As you know gold and GDX have been pathetic and we have been on the right side of the trade here.

However in the very short term they could be getting oversold.

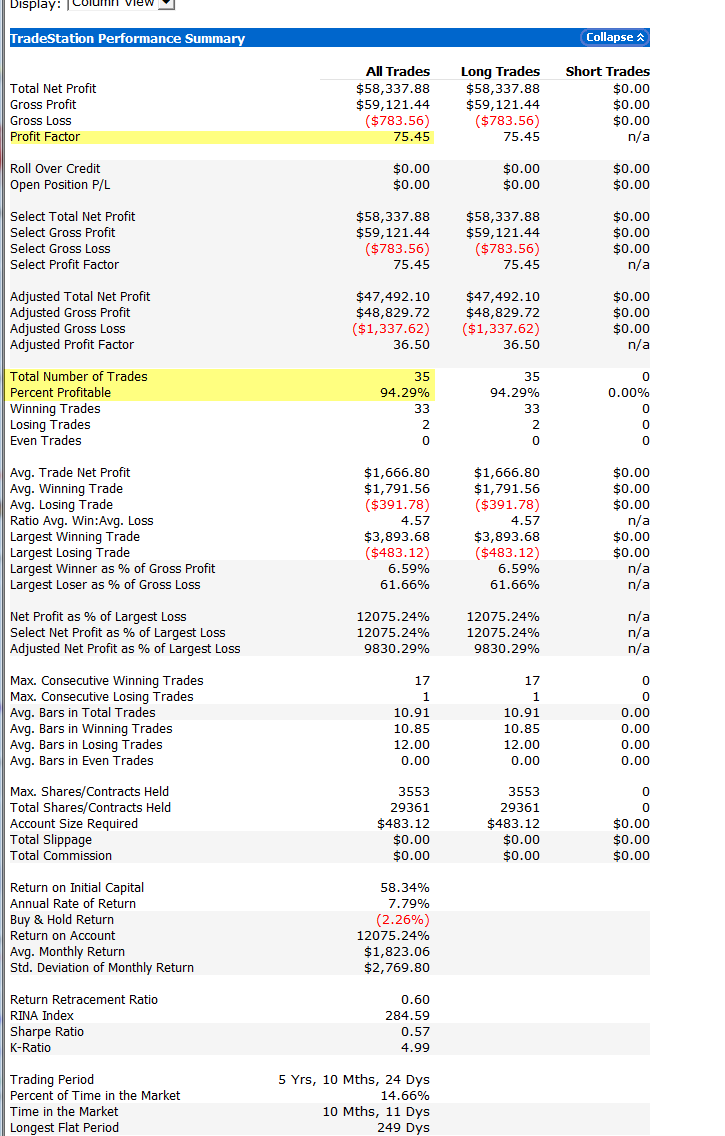

Currently the RSI 2 is at 1.80% on a daily GDX chart which historically is quite oversold. If GDX was above teh 200 day MA, the changes odds of a bounce would be 100% based on historical trades. However the GDX is currently well below the long term 200 day MA and is in a strong downtrend. So what are the odds for a short term bounce? I tested this with my RSI 2 Reversion to the mean system code and here are the results:

Here's a link to the Performance Report showing detailed Statistics

system rules:

Go long GDX when RSI 2 closes below 2%

Exit the trade when RSI 2 closes back above 80%, or hold the trade for a longer period of time if our momentum indicator is positive.

the system scales into a trade in a total of 3 scale-ins of 40%, 30%, 30% - each scale in has to be at a lower (better) price than the first entry.

The results are quite positive - 93% of the trades were winning trades with the largest losing trade at 1.2%. However that said - some of the trades had to take some heat before working out - particularly the times when GDX was really in a strong down trend, many times you got lower prices before GDX finally bounced.

Again I'm posting this for informational purposes only.

My students who have the Tradestation Systems - already have this system and others on their computer

Note: The RSI 2 must stay below 2.2% by the close in order for this system to take a long

No comments:

Post a Comment