Well....the market sure is resilient isn't it! Of course it helps that all the world banks are willing to print endless money/liquidity to help fuel the markets higher, today the ECB lowered rates as expected. Tomorrow we have the US Jobs numbers, let's see how the market reacts to those!

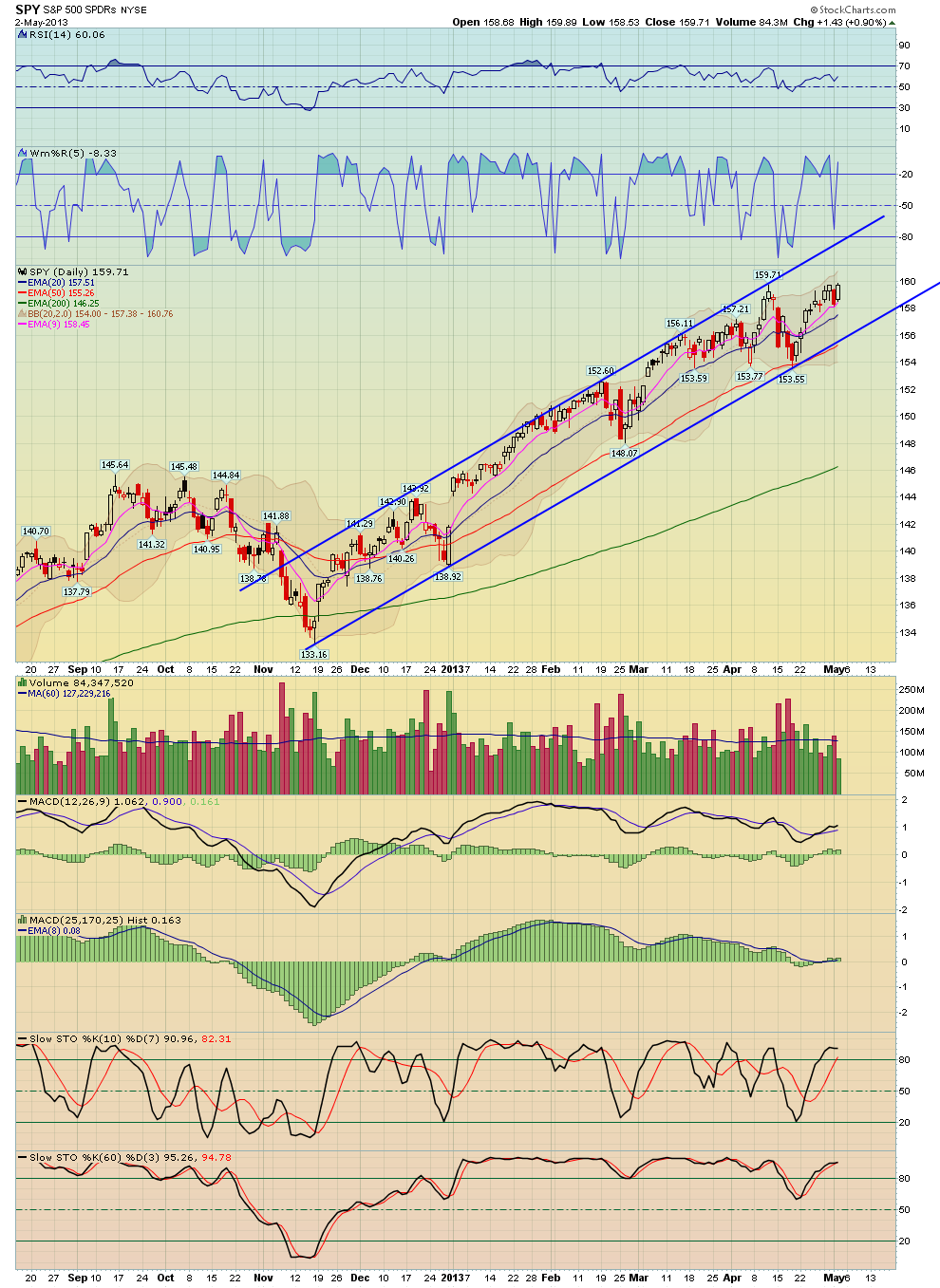

Today the S&P recovered all of yesterday's losses and is once again testing the 1597 highs. Yesterday the SPY and S&P 500 indexes closed right on their 9 EMA's, when a stock or index is still above its short term 9 day EMA, the trend is still up and more follow through to the downside was needed to confirm yesterday's pullback and we didn't get it. The 30 and 60 min bear wedge patterns that I showed yesterday morning played out to their initial targets and have now rebounded back to retest the broken trendline on these wedge patterns - this is a breakpoint, tomorrow is do or die, i.e. either reverse back down or plow through!

enjoy the rest of your day or evening,

Matt

No comments:

Post a Comment