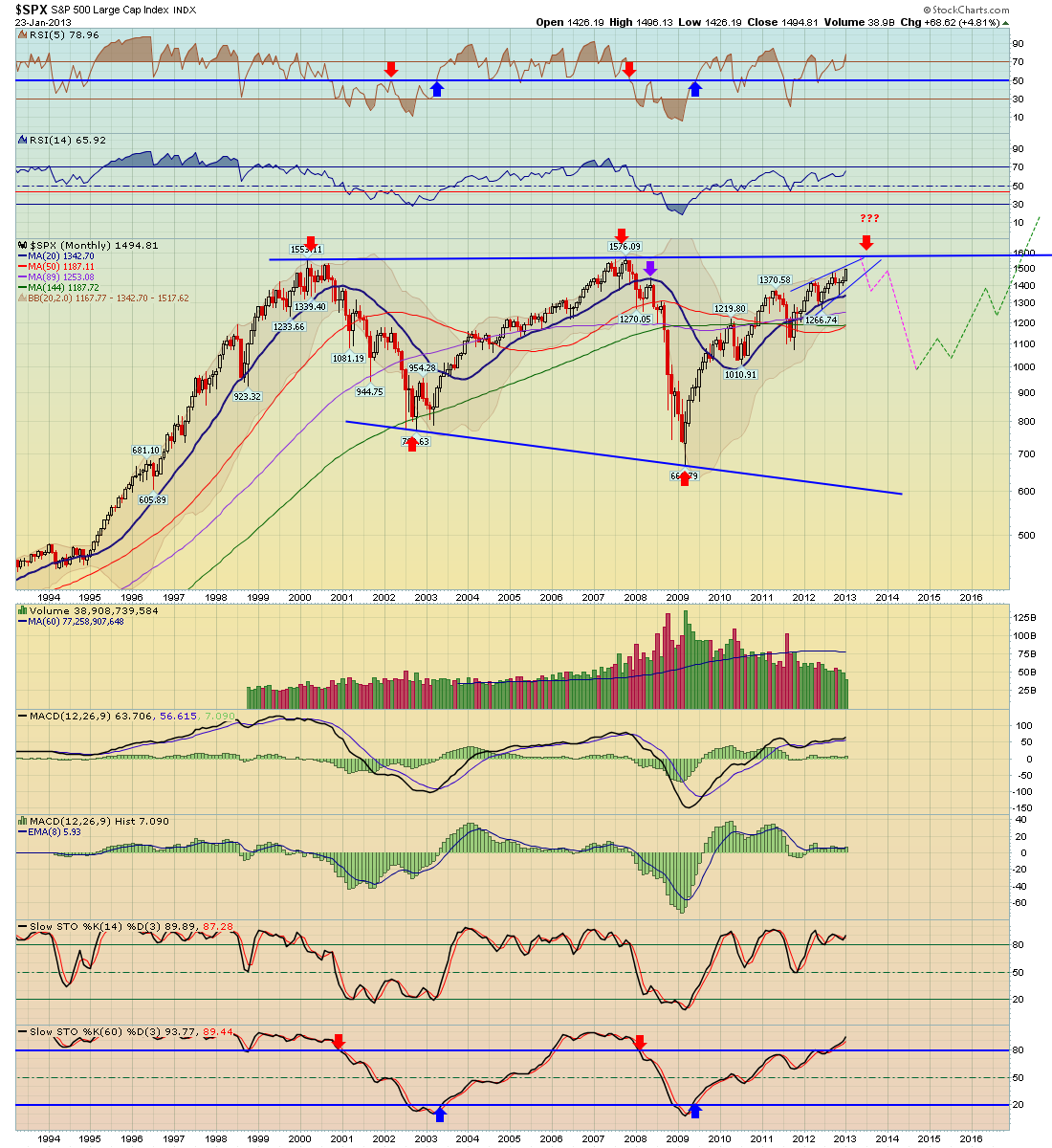

As you know, the market has come all way since the March 2009 bear market bottom where the S&P 500 hit a devils low of 666, today it stands just shy of 1500!

Here's a monthly chart of the S&P 500, potential targets for this year are 1550 - 1600 or the upper trendline (which also corresponds to roughly 1600. However my long term thoughts remain the same, I still consider this bull market, which began in Mar 09 as a cyclical bull market in a longer term Secular Bear market which began in 2000. Secular markets tend to last 16 - 18 years on average, this secular bear market is nearing 13 years now, so historically it's too short to be over. I think the market will be due for another down cycle perhaps later this year or next year - again one target could be the upper trendline of this monthly chart.

here's a history of secular markets, as you can see, they last more than 13 years:

2000 - Present, Secular Bear Market, 13 years so far

1982 - 2000 - Secular Bull Market, lasted 18 years

1966 - 1982 - Secular Bear Market, lasted 16 years

1948 - 1966 - Secular Bull Market, lasted 18 years

1929 - 1948 - Secular Bear Market, lasted 19 years

1920 - 1929 - Secular Bull Market, lasted only 9 /1/2 years (shortest one)

1904 - 1920 - Secular Bear Market, lasted 16 years

So as you can see from this history, I would expect this current secular bear market to not be over yet, I think we have one more down cycle to go through. I don't think the 2009 lows will be tested at all, however a 50% - 61.8% retracement could occur, then perhaps after it's over we'll be ready for the next secular bull market to begin in late 2016 or 2017. See my chart.

Long Term SPX system from 1961:

Of course whatever the market does, my long term long only system will catch the major trends, this system catches the majority of bull market moves and is out during bear markets. Notice that this system when to cash in Jan 2008 well before the big decline in 2008, then got back long in April 2009 and is still long

No comments:

Post a Comment