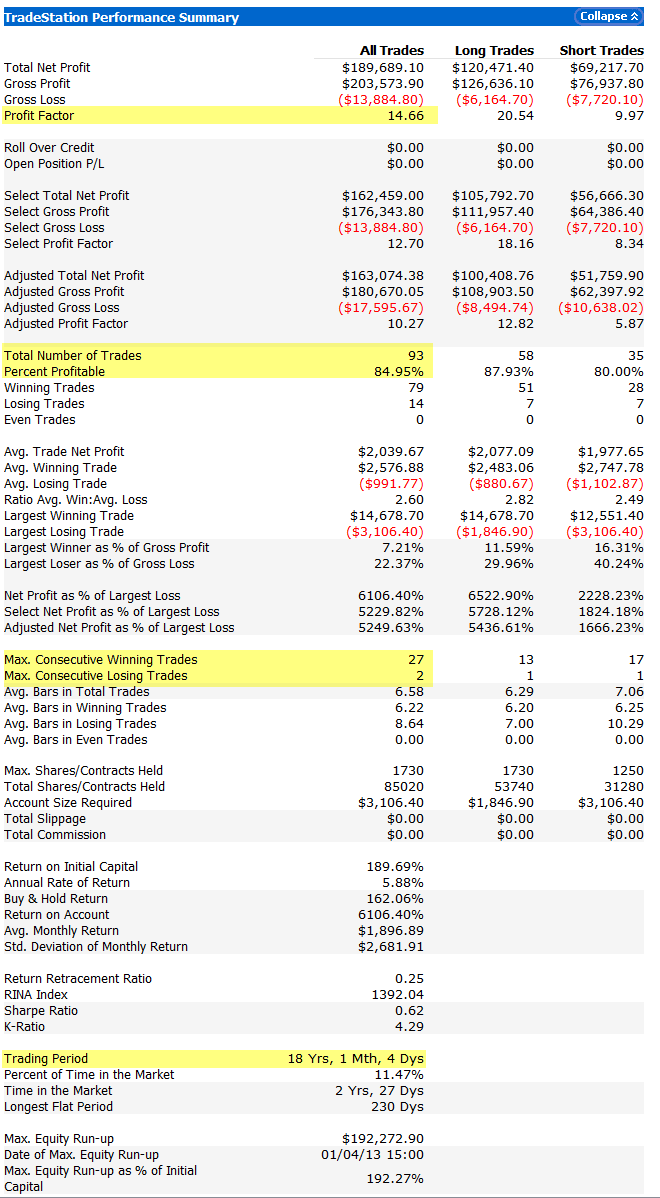

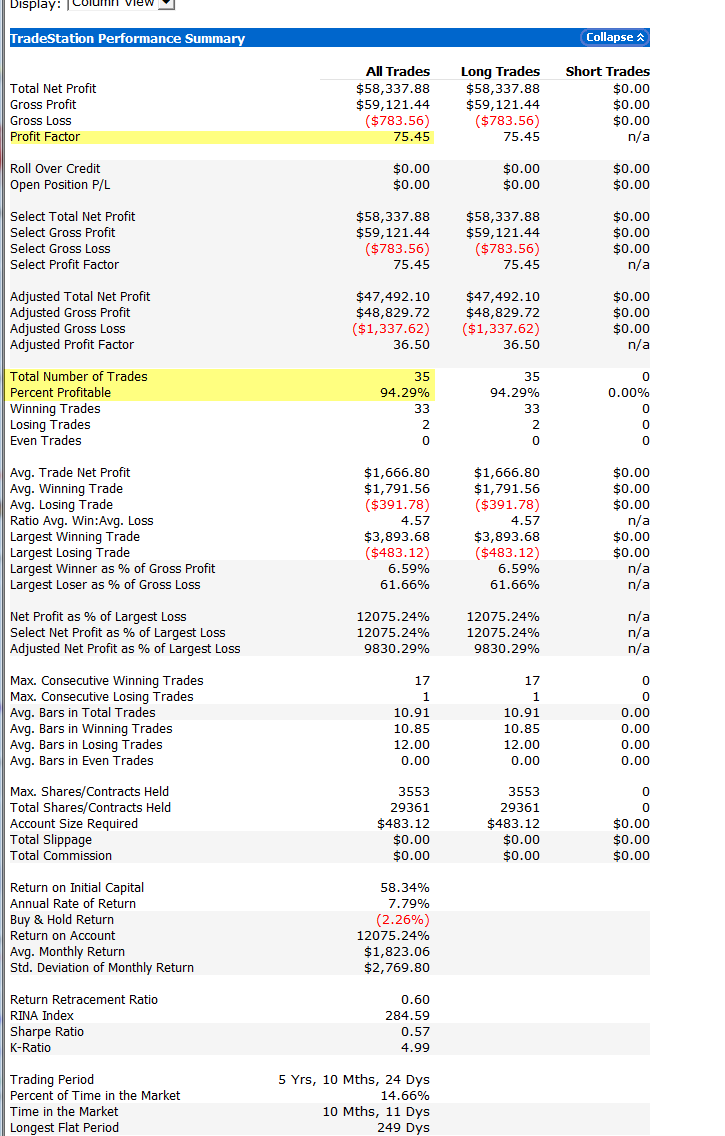

here's a performance report of the system so that you can view all the statistic

Otherwise, I'm not surprised, GDX simply bounced back to the 9 EMA where it reversed off

VIX buy signal worked

$VIX - Chart Link - VIX buy signal worked again, closed back inside the BB's yesterday, that was a buy signal per the system - see the rules on the chart

Tuesday, February 26, 2013

yep nice bounce today in gold, some some it's Because ...

yep nice bounce today in gold, some some it's Because of Bernanke - but again most of the time I've of the opinion that charts just play out and the news is only an excuse.

As I showed, the RSI was the most oversold in history on GLD last wednesday, so it was due for a bounce

also under this weekly wave count, gold needs a bounce as a wave (b), so maybe this bounce is that.

Monday, February 25, 2013

SPY Ver 2 system follow up

As a follow up to my post last Friday, the SPY Ver 2 system which went long last Wednesday and Thur is doing well so far - a trade signal email was sent out last week.

All the market has to do is close slightly up today and this system will get an exit signal - however it will exit tomorrow on the open and not at the close today - all longs for the SPY Ver 2 system are exited on the next day open vs the close of the day (make sure to read the overview tab for this system). This is explained in the Tradestation Systems section in the overview tab for this system. Remember these are reversion to mean systems, they are not trend followings systems, i.e. they buy pullbacks in uptrends and short rallies in downtrends - they mostly get in a trade and get out fairly quickly, once in a while they will hold a trade for a couple months but most of the time they are in and out fairly quickly and ONLY in the market about 25% of the time. This allows you to have your money working somewhere else the other 75% of the time

click here to read about about the SPY Ver 2 system, and here's the full Tradestation Performance report showing all the trades and detailed stats. Also make sure to read the Overview Tab in this section, which explains the systems in general.

The other reversion to mean systems didn't take the long trade (SPY RSI 2, DVY RSI 2) etc because they needd a deeper pullback. Only the SPY Ver 2 went long.

I will be setting up a Webinar soon to discuss the systems and trades in detail.

click here and submit your email to get on our list - I will send out an email in the future to notify you.

Sunday, February 24, 2013

NYMO oversold system

I was not surprised to see the market bounce last week on Thursday and Friday since our NYMO indicator closed below the lower Bollinger Bands on Wednesday, as you can see from the chart, this has generally produced a bounce for the market. However I have some doubts that the market correction is over just yet, we'll see..

Friday, February 22, 2013

Thursday, February 21, 2013

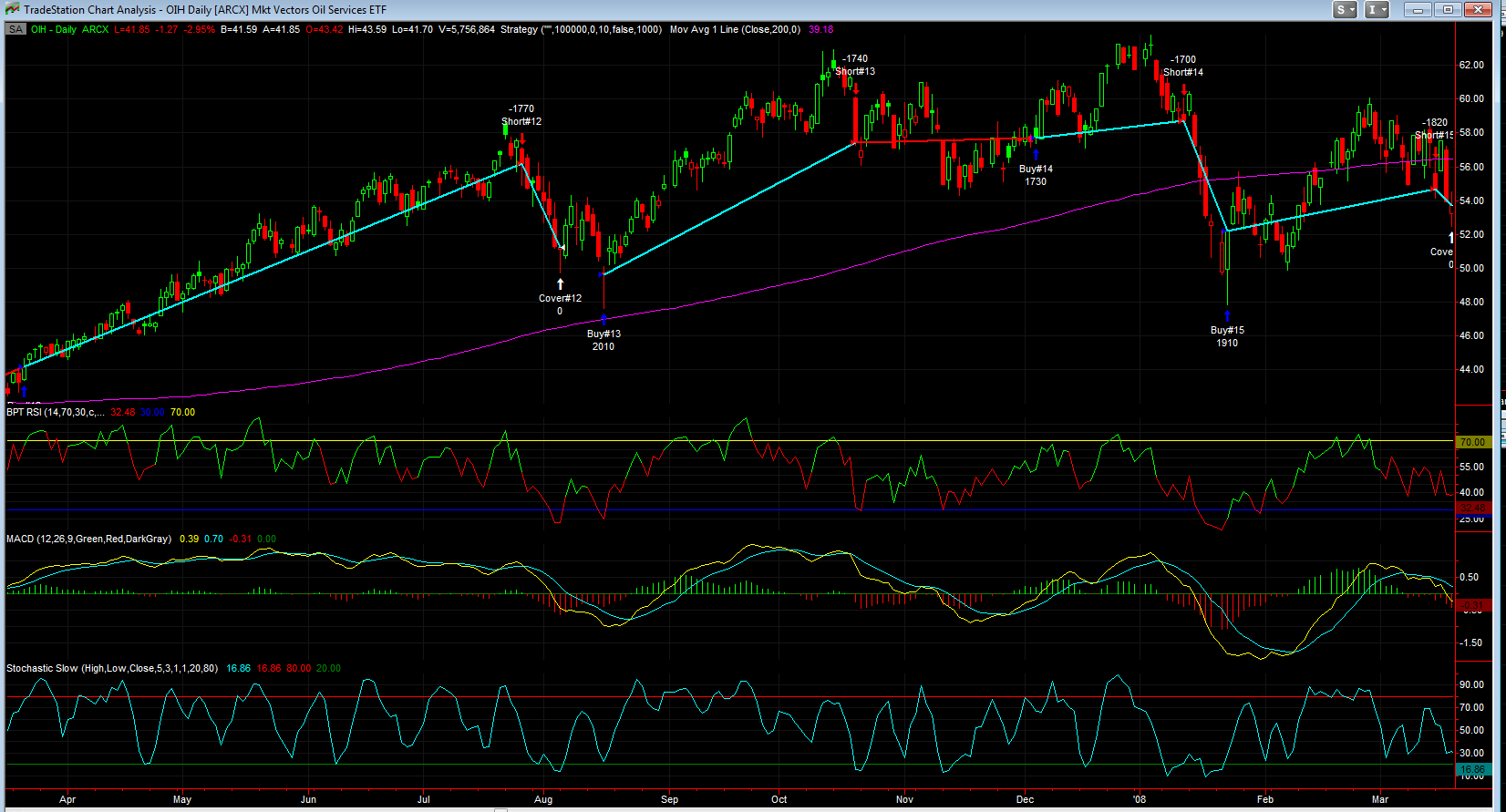

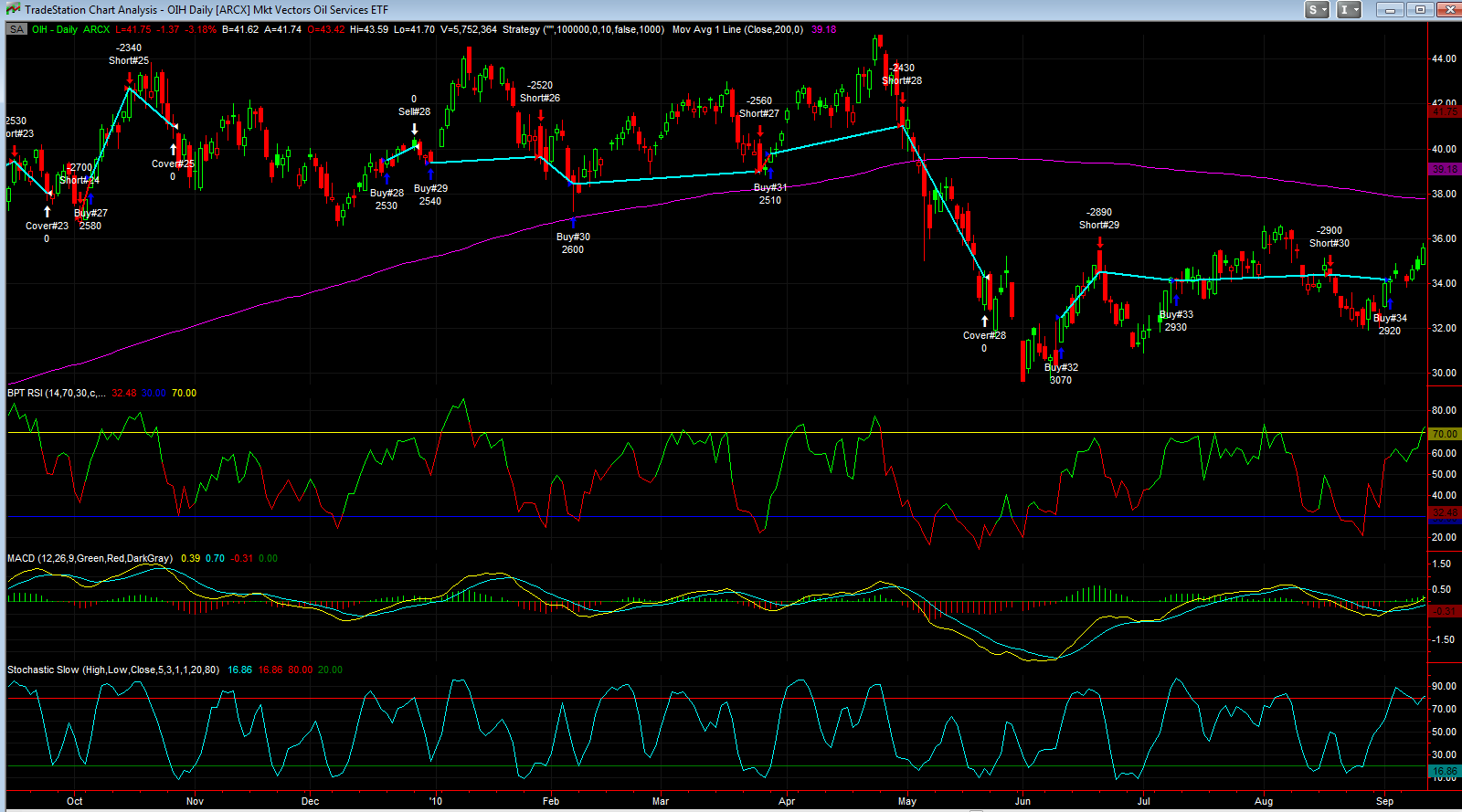

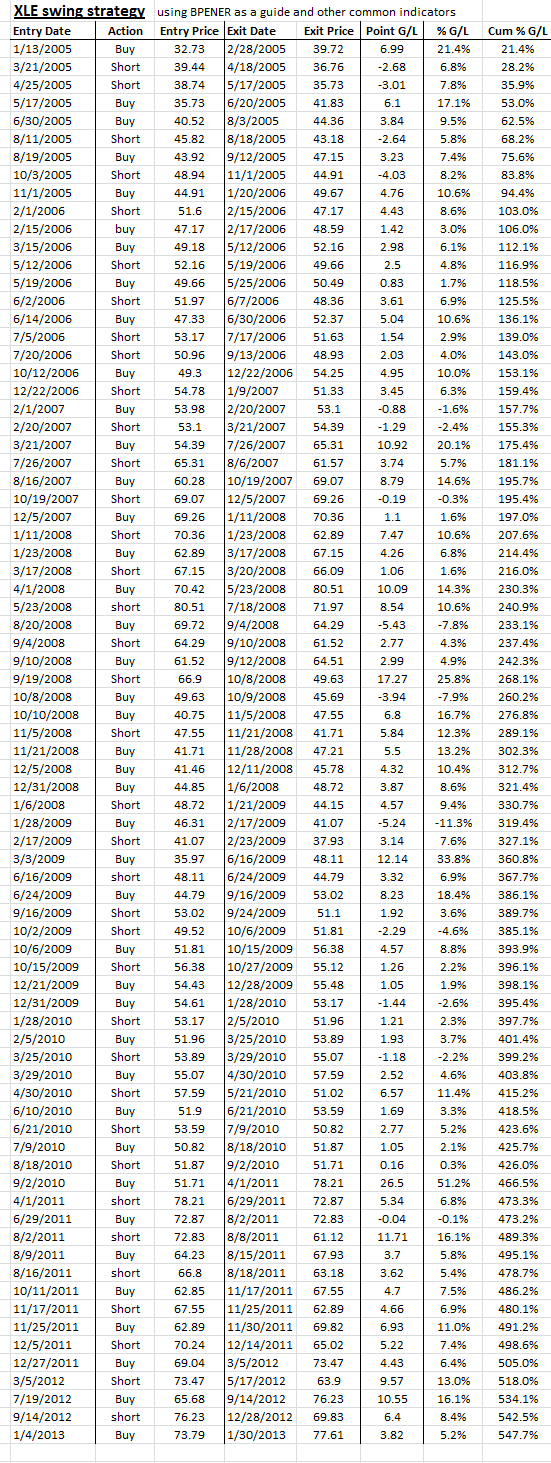

XLE vs OIH for XLE system

OIH - Chart Link - XLE is down -2.44% today vs XLE down -1.2%

Again as I've shown before, trading OIH in place of XLE has made about 25% more profit vs trading XLE. Here's the trade statistics - all trades dates are the same. 100K was used for each trade and no compounding was used to keep things simple. XLE made 570% since 2005, whereas OIH would have made $705K.

XLE Detailed System Report (note this file will only open in Internet Explorer)

OIH Detailed System Report (note this file will only open in Internet Explorer)

I don't use compounding, but if compounding is used, 100K on OIH from 2005 turns into $46 million LOL, here's that report

Wednesday, February 20, 2013

GLD and RSI

The RSI 2 and 14 RSI are the most lover sold they have ever been since GLD began trading.

14 RSI closed at 18.66%, RSI 2 closed at 0.15%.

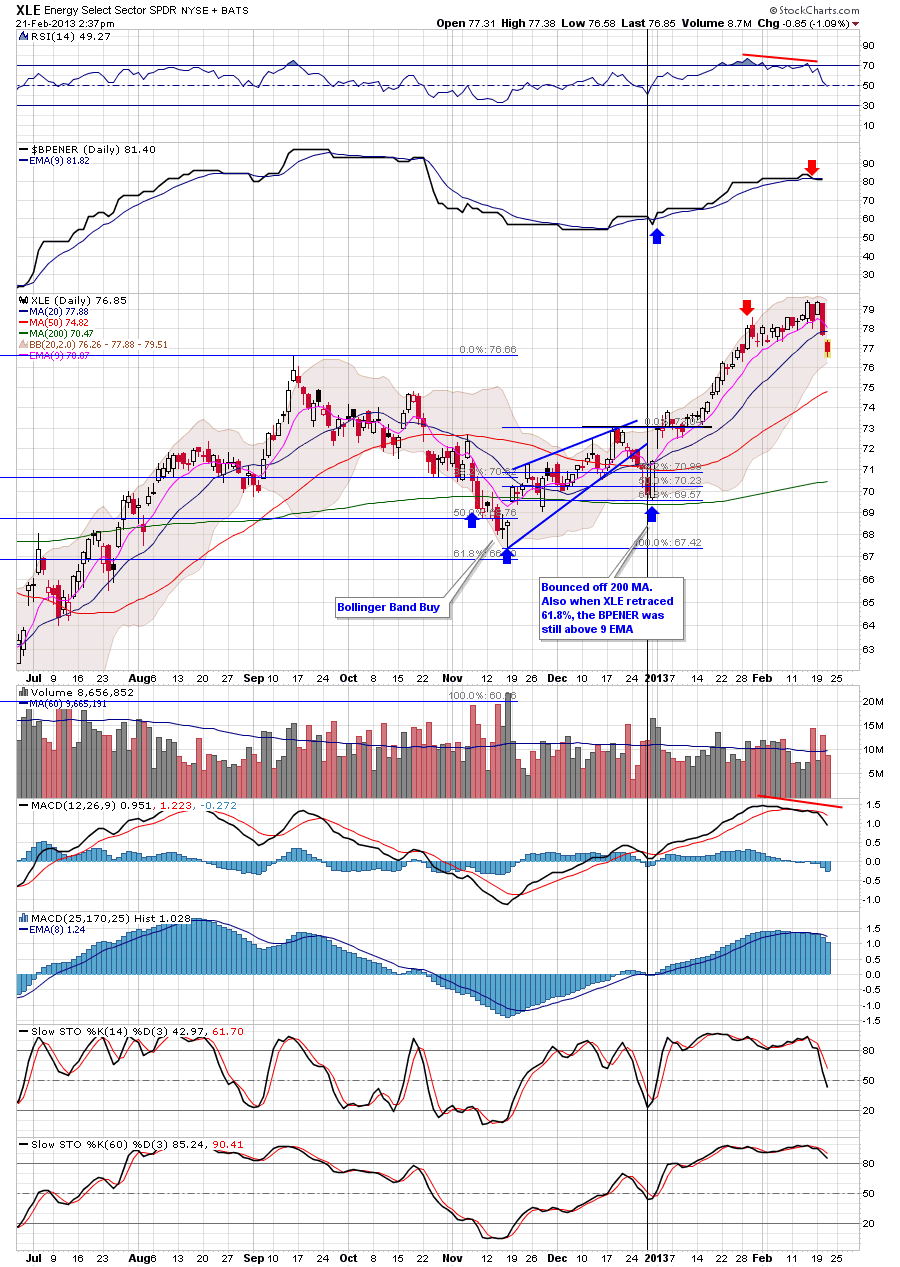

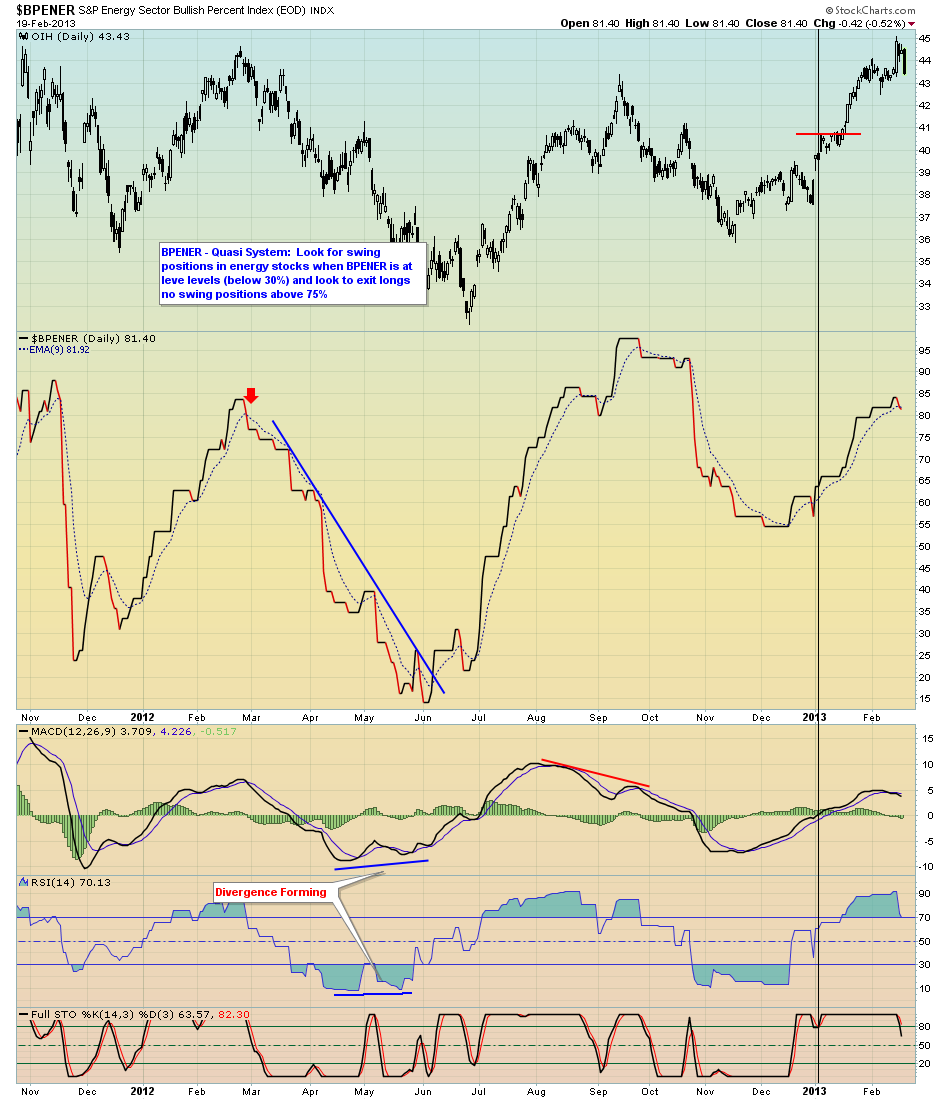

XLE / OIH BPENER swing system

As you know, the XLE swing system took a long trade from Jan 4th to Jan 30th for a very nice 5.2% trade, the system then went to cash and has been sitting in cash since. However some of you may have taken an aggressive short, if you still have that short it's finally starting to look better.

Otherwise it appears that today at the close the XLE system will take a short position. I've attached the XLE swing system trades to this email as well as the BPENER chart.

Otherwise even though this is the XLE system, one thing that I have commented on in the past is that it has been more profitable trading OIH or XOP in place of XLE. Here's a link to two Tradestation Performance reports which show the XLE system and a version if you traded OIH in place of XLE.

XLE Detailed System Report (note this file will only open in Internet Explorer)

OIH Detailed System Report (note this file will only open in Internet Explorer)

GDX RSI 2 quite oversold now

As you know gold and GDX have been pathetic and we have been on the right side of the trade here.

However in the very short term they could be getting oversold.

Currently the RSI 2 is at 1.80% on a daily GDX chart which historically is quite oversold. If GDX was above teh 200 day MA, the changes odds of a bounce would be 100% based on historical trades. However the GDX is currently well below the long term 200 day MA and is in a strong downtrend. So what are the odds for a short term bounce? I tested this with my RSI 2 Reversion to the mean system code and here are the results:

Here's a link to the Performance Report showing detailed Statistics

system rules:

Go long GDX when RSI 2 closes below 2%

Exit the trade when RSI 2 closes back above 80%, or hold the trade for a longer period of time if our momentum indicator is positive.

the system scales into a trade in a total of 3 scale-ins of 40%, 30%, 30% - each scale in has to be at a lower (better) price than the first entry.

The results are quite positive - 93% of the trades were winning trades with the largest losing trade at 1.2%. However that said - some of the trades had to take some heat before working out - particularly the times when GDX was really in a strong down trend, many times you got lower prices before GDX finally bounced.

Again I'm posting this for informational purposes only.

My students who have the Tradestation Systems - already have this system and others on their computer

Note: The RSI 2 must stay below 2.2% by the close in order for this system to take a long

Tuesday, February 19, 2013

Tuesday Feb 19th Market Newsletter

Hello Folks - the last newsletter I posted was our commodities newsletter, here's our general market newsletter. This newsletter also contains a ton of trade ideas, about 20

Tuesday Feb 19th, 2013 Newsetter

Also be sure to check out our coupon for 20% off our 6 month membership!!

Best to your week!

Matthew Frailey