Good morning everyone, as you know the market is up once again, the masses can't seem to buy this market fast enough LOL. Again if you listened to my newsletter last night you heard my rant/speech about playing the trend vs being an ultra bear obsessed with picking tops - eventually you will be right but you will be broke before you catch that elusive top!

Anyway here's a couple charts from my newsletter post last night:

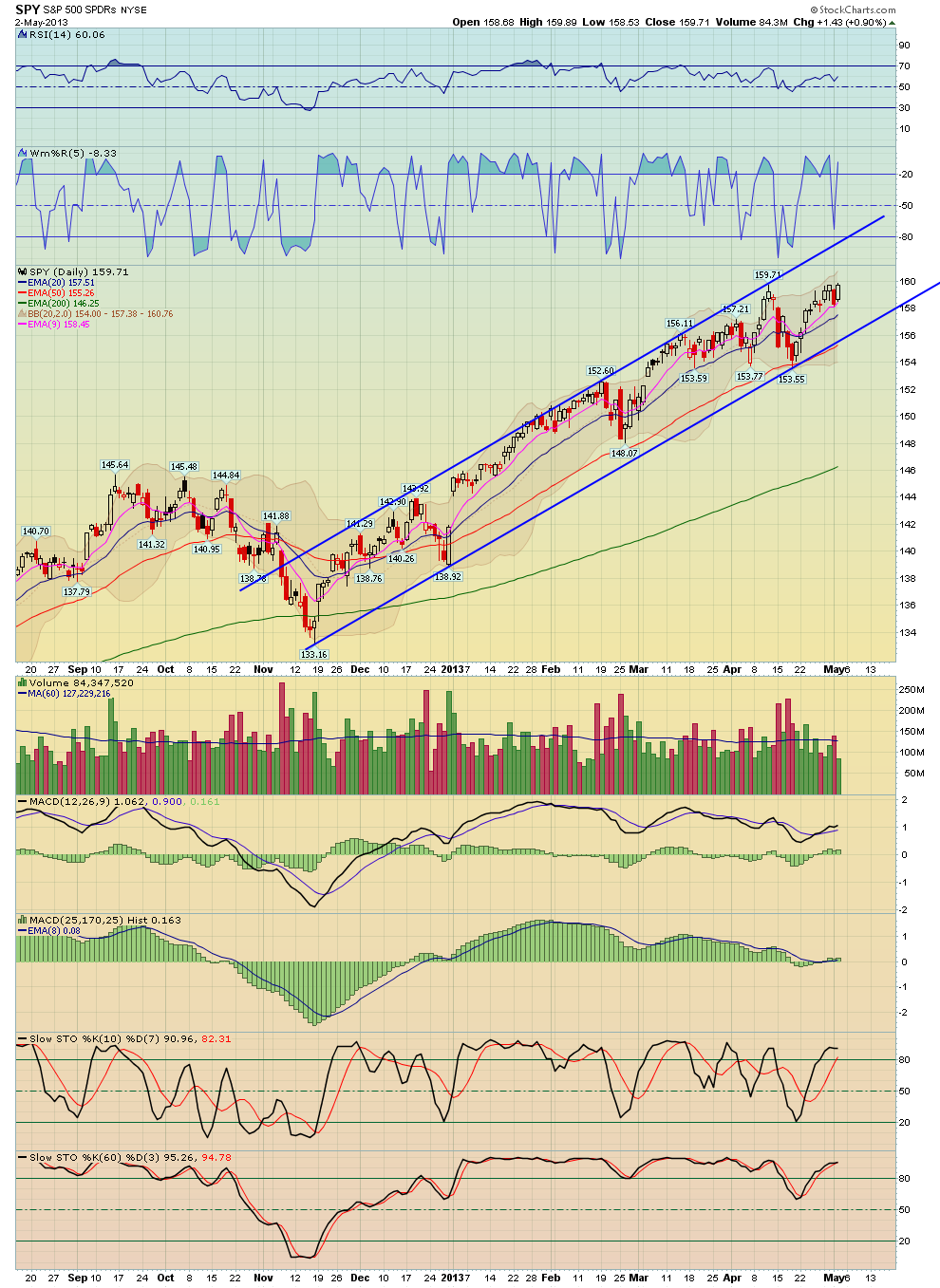

First a 60 min chart of the SPX, as you know it's in a sold uptrend channel and last night I showed the small ascending triangle pattern inside the channel (drawn in black), this pattern is 12 points in height and measures to a target of 1647 (12 + 1635). The second chart shows the 5 min bull flag chart which I also showed last night and has basically met its price target.

This move up is forming some negative divergence on the 60 min SPX chart via the MACD and RSI and is something to monitor, but otherwise the trend is strong.

We have had tons of long ideas posted on our Paid Website