Hello everyone, sorry for the lack of posts lately, I was in China for two week and recently just got back. Anyway here's our most recent newsletter, also please note that I discuss some recent improvements that I've made to the SPY Professional System.

Newsletter Signup

Search

Wednesday, October 23, 2013

Tuesday, October 22, 2013

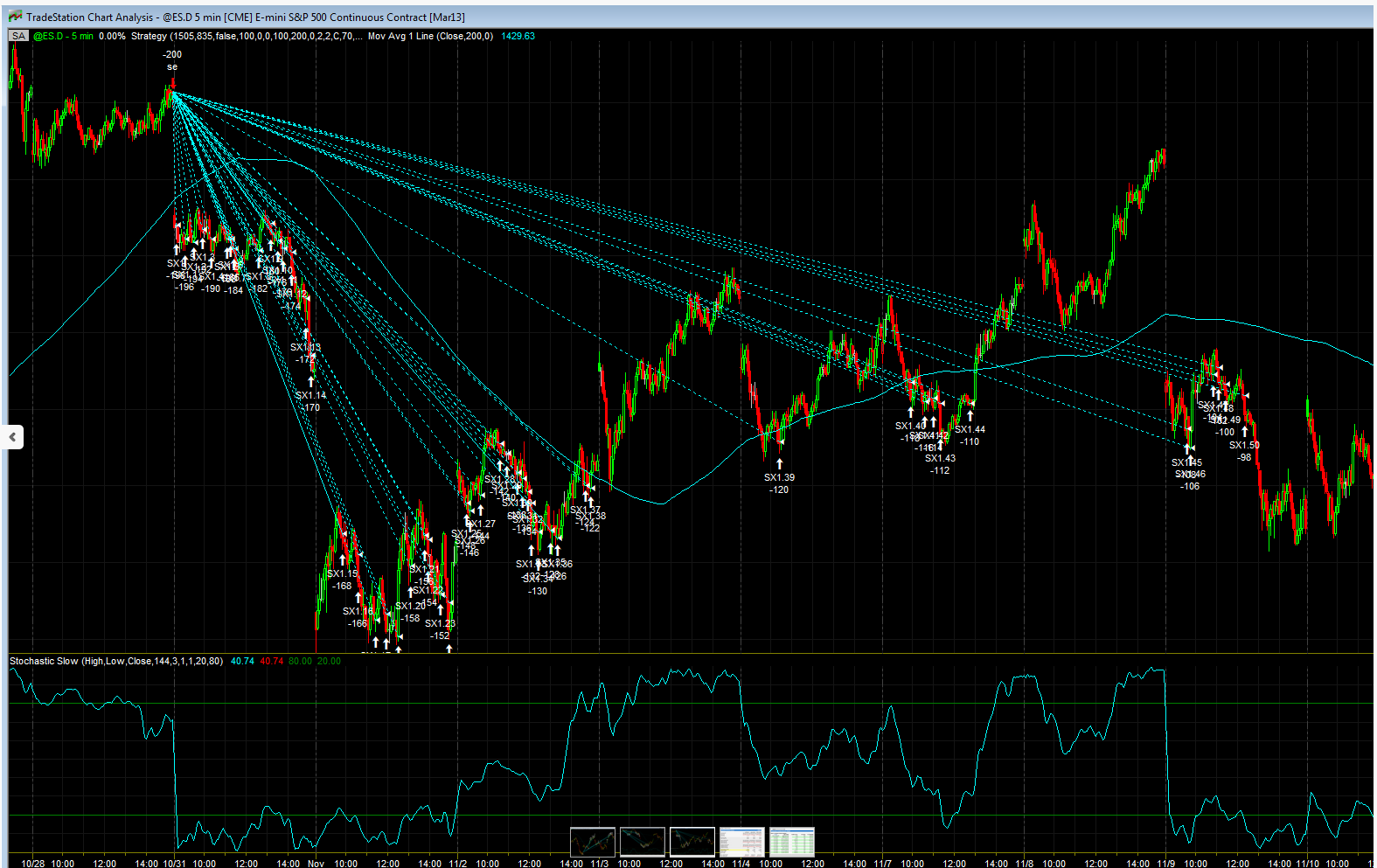

SPY Pro that trades a 5 min ES chart

A fun side note to the BPT Pro system. I have a professional version that trades ES, it has 99.6% winning trades, with 3592 trades and 629 consecutive winning trades - however it's really not a system for most of us here because it is designed to trade large numbers of ES contracts - 50 to 600 ES contracts or more, which is a little rich for my blood and probably for most of you - the lowest # I would trade the system with would be probably 30 - 40 ES contracts, though it does better with more because what the systems does is that it takes the daily trade signals, then uses a 5 min chart to scale in an out at extreme levels intra day and overnight, and the more contracts it trades, the better it can do this.

anyway I suppose if there are any hedgefunds here or Pros, you can contact me if you are interested. Otherwise most of us won't be trading this obviously because of the capital needed, but it's kind of neat to look at the trades and it's a slow day so posting it for fun. Though maybe one day I could set this up on my IB account and some of you accredited investors could link to my account for a fund of some sort, who knows

Tuesday, October 8, 2013

Thursday, October 3, 2013

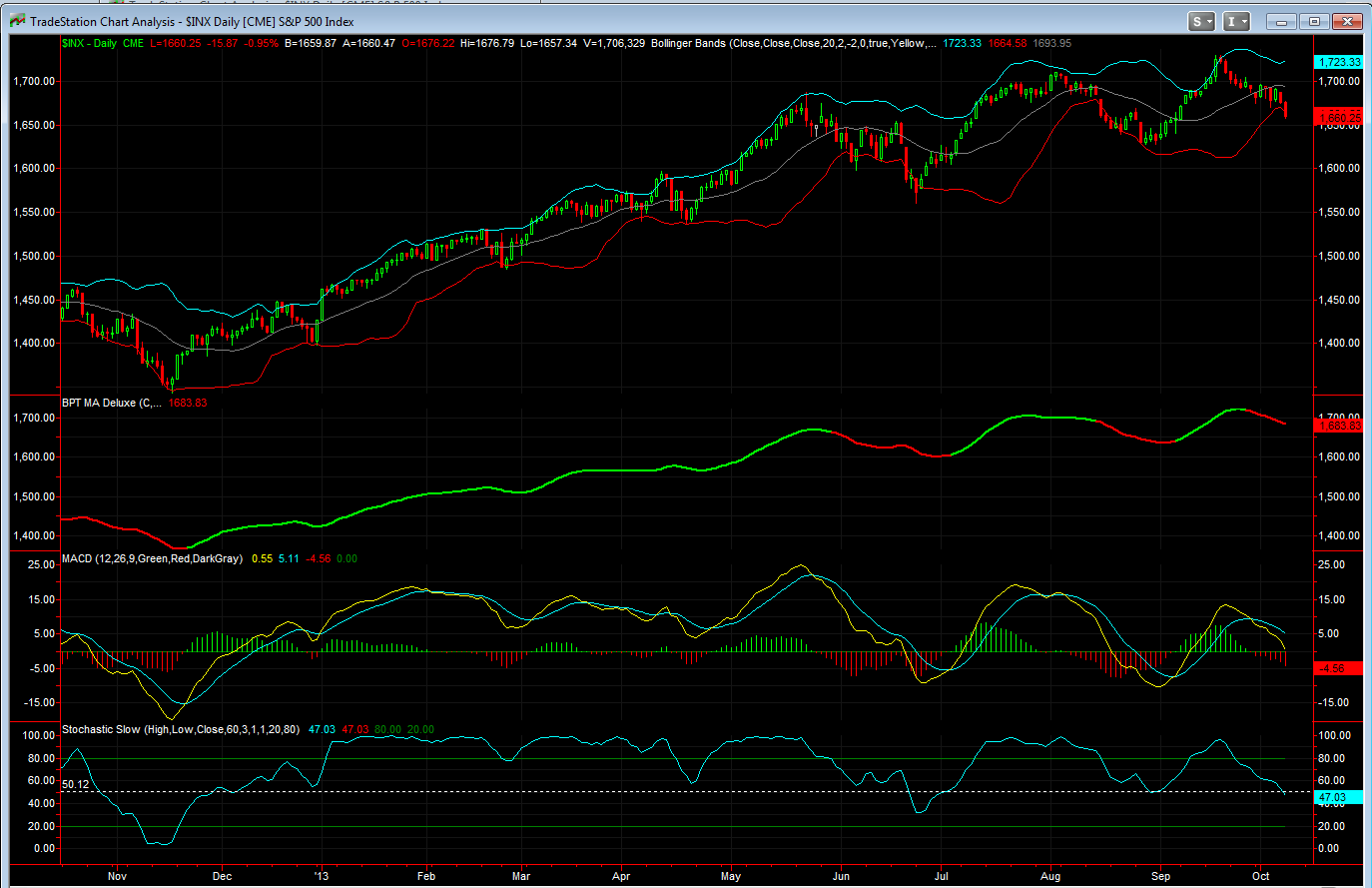

Webinar on BPT MA Deluxe Indicator

You Tube Video

Webinar Today and our most recent Newsletter

CLICK HERE to view the Newsletter - a link to the webinar is provided in the first segment of the newsletter.

The webinar begins at 5:00 pm EST and will last probably 45 min to an hr. I also plan to record it for those who can't make it.

Matthew Frailey

Tuesday, September 24, 2013

SPY Pro and Ver 2 systems follow up

FYI - just to confirm, as I stated yesterday afternoon in an email and in last night's newsletter, the SPY Professional and SPY Ver 2 systems both sold their long positions this morning on the open and are now in cash waiting for the next trade. All systems are now in cash - SPY Pro, SPY Ver 2, SPY RSI 2, and DVY RSI 2 systems

As you know, this was a very nice trade, both systems went long at the Aug 27th bottom. Congrats to all who took the system trades!

I have now updated the statistics and trades on the website - here's a link to the page which shows the trade history to all the systems (SPY Pro, SPY Ver 2, SPY RSI 2, and DVY RSI 2 systems)

CLICK HERE to see a list of all trades together

Also here's the system reports:

- SPY Professional Non-Scaleout Version

- SPY Professional Scaleout Version

- SPY Professional Compounded Version

- SPY Ver 2 Compounded Version

Sunday, September 22, 2013

Video example of futures trading using hidden or reverse divergence

Hello everyone, here's a video I made at the end of the day in which I discuss divergence with a focus on reverse divergence. In the video I do a playback on Dow YM futures and I take trades as divergence sets up.

Please note, this video is quite long, about 28 min and I was unable to convert the video to flash, therefore this video will only play in Windows Media Player! However most of you should have that even if you have a MAC, but you would have to install Windows Media player.

Again the video might be boring to some of you, but if you trade futures it's worth a look

Here's another link that opens in windows media player only if the above doesn't work

Wednesday, September 18, 2013

Our most recent Newsletter

Big day in the market today after the FOMC! In tonight's newsletter I cover the market, our SPY Pro system which has been long during this entire move, and precious metals and gold stocks which could become swing trades.

You can view the Newsletter Here.

Best to your evening,

Matthew Frailey

Sunday, September 15, 2013

Weekend Newsletter and SPY Professional System

Hello Everyone, here's the weekend general market newsletter - please note, this newsletter contains a very detailed discussion of the SPY Professional System - thus make sure to listen to tonight's newsletter

CLICK HERE To view the Newsletter

best to your evening and it should be an eventual week!

Matthew Frailey

Wednesday, September 11, 2013

Our most recent Newsletter

Hello Everyone, the market has had a nice move off the Aug 27th low and our SPY Profession system has been killing it!

Monday, September 9, 2013

SPY Pro Scaleout system hit its second price target

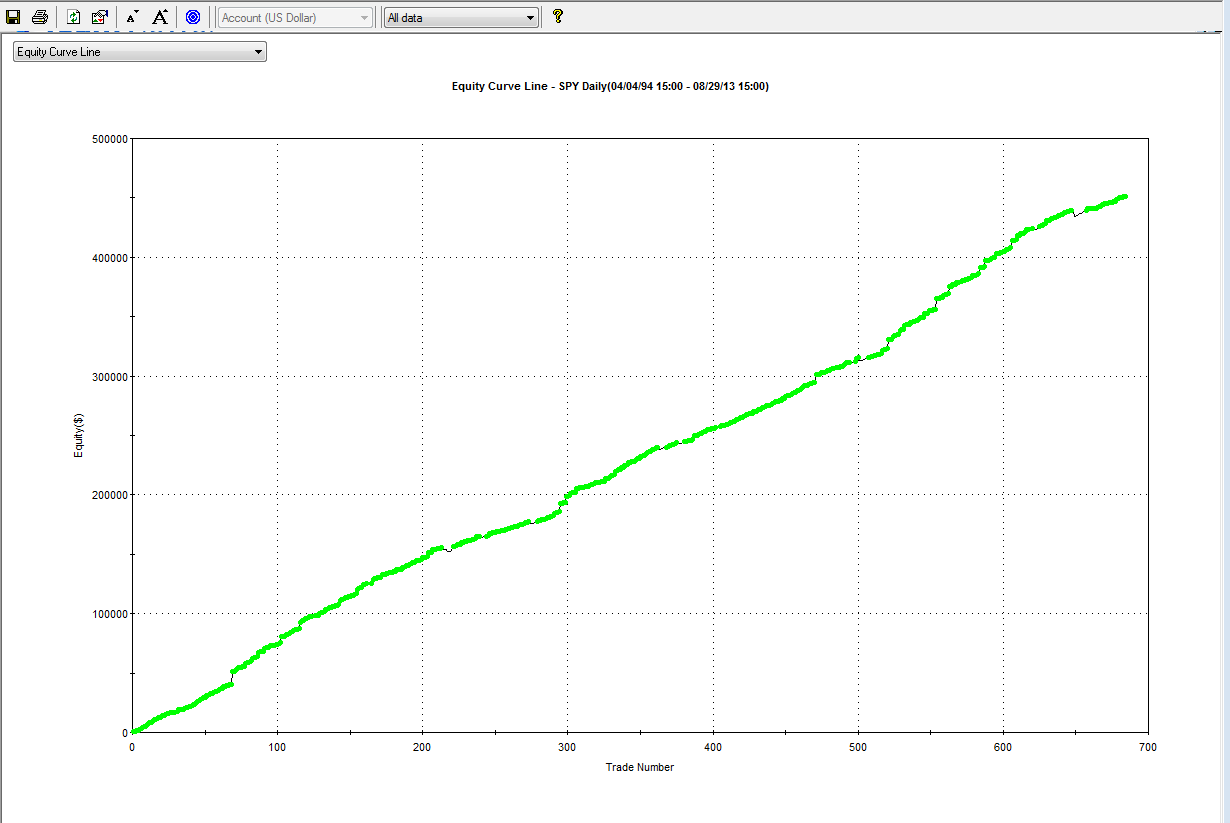

As I discussed previously to keep an eye on, the SPY Pro system just hit its second scaleout profit target and exited another 20% of its shares - the system now has 60% of its remaining shares left. I've updated the trade on the website, you can find it in this section (click here), as well as the updated statistics - the system now has 96.06% winning trades, 685 winning trades, only 26 losing trades over nearly 19 years.

Should this trade continue to be held, here's something to be on the look out for

CLICK HERE to watch the video,

The SPY Ver 2 is long (it does not scale out)

The DVY RSI 2 system is long and will exit its long position today at the close

Market intra day comments

$SPX - Chart Link - market up as you know, however as you can see from the 15 and 60 min charts, price is still staying inside the channel with the upper trendline acting as resistance

Thursday, August 29, 2013

SPY Pro System achieved its first scale out

As I stated previously, the SPY Pro Scaleout version would scale out of 20% of its shares at a 1% gain at a price of SPY $164.96, that just occurred as you can see from the chart. Again if you are following the scale out version please don't wait for me to post the confirmations, as I stated, the best thing to do is to simply place a GTC sell limit order in at your broker when you first enter the trade, that way it will just execute automatically for you.

I'm also including the stats: 96.05% winning trades, 684 total trades, 93 consecutive winning trades, 2 consecutive losing trades and a beautiful profit curve.

In regards to the rest of the system trade, if SPY closes over the 8 day moving average, the system will exit it's total position and go to cash, that's actually not to far away and something you can monitor on your own, just add an 8 day MA to a daily chart of SPY.