I had a question regarding the SPY Pro yearly gains - here's a few snapshots of reports. The SPY pro as a single entry and exit gained an average yearly gain of 32% over 19 years, This year is still open and 2011 was the worst year of course (in fact all reversion to mean systems suffered that year). The SPY Pro scaleout version has a much higher winning % of 96% vs 90% for the single entry/exit version but a lower total gain, which makes sense because it doesn't always have a full position as it scales out too early sometimes - made an average of 22% per year. This is all non compounded, which means that the same $dollar amount was invested in 1995 as was recently, i.e. $100K for each trade.

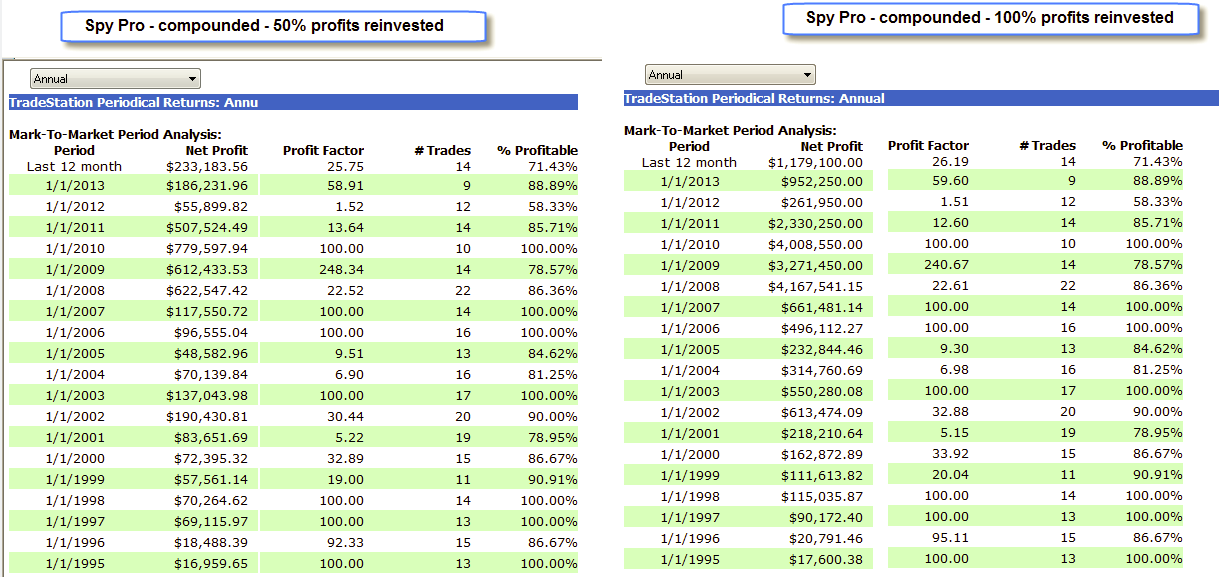

If you throw compounding into the mix, the returns of course do what you would expect with the power of compounding. The second chart shows 100% compounding and 50% compounding, which means that 100% of the profits were re-invested in one version and 50% in another - to me the 50% version makes more sense.

again it's up to you to do what you want, I'm just posting this because a member asked me some questions about yearly gains and single entry vs multi entry etc.

Also from a time standpoint, the SPY pro system is only in the market 46% of the time, which means it is in cash more than 50% of the time.

The other systems are in the market less, for example the SPY RSI 2 system is only in the market about 23% of the time, which means it is in cash 77% of the time however even being in cash this much it is still able to generate 13% average gains per year non compounded, not bad.

No comments:

Post a Comment