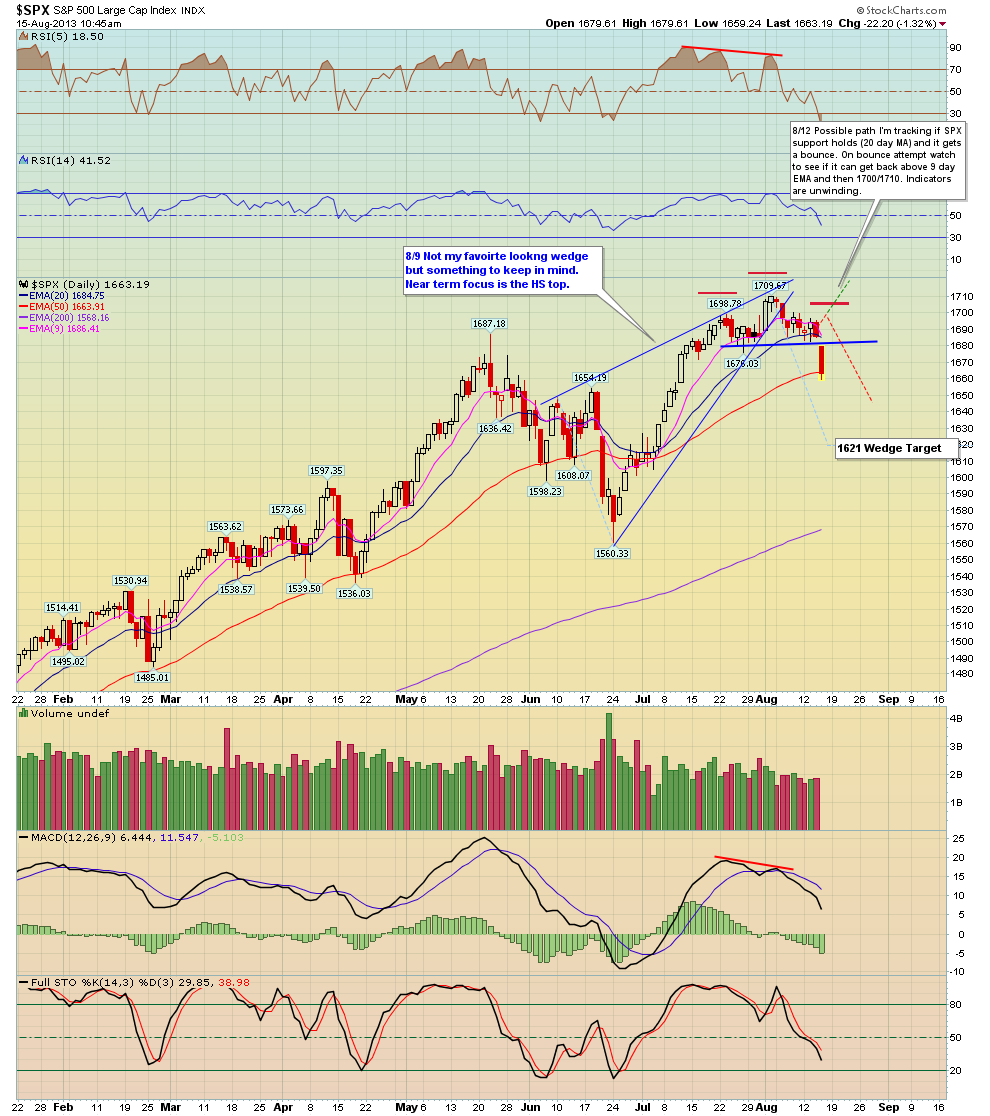

The market gaps a lot and had little movement intra day - in fact the market has made the majority of its gains overnight on gaps. I've shown these statistics a few years ago, however I thought it was time to post them again because they really illustrate this point well.

I wrote two very basically strategies in Tradestation to graphically illustrate this point:

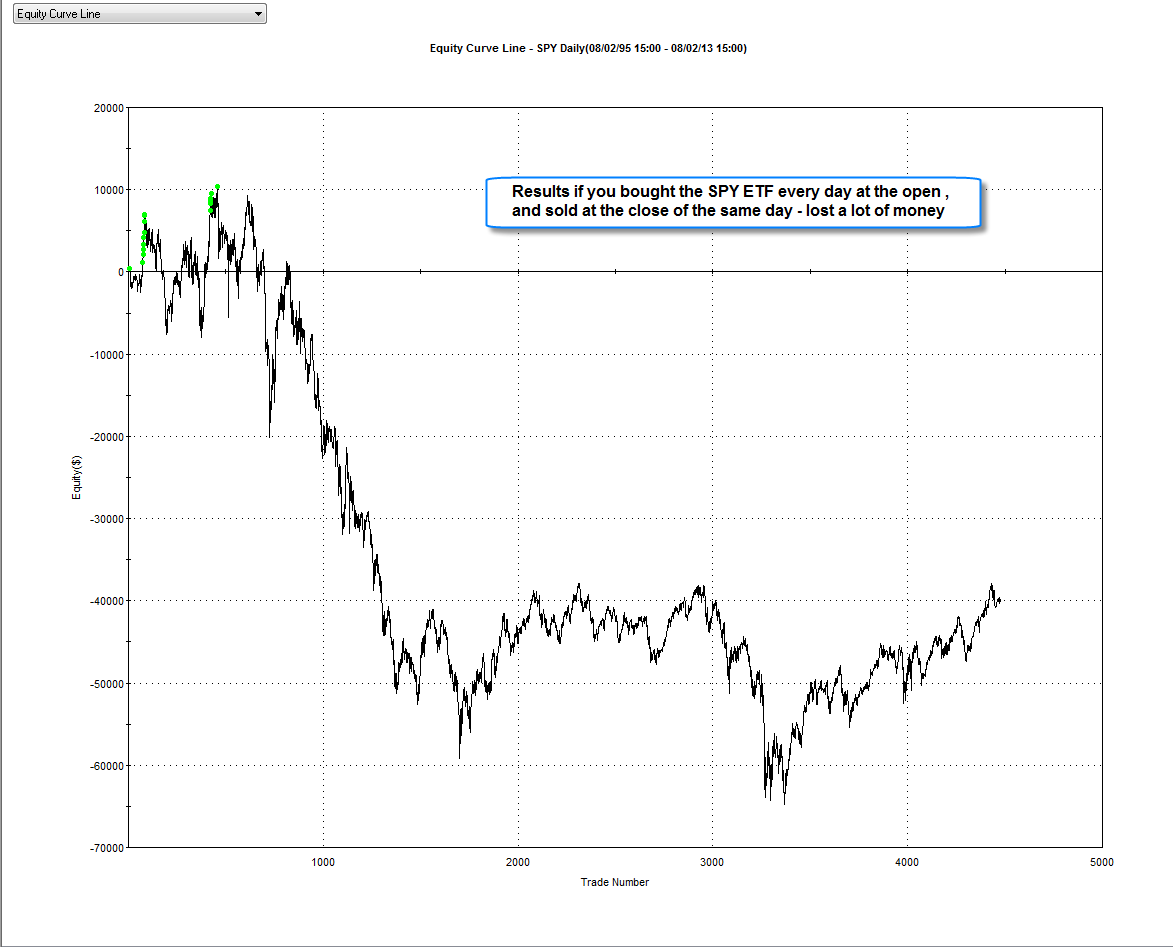

One strategy simply buys the ETF SPY at the open and sells it on the close of the same day.

The other strategy simply buys the ETF SPY at the close and sells it on the open of the next day.

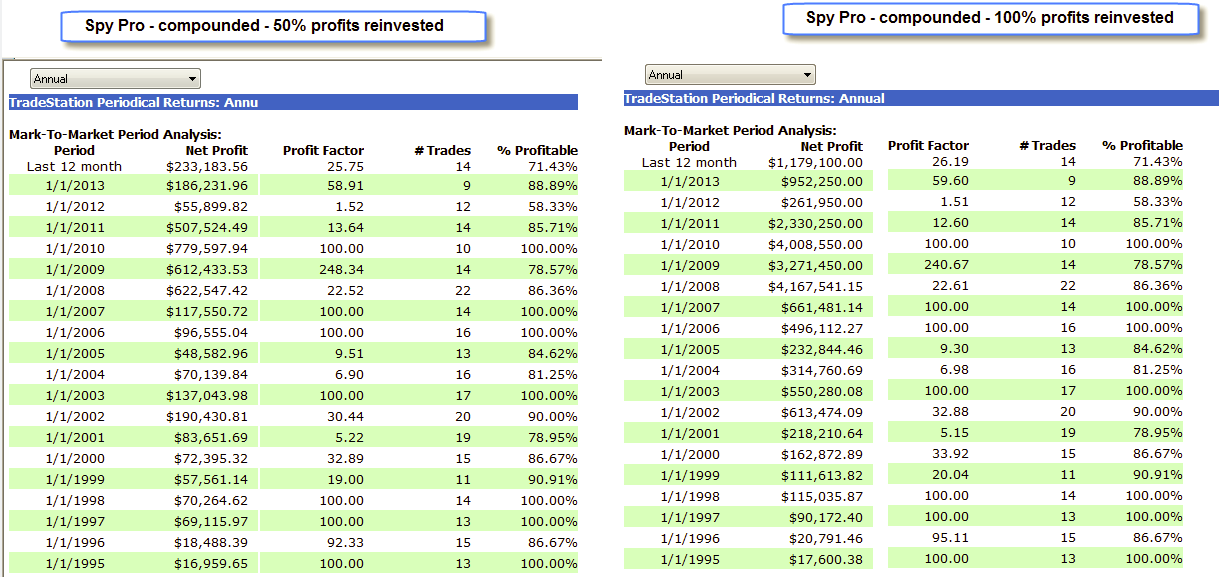

For the strategies I'm using $100K for each buy and I'm not counting commissions because these are not meant to be strategies that you actually trade - I'm simply showing the effect that gaps have had on the market over the last 18 years.

As you can see from the two profit curve charts below, the results are quite astounding, if you bought the SPY ETF every day on the open and sold it at the close of the same day, you lost money consistently every year! Your $100K turned into about 60K losing about $40!. Amazing that you actually lost money simply buying the open and selling the close.

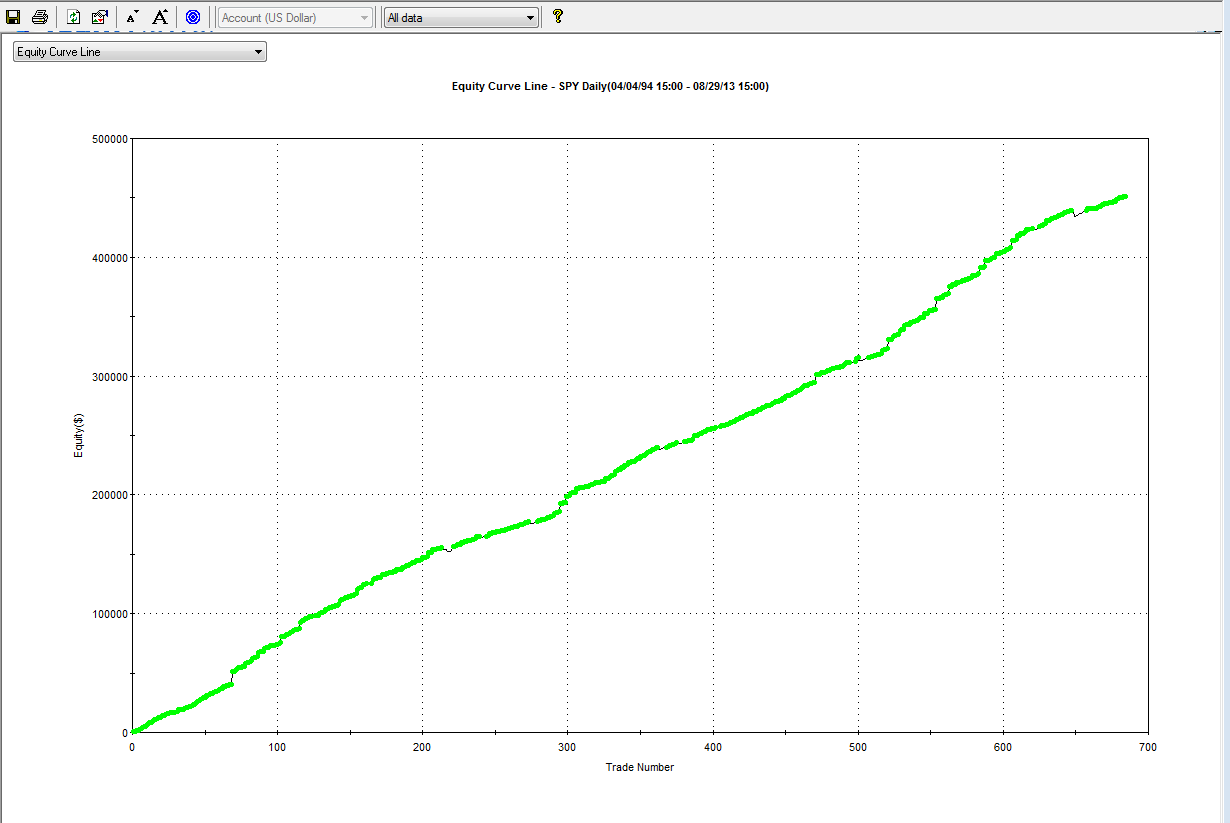

The second chart shows what happens if you simply buy the SPY at the close and sell on the open of the next day - as you can see, your $100K turned into over $400K!! Quite a difference!

So as you can see - if you recently thought to yourself, "man the market gaps all the time and seems to make most of its moves overnight" you are right - in fact the results are probably more shocking than you realize. The public masses think that the market makes its gains during the day, but this is not the case.

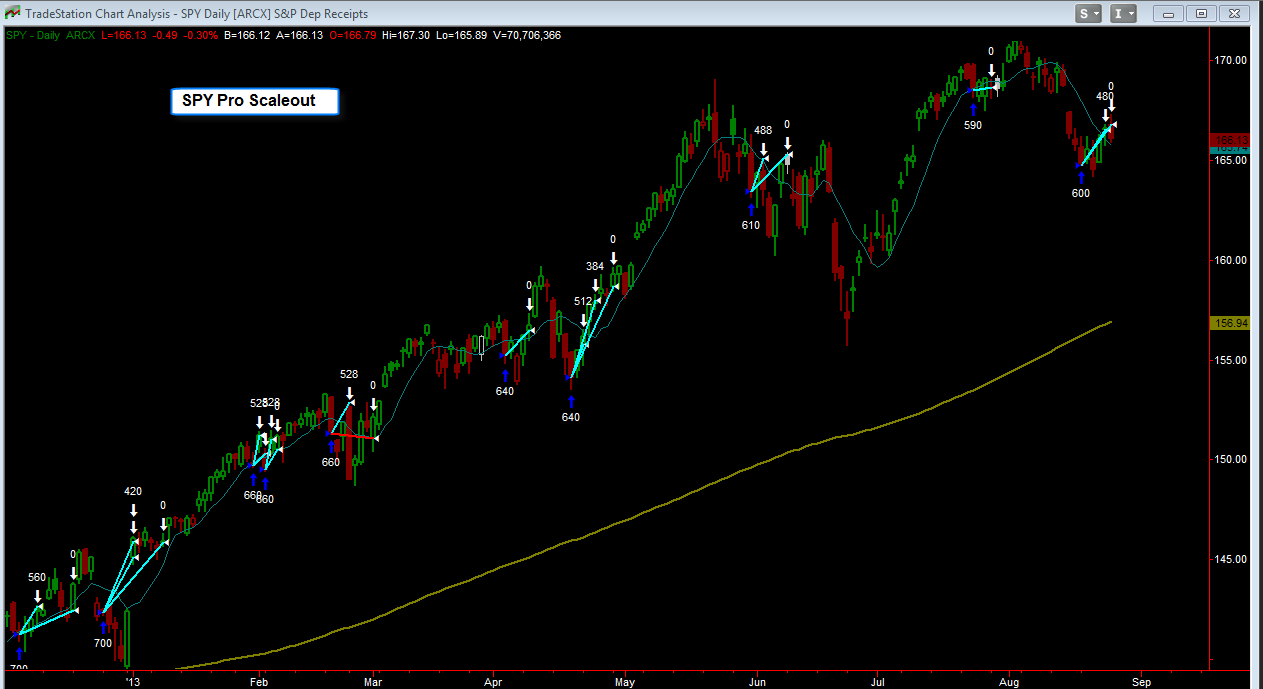

Also guys - regarding the SPY Ver 2 and Pro systems - this is why those systems exit their long positions on the next day open vs that same day