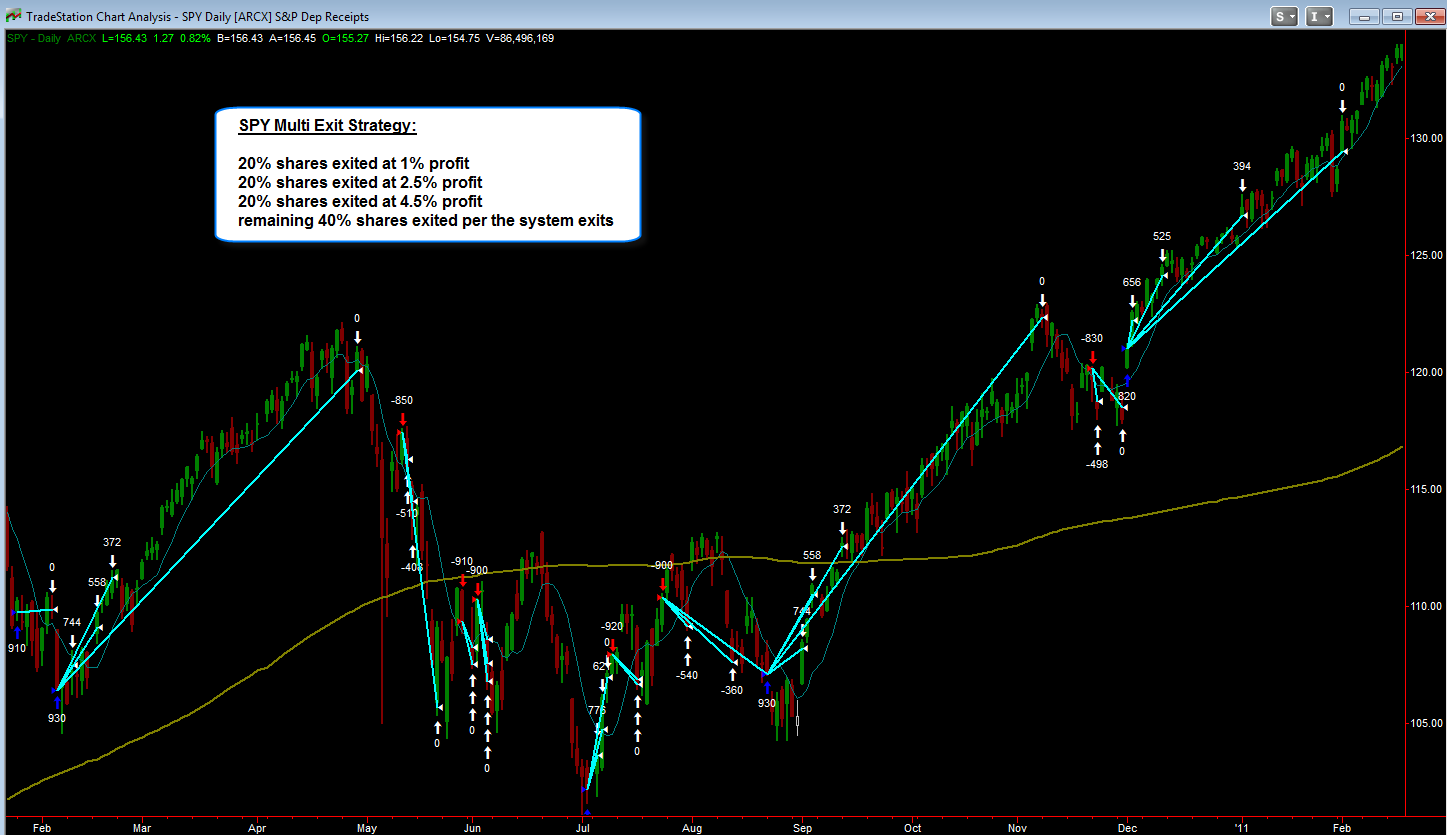

Here's an offshoot of one of the reversion to mean SPY systems that I may be adding to the 'Tradestation Systems' section of the website. I added a scale out component to it: Sell 20% of shares after a 1% gain, sell 20% of shares at a 2.5% gain, and another 20% of shares at a 4.5% gain. Exit the remaining 40% shares per the normal system exit. The total profit is lower however the % winning trades goes up to almost 96%

Again it's not a perfect system, there will be bad trades, for example take a look at the last chart example, you can see how it bought the pullback on May 3rd, which ended up being quite a bad trade; I would like to add some kind of Sell In May seasonality component where the system needs a deeper pullback or more stringent rules to take a long in late April - June etc.

Also if you look at the yearly stats, the totals are % gains for the year, before 2012 reversion to mean systems did well, however I have noticed that most reversion to mean systems started to struggle from 2011 and into 2012. However so far this year it's doing better than last year

No comments:

Post a Comment