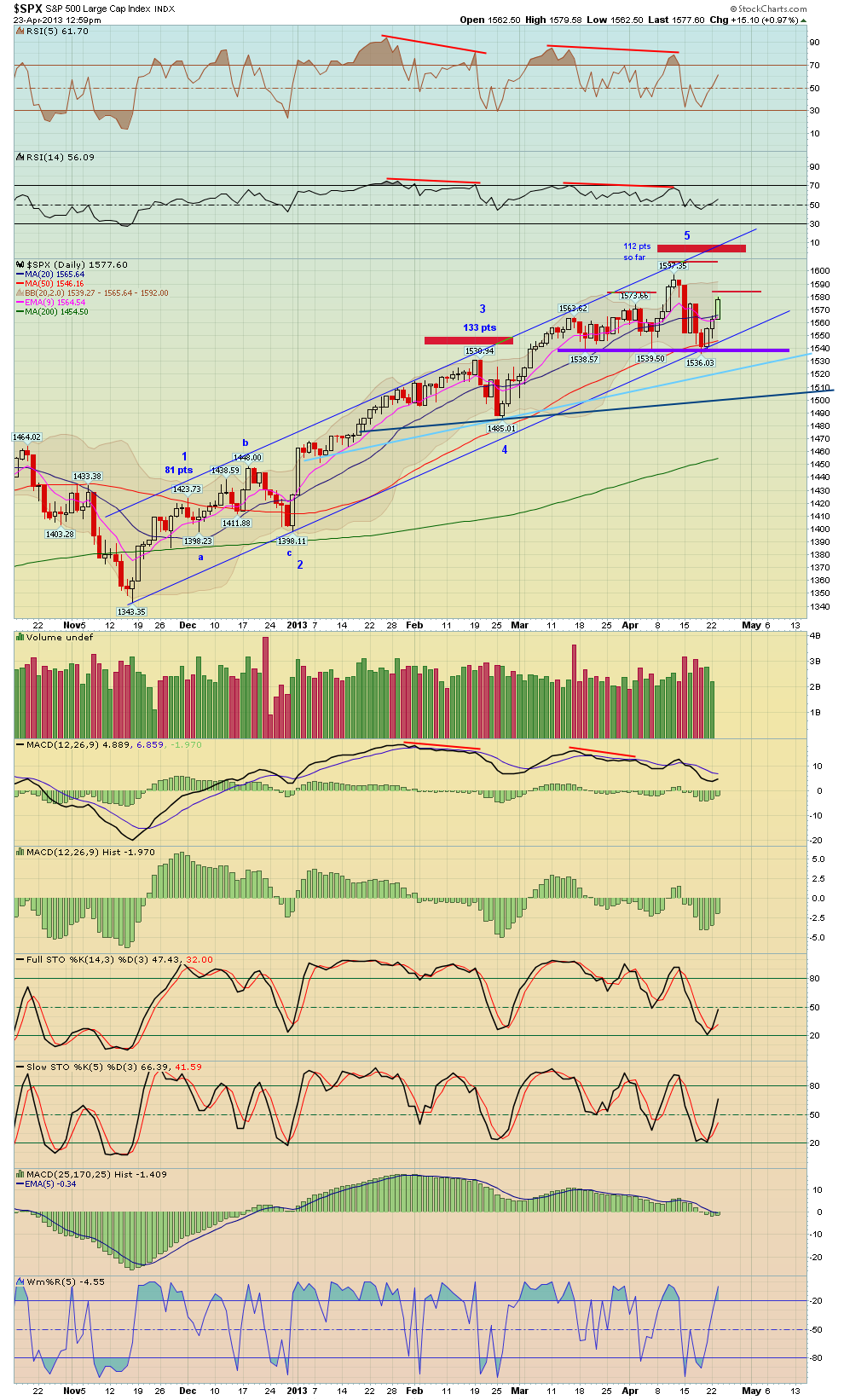

Last week on Thursday the market was down strongly and folks were getting bearish, however as you may recall I posted two S&P 500 charts, which showed how important the 1540 support area was for the S&P. Since that time the S&P 500 has rebounded 38 points off that level! Therefore I hope some of you bears covered your shorts there and took profits because at the very least you can now start to scale back into your shorts at a much higher levels, 38 SPX points is tough to shit through! This is why I pointed out that 1540 support area last Thursday.

The first chart shows the P&F chart which I showed on Thursday, clearly that 1540 was big support, now however keep an eye on the 1580 area. The second chart shows a daily candlestick chart, could today's move still be part of a RS to form a H&S pattern? Perhaps, however as of yet we have yet to see any reversals, but you could look to scale into some lower risk shorts (38 points higher up here) with a tight stop, or you can wait for a reversal trigger, your choice, however shorting up here is MUCH more objective than last week's oversold condition.

Otherwise we'll see what the market does here, it could also form a triangle and attempt to form one more high to trick both the 'bulls' and the 'bears' who are not expecting that, or form a flat, or top out in here in the upper 1570's, again let's see how it plays out

Newsletter Signup

Search

Followers

Blog Archive

-

▼

2013

(274)

-

▼

April

(61)

- Here's a Mechanical SPY daily system that wins 96%...

- Commodity Weekend Newsletter for April 28th, 2013

- Other Gold Charts

- GLD gold ETF, perfect gap fill!

- Here\'s Our latest Newsletter

- Gold stocks are up again, here's a video update on...

- GDX looking more interesting and BPGDM may give co...

- Market up nicely again, follow up to my market pos...

- Educational Newsletter on Hidden Divergence

- Cost of Mining an ounce of gold - table of gold st...

- Market follow up comments

- The S&P 500 is testing a major pivot

- GDX RSI 2 oversold Statistics

- Copper and the market

- Intra day market video market update and a look at...

- Market Comments

- ABX gold stock comments

- VIX going to close inside it\'s Bollinger Bands

- Nice oversold bounce - comments

- Important Newsletter Update for Monday April 15th,...

- Our Thoughts and Prayers are with the People Affec...

- S&P 500 monthly chart - perfect kiss and rejection

- Here's a video update on GDX, as I showed earlier ...

- GDX daily Renko system chart

- Comments on Gold

- GDX and the gold market

- In-depth look at gold stocks

- General Market Weekend Newsletter

- Precious metals market

- TSO

- S&P 500 monthly Big Picture and Video Discuss

- A look at Japan's Nikkei Stock Index short term an...

- GDX, gold stocks and precious metals

- SPX monthly nearing the upper trendline

- Market at new highs, comments

- NAMO and NYMO indicators

- here's a follow up to that SPY multi exit system, ...

- ANV follow up

- Market Comments

- SMH - Semiconductor ETF

- SPY system I may add to the site

- Comments on AAPL technicals/charts

- General Market Newsletter Sunday April 7th

- XXIA Trading Education Example - one of our recent...

- Silver bounced off the long term support trendline

- Market Close

- ANV gold stock

- Market Comments

- Nice pullback in the market, I hope you guys caugh...

- Amazing, Silver is actually testing the long term ...

- NYMO and NAMO with Bollinger Bands

- Nice market sell off today, congrats if you took p...

- GDX RS2 2 indicator is very oversold

- Capitulation in gold stocks

- Wednesday Morning April 2nd, 2013 Newsletter

- Precious Metals, Gold, Silver, Gold Stocks

- General Market Analysis April 2nd, 2013

- S&P 500 nearing the all time high

- Semiconductors - potential H&S pattern forming

- Corn

- General Market Newsletter - Market toppy?

-

▼

April

(61)

Tuesday, April 23, 2013

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment