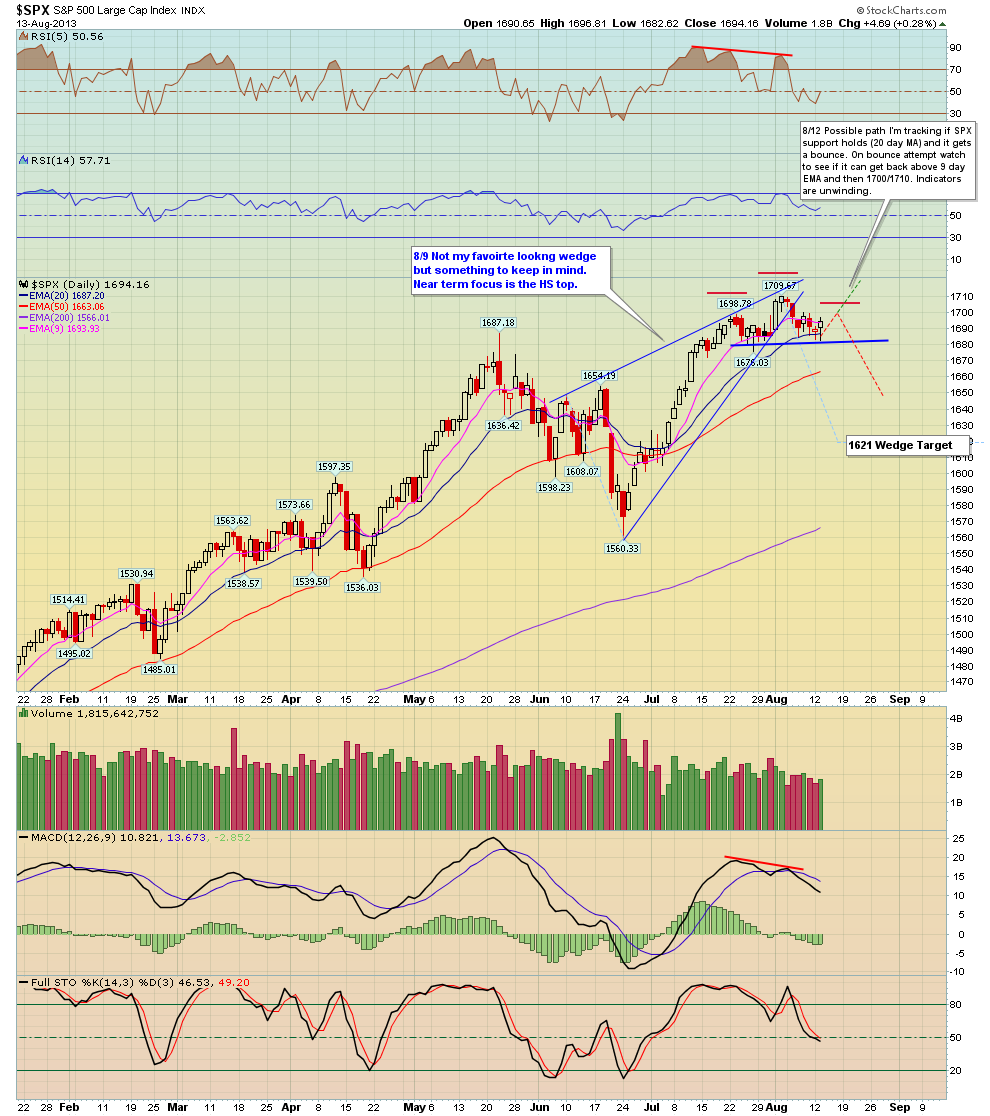

As I discussed last night, the SPX is nearing a SHORT TERM inflection point. Of late we have seen lethargic action leading to a choppy decline which has allowed the oscillators to unwind some of their overbought readings. The SPX is still finding support from its 20 EMA (important to hold). So the question here is if the SPX can may another attempt at new highs (the QQQ's did) or if it fails and forms a lower high (RS) and turns down. Thus, it's been mainly a trader's market of late with many trading around earnings. Simply put, the 20 EMA is the key support with resistance at 1700 and 1710. Continue to trail stops upward on longs and if playing shorts also adhere to proper stops.

Newsletter Signup

Search

Followers

Blog Archive

-

▼

2013

(274)

-

▼

August

(15)

- SPY Pro System achieved its first scale out

- SPY pro system response to a question

- Just go back a few in ago - update on SPY Pro syst...

- Here\'s our awesome free weekend newsletters!

- Commodity Newsletter and General Market Newsletter...

- Man some of these moves awesome!

- Head & Shoulder pattern playing out beautifully

- SPX 60 and 30 min comments

- SPX Daily

- General Market Newsletter for Sunday August 11th 2013

- GDX chart

- Guide for Tracking an Uptrend

- Nice chart showing long term fib cycles

- The market has made the majority of its gains over...

- Updated Market Stats

-

▼

August

(15)

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment