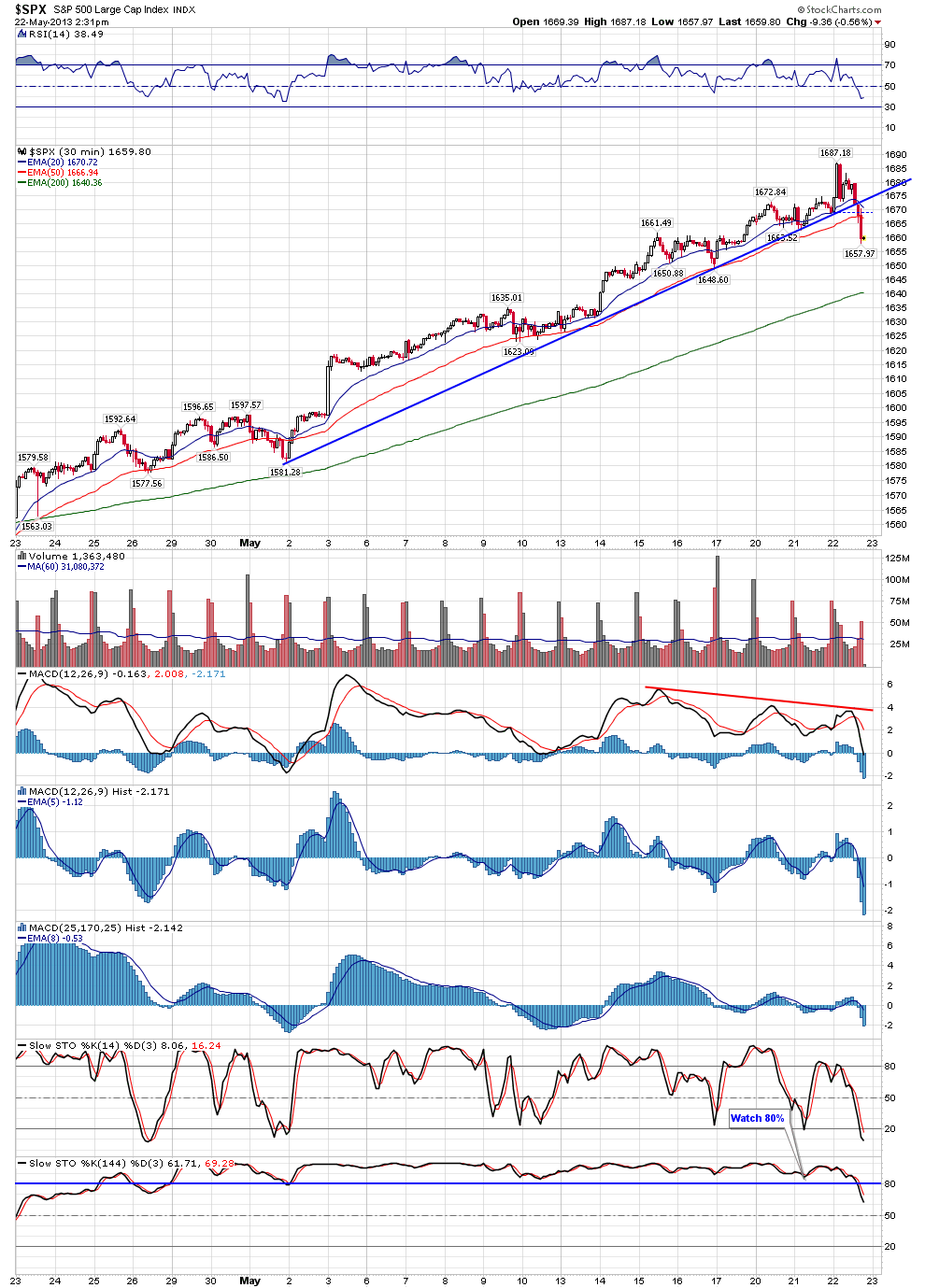

Here's a quick update on the markets, as you know the market was up nicely earlier in the day but reversed after Bernanke's talk.

As I pointed out earlier, the SPX exactly tagged the upper trendline of the channel that we have been following, and logically pulled back from that trendline - there was also strong negative divergence in place as you can see via the MACD. Currently the SPX has pulled all the way back to the lower trendline of the channel which is support, however will it hold?

The second chart shows a shorter term 30 min chart, this uptrend line was broken first.

The third chart shows our wave count that I discussed yesterday, with today's pullback it looks like the wave 4 has finally begun. One initial target would be the last wave 4, which is in the 1648 - 1650 range.

Newsletter Signup

Search

Followers

Blog Archive

-

▼

2013

(274)

-

▼

May

(34)

- Udpate on SPX daily and 60 min charts with the BPT...

- Our Recent Market Newsletter

- NYMO with Bollinger Bands - powerful indicator

- Technical Analysis on economic data

- Market comments and education

- Unemployment rate plotted with MACD

- Huge Memorial Newsletter for 2013

- NYMO and NAMO Indicators with Bollinger Bands

- Our Market Newsletter and some charts

- Wed Afternoon market comments/update

- S&P 500 tagged the upper trendline of the channels

- Silver may have put in a 5th wave bottom yestrday

- S&P 500 market comments and a video

- Market comments

- Market Newsletter

- SPY 60 min system and BPT MA Deluxe comments

- Our Most Recent Newsletter

- S&P 60 min chart - tagging the upper trendline

- I think it's time to get the bunny out again!

- Quick Market Update

- Our most recent newsletter

- Our most recent Newsletter

- BPT MA deluxe moving average indicator

- Hapyy Fibonacci Day, 5/8/13

- Video update on today's action in gold stocks

- SPX daily follow up

- Market Update

- SPX daily charts/comments

- Here are the employment numbers, positive report

- Market Recap

- Sell in May and go away Statistics and Excel Sheet

- Market Close and follow up to my morning post

- Comments on Gold and GDX

- Short term market comments - bear wedge patterns

-

▼

May

(34)

Wednesday, May 22, 2013

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment